|

#1

| |||

| |||

|

HI I would like to have the details about Basic Savings Bank deposit Account offered by Oriental Bank of Commerce as well as the online application form?

|

|

#2

| |||

| |||

|

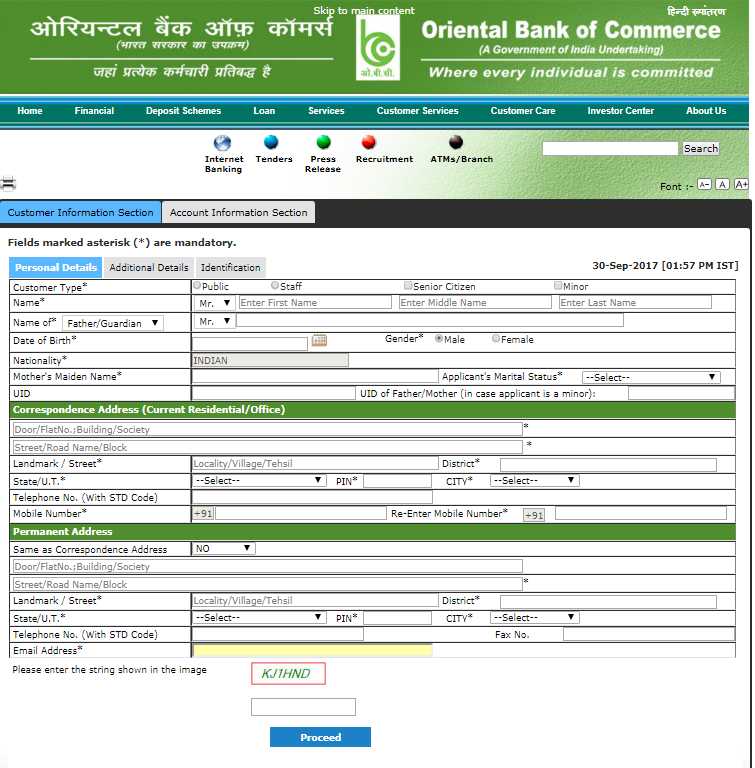

Oriental Bank of Commerce is an India-based bank set up in Lahore (at that point the city of British India, and as of now in Pakistan), is one of general society division banks in India. The bank has advanced on a few fronts, crossing the Business Mix characteristic of ₹2 lac crores as on 31 March 2010 making it the seventh biggest Public Sector Bank in India. Basic Savings Bank Deposit Account (Basic SB Deposit) Striking Features Qualification: Material to every Indian Citizen who are qualified to open record with the bank, who generally can't bear the cost of without budgetary hardship the cost of keeping up a ledger. The record under the plan ought to likewise be made accessible to recipients of Social Security Schemes of Govt. of India and to BPL recipients on expansive scale with the essential presumption that such records are opened for the individual not having any managing an account relationship prior. Opening of Account: The client needs to deliver two photos, isolate records for confirmation of character and address. The KYC prerequisites are as under 1. In the event that the address on the record submitted for personality evidence is same as that announced by the client in the record opening structure, the archive might be acknowledged as a substantial verification of both character and address. 2. In the event that the address demonstrated on the archive submitted for personality evidence varies from the present address specified in the record opening structure, a different verification of address ought to be gotten. For this reason, a lease assention showing the address of the client appropriately enlisted with State Government or comparative enrollment specialist might likewise be acknowledged as a proof personality and address. 3. Records under this Scheme can be opened for the qualified people either under their own particular names (singular limit) or in joint names or with minors. 4. The holders of Basic Savings Bank Deposit record won't be qualified for opening whatever other sparing bank store account in the bank. Features: Ostensible Initial Deposit of Rs. 10/ - for opening of the Account. No Minimum Balance Requirement/No Minimum Balance Charges. No Standing Instruction Charges for Transfer of Funds inside same Branch. No Incidental Charges for non-working/actuating the out of commission account. Selection Facility. One Check Book of 25 Leaves, Free of Cost, amid a Calendar Year. Checks attracted support of the record holder should be gathered in these Accounts. Free ATM Card office. No confinement on number of credits in the record or on the most extreme adjust in the record. A most extreme of 6 withdrawals (counting ATM and Transfers) every month are allowed, free of any charges. For extra withdrawals amid a month (i.e. far beyond the 6 free of cost), charges of Rs. 5/ - per withdrawal should be collected. ECS NEFT, issuance of DD and so forth are accessible with material administration charges. Internet Banking facility is not permitted. Other services can be availed on charges prescribed by the Bank. Fundamental SB Account holders can store in Term Deposit Products viz. Dynamic Deposit(PD) or Fixed Deposit (FDR) or Cumulative Deposit (CDR). Oriental Bank of Commerce Online Account Opening Form

__________________ Answered By StudyChaCha Member |

|

| |