|

#1

| |||

| |||

|

Please gather some information about Mortgage/ Property loan offer by Indian Bank to customers, so that I can go through it?

|

|

#2

| |||

| |||

|

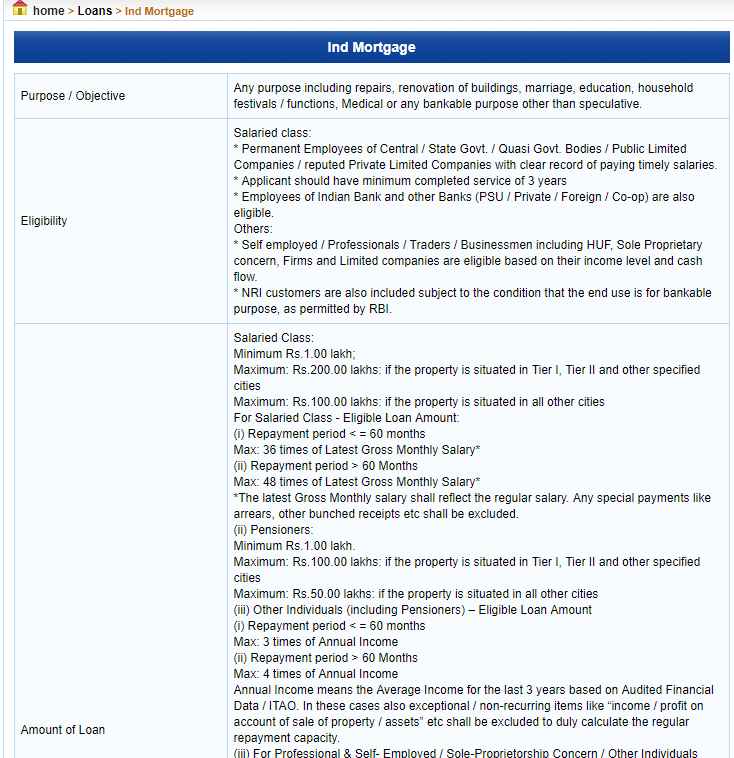

On your reference I will let you know more about Indian Bank, Mortgage/ Property loan so that you can get idea easily. Eligibility Permanent Employees of Central / State Govt. / Quasi Govt. Bodies / Public Limited Companies / reputed Private Limited Companies with clear record of paying timely salaries. Applicant should have minimum completed service of 3 years Employees of Indian Bank and other Banks (PSU / Private / Foreign / Co-op) are also eligible. Others: Self employed / Professionals / Traders / Businessmen including HUF, Sole Proprietary concern, Firms and Limited companies are eligible based on their income level and cash flow. NRI customers are also included subject to the condition that the end use is for bankable purpose, as permitted by RBI. Income criteria (i) Salaried Class: Minimum monthly Gross Income of Rs.25000/- Spouse income may be included for eligibility (regular & backed by income proof), in such cases Spouse shall join as Co-applicant. Proof of income: 1. Latest Pay slip for last six months / Certificate from Employer 2. Latest Income Tax Form 16A / IT Returns / ITAO 3. Copy of Statement of account for a period of 6 months (ii) P & SE, Other Individuals, Sole-proprietor & Other Business Class: Minimum Annual Cash Profit (PAT + Depreciation) of Rs.3.00 lakhs OR Annual Taxable Income of Rs.3.00 lakhs based on latest ABS / ITAO. Proof of Income: 1. Audited Balance Sheet for immediately preceding 3 years 2. Income Tax Returns for immediately preceding 3 years / ITAO Margin 40% of the Realisable Sale Value of the immovable property offered as security – if property is situated in Tier-I & II cities. 50% in case of properties situated in other places For full information please check the file Mortgage Loan    Address:- Indian Bank PB No: 5555, 254-260, Avvai Shanmugam Salai, Royapettah, Chennai - 600 014 Phone:- 044 28134300

__________________ Answered By StudyChaCha Member |