|

#51

| |||

| |||

|

State Bank of India was founded in July 1, 1955, it is an Indian multinational, Public Sector banking and financial services company and it is a government-owned corporation and it offers some of the most exciting Personal Loan products in India…. Interest Rate for SBI Personal Loan: 2.02% - 3.03% of the loan amount. Interest Rates: Personal Loans Scheme (SBI Saral): 8. 50% above Base Rate floating, currently 18.50% per annum.  Age limit: Minimum: At least 21 years old Maximum: Less than 58 years old Loan Amount: Minimum Loan amount: Rs.25,000/- Maximum loan amount: 12 times Net Monthly Income for Salaried Individuals and pensioners subject to a maximum of Rs.10 lacs. Documents required to apply for loan : Signed Application form with photograph Proof of identity: Passport/ voter ID card/driving license Documentation for salaried applicants: Latest salary slip Current dated salary certificate with the latest Form 16 Documentation for self-employed applicants: Latest Bank statement Latest ITR or Form 16 Processing fee cheque Last 3 months bank statement/6 months bank passbook

__________________ Answered By StudyChaCha Member |

|

#53

| |||

| |||

|

State Bank of India is one of the Big Four banks of India, along with Bank of Baroda, Punjab National Bank and ICICI Bank, it is an Indian multinational, Public Sector banking and financial services company and it was founded in 1 July 1955. SBI offers 4 exciting types of Personal Loans: Xpress Credit Personal Loan, SBI Saral Loan, SBI Festival Loans, Personal Loans to pensioners. Interest Rates on SBI Personal loans as 03 October 2015: • Xpress Credit - 12.85% - 15.35% p.a. • SBI Pension Loans - 13.35% p.a. • Jai Jawan Pension Loan - 14.45% p.a. • SBI Saral Personal Loan - 18.20% p.a. • Festival Loan Scheme - 16.45% p.a. • Clean Overdraft - 17.95% p.a. Documents Required: 1). Passport size photograph 2). Proof of official address for self employed individuals and professionals. This can include shop and establishment certificate/Lease deed/Telephone Bill 3). Latest Salary clip and Form 16, in the case of salaried persons. Loan Amount: 2.50 lakhs in Non Metros 5 lakhs in Metros Upto 10 lakhs where salaried account or current account is with Sbi It is determined by your repayment capacity. Minimum Income:Rs.24,000/- in metro and urban centres Rs.10,000/- in rural/semi-urban centres Maximum Loan Amount:12 times Net Monthly Income for salaried individuals and pensioners subject to a ceiling of Rs.10 lacs in all centres Address: State Bank of India Bail Bajar, Sakinaka, Mumbai, Maharashtra 400072

__________________ Answered By StudyChaCha Member |

|

#55

| |||

| |||

|

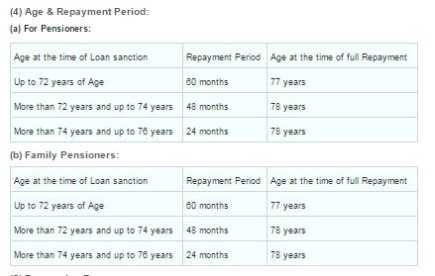

State Bank of India (SBI) Personal Loans can help an individual to meet financial need in expenses for domestic or foreign travel, medical treatment of self or a family member, meeting any financial liability etc.. SBI offers 4 exciting types of Personal Loans: Xpress Credit Personal Loan, SBI Saral Loan, SBI Festival Loans, Personal Loans to pensioners. And you want information about SBI Pension Loans Interest rate so here I am giving you the same please have a look…… SBI Pension Loans Interest Loan- 3.90% above Base Rate, currently 13.20% p.a. Eligibility: The pensioner should not be more than 76 years of age In addition, pensioners whose pensions are disbursed by Government Treasuries by means of cheques drawn in favour of our branches, as per mandate of the pensioner, are also proposed to be included. In such cases, the original Pension Payment Order (PPO) remains in the custody of the Treasury and the pensioner gives a mandate to the Treasury for payment of pension through a particular branch of a bank. Loan Amount: For Pensioners: Minimum: Rs. 25,000/- Maximum: 18 months' Pension with a ceiling of: Rs. 14.00 lacs: For Pensioners who are upto 72 years of age. Rs. 12.00 lacs: For Pensioners who are above 72 years and upto 74 years of age. Rs. 7.50 lacs: For Pensioners who are above 74 years and upto 76 years of age. For Family Pensioners: Minimum: Rs. 25,000/- Maximum: 18 months' Pension with a ceiling of: Rs. 5.00 lacs: For Pensioners who are upto 72 years of age. Rs. 4.50 lacs: For Pensioners who are above 72 years and upto 74 years of age. Rs. 2.50 lacs: For Pensioners who are above 74 years and upto 76 years of age. Age & Repayment Period:  Margin: Nil

__________________ Answered By StudyChaCha Member |