|

#1

| |||

| |||

|

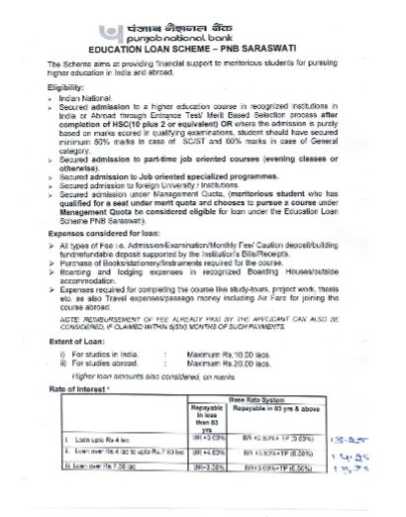

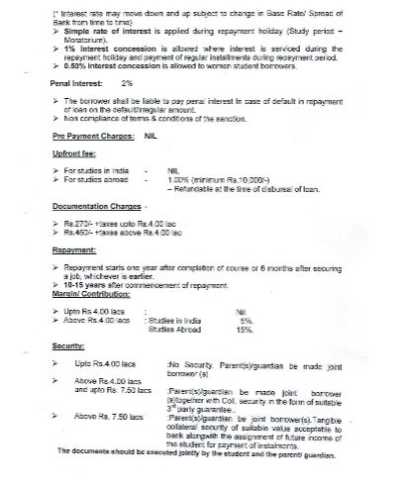

Hello sir I am the student and want to apply for the PNB SARASWATI Education loan scheme of the Punjab National Bank for my higher studies so please tell me the eligibility required to apply for this? Punjab National Bank provides the PNB SARASWATI Education loan scheme to the students for the higher studies Here are the complete details of it Eligibility Required: Candidate should be an Indian national Must have secured admission to a higher education course in recognized institutions in India after completing 12th or equivalent Margin Up to Rs. 4 lac – NIL Above Rs. 4 lac - 5% Rate of Interest Loan upto Rs 4 lac – Base Rate+2% Loans above Rs 4 lac upto Rs 7.50 lac – Base Rate+3% Loans above Rs 7.50 lac – Base Rate+2.50% Base Rate+1% to be charged for all loans Repayment (Maximum) For loans upto Rs.7.50 lac - upto 10 years For loans above Rs.7.50 lac - upto 15 years PNB SARASWATI Education loan scheme   Last edited by Aakashd; March 1st, 2020 at 02:21 PM. |

|

#3

| |||

| |||

|

Punjab National Bank was founded in May 19, 1894, it has over 6,300 branches and over 7,900 ATMs across 764 cities and it is an Indian financial services company based in New Delhi, India. Punjab National Bank provide three Education Loan Schemes; PNB Saraswati PNB Kaamgar PNB Pratibha Eligibility: Applicants must be an Indian national. Applicants must have secured admission to a higher education course in recognized institutions in India through Entrance Test/ Merit Based Selection process after completion of HSC(10 plus 2 or equivalent). Margin: Up to Rs. 4 lac - NIL Above Rs. 4 lac - 5% Scholarship/ assistantship may be considered in margin. Margin may be brought-in on year-to-year basis as and when disbursements are made on a pro-rata basis. Rate of Interest: Loan upto Rs 4 lac – Base Rate+2% Loans above Rs 4 lac upto Rs 7.50 lac – Base Rate+3% Loans above Rs 7.50 lac – Base Rate+2.50% Base Rate+1% to be charged for all loans, Documentation Charges: Rs.270/- for loans upto Rs. 4 lac and Rs.450/- for loans above Rs.4.00 lac. Repayment (Maximum): For loans upto Rs.7.50 lac - upto 10 years For loans above Rs.7.50 lac - upto 15 years Documents required for Education Loan: (i) Loan application on Bank's format. (ii) Passport size photograph. (iii) Proof of Address. (iv) Proof of Age. (v) Copy of PAN of student Borrower. (vi) Proof of having cleared last qualifying examination. (vii) Letter of admission. (viii) Prospectus of the course wherein charges like Admission Fee, Examination Fee, Hostel Charges etc. are mentioned. (ix) Details of Assets & Liabilities of parents/co-obligants/guarantors. (x) In case loan is to be collaterally secured by mortgage of IP, copy of Title Deed, Valuation Certificate and Non-encumbrance Certificate from approved Lawyer of the Bank be obtained at the cost of the borrower. (xi) Photocopy of Passport & Visa in case of study abroad. (xii) Any other document/information, depending upon the case and purpose of the loan.

__________________ Answered By StudyChaCha Member |

|

#5

| |||

| |||

|

Punjab National Bank was founded in May 19, 1894, it is an Indian financial services company based in New Delhi, India and the bank has over 6,300 branches and over 7,900 ATMs across 764 cities. Education loan scheme for students pursuing Higher Education in India. To provide financial support to meritorious students for pursuing higher education in India. Eligibility Must be an Indian national. Must have secured admission to a higher education course in recognized institutions in India through Entrance Test/ Merit Based Selection process after completion of HSC(10 plus 2 or equivalent). Cases of Management Quota may be considered on merit basis; Purpose Fee payable to college/ school/ hostel Examination/ Library/ Laboratory fee. Insurance premium for student borrower, if applicable. Caution deposit, Building fund/refundable deposit supported by Institution bills/receipts. Purchase of books/ equipments/ instruments/ uniforms. Purchase of computer at reasonable cost, if required for completion of the course. Any other expense required to complete the course - like study tours, project work, thesis, etc. Margin Up to Rs. 4 lac - NIL Above Rs. 4 lac - 5% Scholarship/ assistantship may be considered in margin. Margin may be brought-in on year-to-year basis as and when disbursements are made on a pro-rata basis. Rate of Interest Loan upto Rs 4 lac – Base Rate+2% Loans above Rs 4 lac upto Rs 7.50 lac – Base Rate+3% Loans above Rs 7.50 lac – Base Rate+2.50% Base Rate+1% to be charged for all loans, irrespective of amount, where 100% tangible collateral security in the shape of IP, enforceable under SARFEASI act, and/or liquid security is available. Simple interest be charged during the Repayment holiday/ Moratorium Period Docs Required for Education Loan: ID Proof Address Proof DOB Proof Financial Docs

__________________ Answered By StudyChaCha Member |

|

#7

| |||

| |||

|

Punjab National Bank was founded in 19 May 1895 under the Indian Companies Act, with its office in Anarkali Bazaar, Lahore and it is an Indian financial services company. Hello Friend, let me tell you that Punjab National Bank offer 3 Education Loan Schemes: PNB Saraswati: Regular Scheme for pursuing Higher studies in India & Abroad. PNB Kaamgar: Education Loan Scheme for pursuing Vocational Courses/ Skill Development courses. PNB Pratibha: Collateral free Education loans at lower ROI to those students getting admission in of 103 premier institutions in India, as identified by Bank. Here I am givng you information about PNB Saraswati- Education Loan Scheme This Education Loan Scheme provides financial support to meritorious students for pursuing higher education in India and abroad. Eligibility for PNB Saraswati- Education Loan: Student must have obtained admission in eligible course through merit based selection process. Where the admission is purely based on marks scored in qualifying examinations, cut off percentage of marks is fixed: (i) 50% for SC/ST, and; (ii) 60% for General category. Student should be an Indian national. Age limit: No limit Margin Up to Rs. 4 lac - NIL Above Rs. 4 lac - 5% Scholarship/ assistantship may be considered in margin. Margin may be brought-in on year-to-year basis as and when disbursements are made on a pro-rata basis. Rate of Interest Loan upto Rs 4 lac – Base Rate+2% Loans above Rs 4 lac upto Rs 7.50 lac – Base Rate+3% Loans above Rs 7.50 lac – Base Rate+2.50% Base Rate+1% to be charged for all loans, irrespective of amount, where 100% tangible collateral security in the shape of IP, enforceable under SARFEASI act, and/or liquid security is available. Simple interest be charged during the Repayment holiday/ Moratorium Period

__________________ Answered By StudyChaCha Member |