|

#1

| |||

| |||

|

Hi I am interested in having information about Volunteer Income Tax Assistance (VITA) program as well as the scope of the service and a sample resume format for an individual having completed Volunteer Income Tax Assistance (VITA) program?

|

|

#2

| |||

| |||

|

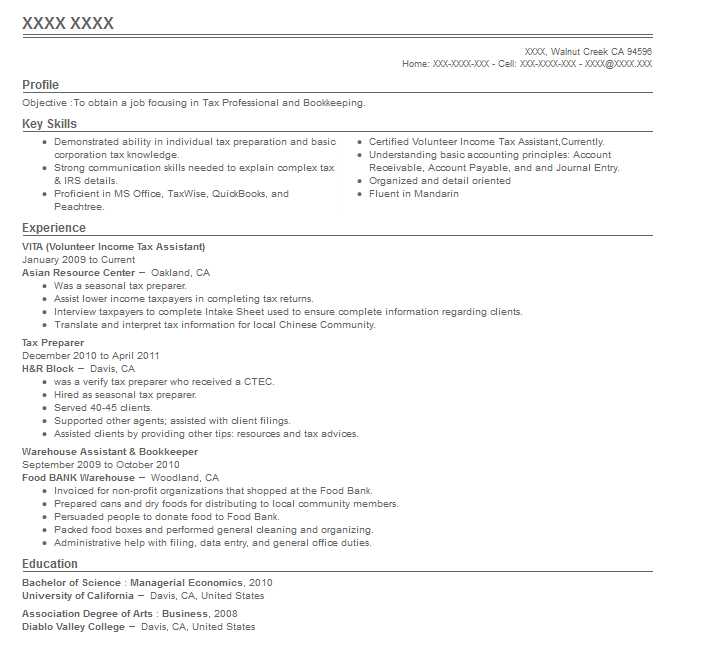

The Volunteer Income Tax Assistance (VITA) program is an activity supported by the Internal Revenue Service. Established in 1971 by Gary Iskowitz at California State University, Northridge. Since the 1970s the program has bloomed to a few thousand destinations across the country joining forces with non-benefit associations, city governments, and significant state funded colleges to document a great many returns each year. One of the central purposes of the VITA program is raising citizen mindfulness and receipt of the Earned Income Credit (EIC). Extent of Service As already said, all profits are required by the IRS to be set up by affirmed volunteers. There are different duty law, and non-assess law related confirmations. Each volunteer, regardless of whether they will be planning expense forms or going about as a greeter, or admission pro, is required to pass a morals and set of principles exam. Past that, those volunteers who wish to end up assess preparers should additionally pass an exam identifying with the admission and meeting process and a fundamental duty law exam. There are an aggregate of seven assessment law accreditation exams. To be viewed as capable, volunteer must score at least 80 on an exam to get a passing score. Accreditations keep going for one duty year, at that point the preparer must recharge their confirmation. Sample Resume Format for an Individual having Completed Volunteer Income Tax Assistance (VITA) program

__________________ Answered By StudyChaCha Member |