|

#1

| |||

| |||

|

Hi I would like to have information about the Tax Saving Scheme by the State Bank of India as well as the detailed interest rates for various time periods?

|

|

#2

| |||

| |||

|

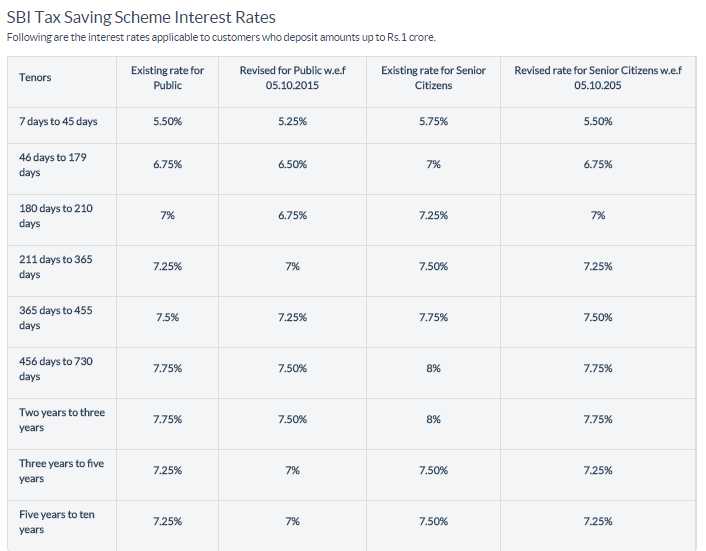

The Tax Saving Scheme by the State Bank of India has been intended to help people and HUFs spare cash on assessment and determine viable yields. It can either be a solitary record or a shared service, and clients must be Indian occupants to pick up qualification to apply for the same. Qualification Criteria To profit the expense sparing plan, the State Bank of India has set out a few criteria that candidates must match. Case in point, you should live in India and can be either an individual, or a Karta of a Hindu Undivided Family. All candidates are required to have a PAN (Permanent Account Number) for money charge purposes. Account Type Term Deposit Account / Special Term Deposit Account (Single Account) Deposit Amount The minimum amount of money that can be deposited is Rs.1,000 or multiples thereof The maximum amount of money that can be deposited must not exceed Rs.1,50,000 in a year Rate of Interest As applicable to term deposits, with the lowest being 5.25% and the highest being 7.5%. Senior citizens get an extra 0.5% return on their investment. Period The minimum tenor for this scheme is 5 years and the maximum tenor is 10 years. Premature withdrawal is now allowed before the expiry of five years since the date on which the scheme was issued. TDS Tax benefits provided under section 80C of Income Tax Act, 1961 Loan against the scheme Not available (The term deposit or standard term deposit cannot be pledged as security to avail the loan) Nomination (if any) Available. Only one person can be nominated by an individual, but joint accounts can nominate more than one person with common consent. SBI Tax Saving Scheme Interest Rates Following are the interest rates appropriate to customers who deposit amounts up to Rs.1 crore.

__________________ Answered By StudyChaCha Member |