|

#1

| |||

| |||

|

I have passed graduation and now I want to get admission in MBA and for that I want to get the education loan details of State Bank of India so can you provide me that as it id very urgent for me?

|

|

#2

| ||||

| ||||

|

As you want to get the education loan details of State Bank of India so here is the information of the same for you: Eligibility: For school/graduate education in India or abroad: Candidates must have passed Minimum second division (pass marks for SC/ST) For technical/professional/specialized /post graduate studies in India or abroad: Securing admission. Parents/guardians having independent source of income Loan Amount: * For school/graduate education in India or abroad: A maximum of 6 times the monthly net income of the parent/guardian, subject to a cap of Rs. 1 lac * For technical/professional/specialized/post graduate studies in India or abroad: 90% of the cost of the study, subject to a maximum of Rs. 5.0 lacs for studies in India and Rs. 10.00 lacs for studies abroad Interest: Loans up to Rs 2 lacs 12% and loans over Rs 2 lacs 14% per annum. Securities: Some security acceptable to the Bank would be required. Application & Procedure: Candidates who are eligible can obtain application forms for the loan from the designated branches of the bank or download the form from the bank’s website The bank makes an agreement with the student who also has to provide a guarantee from the parent or third party. The loan amount is disbursed in installments and remitted directly to the Institutes after the necessary formalities are completed. Repayment of Loan: I. For school/graduate education in India or abroad: Loan may be conveniently repaid in 36 monthly installments by the parent/guardian II. For technical/professional/specialized/post graduate studies in India or abroad: Conveniently repay in a maximum period of 60 months after completion of course or securing a job, whichever is earlier. A nominal amount of 0.5% of the loan only need be paid per month towards part payment of interest Contact Details: State Bank of India PT Rajan Rd, Chinna Chokkikulam, Madurai, Tamil Nadu 625002 India Map Location:

__________________ Answered By StudyChaCha Member |

|

#4

| |||

| |||

|

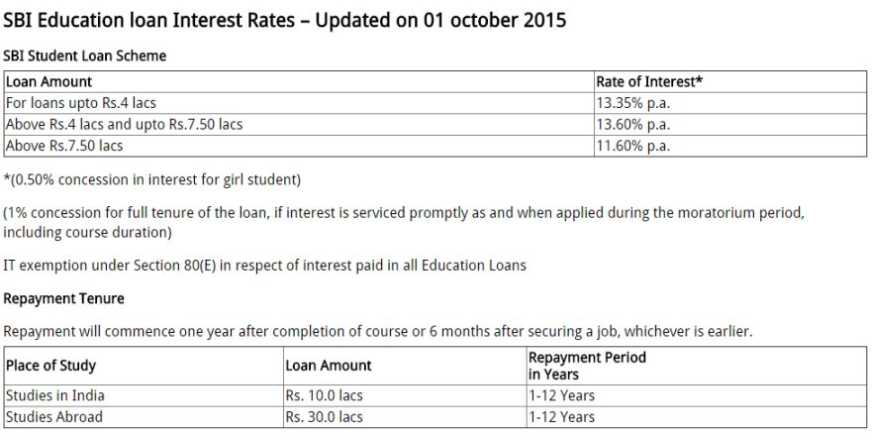

Loan scheme for educational loan in SBI is as follows- A loan granted to Indian Nationals for having higher education in India or abroad where admission has been secured. Repay period of upto 12 years after Course Period + 12 months of repayment holiday All those students who approach for an education loan for more than Rs 4.00 lacs for Studies abroad will be required to make a deposit of Rs 5000/-. If the applicant avails of the loan, the amount of Rs 5000/- will be adjusted against the contribution of margin money by him. Eligibility A loan granted to Indian Nationals for having higher education in India or abroad where admission has been secured. Courses Covered a. Studies in India: Graduation, Post-graduation with regular technical and professional Degree/Diploma courses conducted by colleges/universities approved by UGC/ AICTE/IMC/Govt. etc Regular Degree/ Diploma Courses conducted by autonomous institutions like IIT, IIM etc Teacher training/ Nursing courses approved by Central government or the State Government Regular Degree/Diploma Courses like pilot training, shipping, Aeronautical etc. approved by Director General of Civil Aviation/Shipping/ concerned regulatory authority b. Studies abroad: Job oriented professional/ technical Graduation Degree courses/ Post Graduation Degree and Diploma courses like MCA, MBA, MS, etc offered by reputed universities Courses conducted by Chartered Institute of Management Accountants – London, Certified Public Accountant in USA etc. Expenses Covered Fees which is payable to college/school/hostel Examination/Library/Laboratory fees Purchase of Books/Equipment/Instruments/Uniforms, Purchase of computers- essential for completion of the course (maximum 20% of the total tuition fees payable) Caution Deposit/Building Fund/Refundable Deposit (maximum 10% of tuition fee of entire course) Travel Expenses/Passage money for studies abroad Cost of a Two-wheeler upto Rs. 50,000/- Some other expenses required to complete the course like study tours, project work etc Loan Amount For study in India - maximum Rs. 10 lacs Study abroad - maximum Rs. 30 lacs Margin For loans up to Rs.4.0 lacs : No Margin For loans above Rs.4.0 lacs: Studies in India: 5% Studies Abroad: 15% Repayment: Maximum Loan Limit Repayment Period Upto Rs. 4 Lacs Upto 10 years Above Rs. 4 Lacs and upto Rs. 7.5 Lacs Upto 10 years Above Rs. 7.5 Lacs Upto 12 years For more details about educational lone of SBI I’m giving attachments Education loan SBI

__________________ Answered By StudyChaCha Member |