|

#1

| |||

| |||

|

Hello sir, my brother is looking for education loan from bank of India for engineering. Is there any one can give me detail of Bank Of India Education Loan?

|

|

#2

| |||

| |||

|

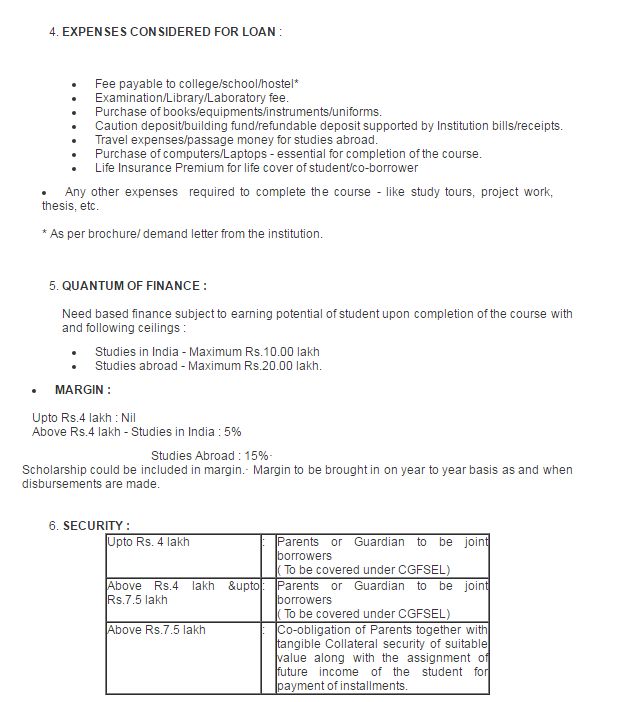

The bank of India is provides facility to students for to get education loan on fix interest rates. The Star Educational Loan Scheme by Bank of India aims at providing financial support from the bank to deserving/ meritorious students for pursuing higher education in India and abroad. The main emphasis is that every meritorious student is provided with an opportunity to pursue education with the financial support on affordable terms and conditions. Detail of Bank Of India Education Loan:   ELIGIBILITY CRITERIA Should be an Indian National; Secured admission to professional/technical courses in India or Abroad through Entrance Test/Merit based selection process Good academic career The student should not have outstanding education loan from any other Institution Father/Mother should be co-borrower Eligible course: Studies in India (Indicative list) Graduation/ Post Graduation courses Professional courses: Engineering, Medical, Agriculture, Veterinary, Law, Dental, Management, Computer, etc. Courses conducted by IIM, IIT, IISc, XLRI, NIFT, NID and other Institutes set up by Central/State Govt. Other courses leading to diploma/degree, etc. conducted by colleges/universities approved by UGC/Govt./AICTE/AIBMS/ ICMR, etc Graduation: For job oriented professional/technical courses offered by reputed universities. Post-Graduation: MCA, MBA, MS, etc. Courses conducted by CIMA - London, CPA in USA, etc. Quantum of finance: Studies in India - Maximum Rs.10.00 lakh Studies abroad - Maximum Rs.20.00 lakh Margin: Upto Rs.4 lakh: Nil Above Rs.4 lakh Studies in India: 5% Studies Abroad: 15%• Scholarship could be included in margin. Security: Upto Rs. 4 lakh : No security Above Rs.4 lakh &upto Rs.7.5 lakh: Collateral security in the form of a suitable third party guarantee. Above Rs.7.5 lakh: Co-obligation of Parents together with tangible Collateral security of suitable value along with the assignment of future income of the student for payment of installments Interest Rates: Loan Amount/ Applicant Type Interest Rate Up to Rs.7.50 lakhs 3% above the base rate Above Rs.7.50 lakhs 2.50% above the base rate Women Beneficiaries Concession of 0.5% per annum for limits up to Rs.50,000 and 1% for limits over Rs.50,000 Loan for Professional courses Concession ranging from 0.5% to 1% If interest is serviced during moratorium 1% concession

__________________ Answered By StudyChaCha Member |