|

#1

| |||

| |||

|

Can you provide me the guidelines for Credit Insurance as provided by IRDAI or Insurance Regulatory and Development Authority India?

|

|

#2

| |||

| |||

|

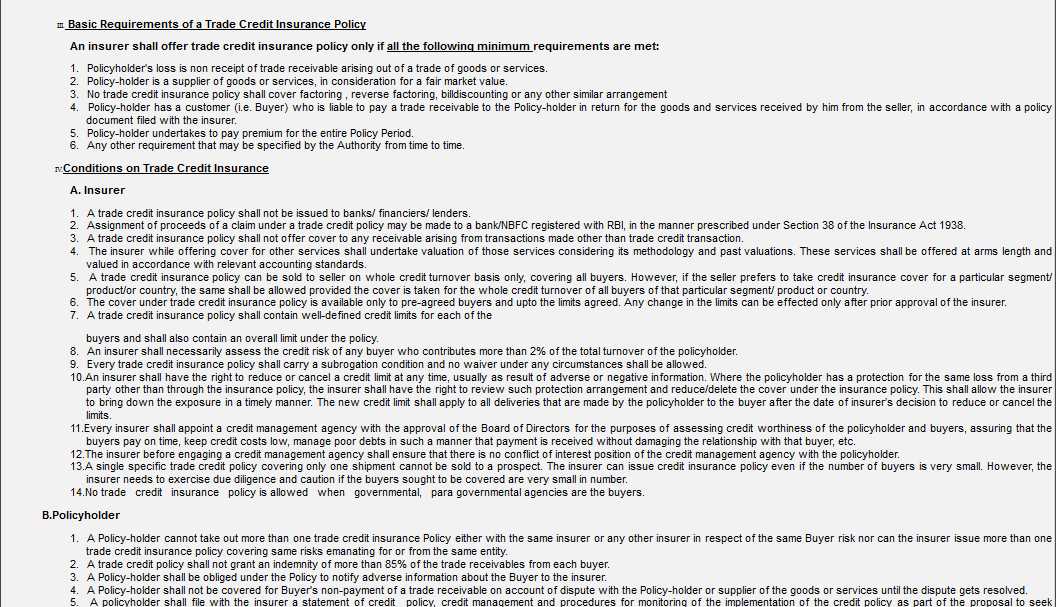

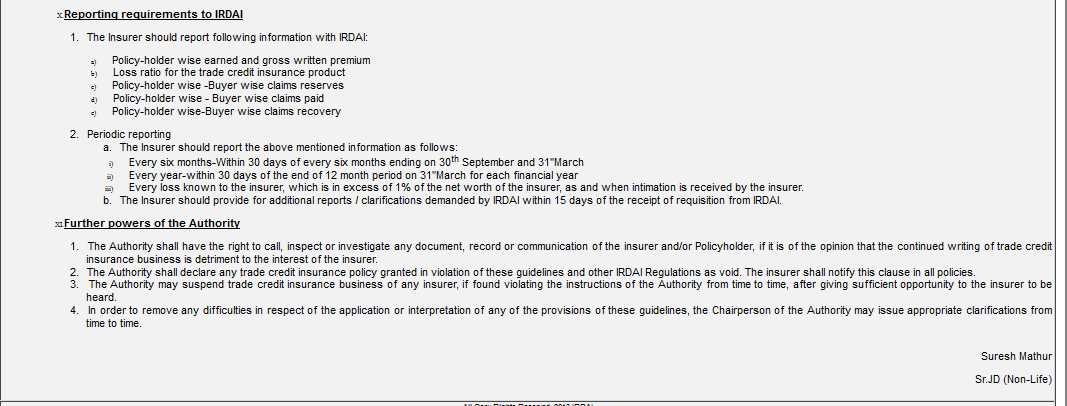

The IRDAI or Insurance Regulatory and Development Authority India had issued guidelines on trade credit Insurance on 13-12-2010 vide circular ref IRDA/NL/CIR/Cre/205/12/2010, to regulate the business of Credit Insurance in India. The Authority hereby issues the revised guidelines on Trade Credit Insurance under Section 14 of the IRDA Act 1999. These guidelines come into force with immediate effect. These guidelines, succeed the “IRDA’s guidelines on trade credit insurance” issued by the Authority on 13-12-2010 vide circular ref IRDA/NL/CIR/Cre/205/12/2010. Basic Requirements of a Trade Credit Insurance Policy An insurer shall offer trade credit insurance policy only if all the following minimum requirements are met: 1. Policyholder's loss is non receipt of trade receivable arising out of a trade of goods or services. 2. Policy-holder is a supplier of goods or services, in consideration for a fair market value. 3. No trade credit insurance policy shall cover factoring, reverse factoring, bill discounting or any other similar arrangement 4. Policy-holder has a customer (i.e. Buyer) who is liable to pay a trade receivable to the Policy-holder in return for the goods and services received by him from the seller, in accordance with a policy document filed with the insurer. 5. Policy-holder undertakes to pay premium for the entire Policy Period. 6. Any other requirement that may be specified by the Authority from time to time. IRDA Credit Insurance Guidelines

__________________ Answered By StudyChaCha Member |