|

#1

| |||

| |||

|

Can I apply for the Chartered Accountant course after completing BBA????

|

|

#2

| ||||

| ||||

|

Yes of course, you can apply for the Chartered Accountant course after completing BBA. You can directly join the IPCC course without writing CA-CPT Exam. The eligibility criteria for the graduates to write IPCC directly is as under: In case of a Commerce Graduate – 55% In case of a Non-Commerce Graduate – 60% This course has three stages: CPT IPCC and final Subjects fort he IPCC GROUP-1 Accounting, Law ethics and communication, Cost accounting and financial management, Taxation Part-1: income tax, Part-2: service tax and VAT, GROUP -2 Advanced accounting, Auditing and assurance, Information technology and strategic management section:a: Information technology, section:b: Strategic management

__________________ Answered By StudyChaCha Member |

|

#3

| |||

| |||

|

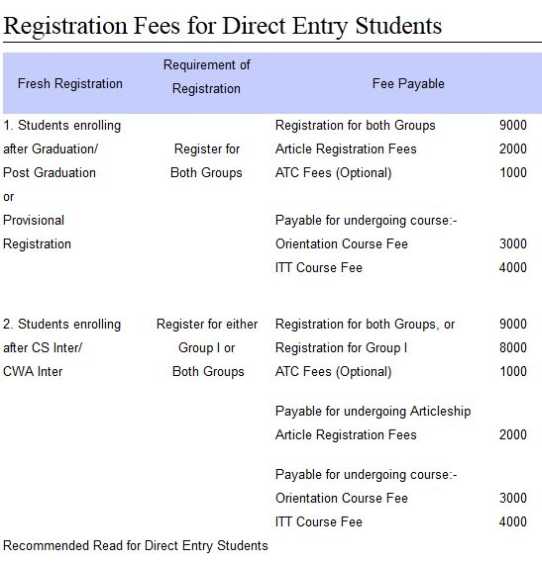

The CA course comprises of CPT, IPCC, Articled Training and Final Course. Candidates are exempted from CPT, subject to anyone of the qualification given below. 1. Graduation in Commerce stream with 55% or more marks in aggregate. or 2. Graduation in Non-commerce stream with 60% or more marks in aggregate. or 3. Intermediate level qualification of Company Secretary Couse or Cost and Work Accounts course. Fees:  CA course details    For detailed info here is attachment..............................

__________________ Answered By StudyChaCha Member |