|

#1

| |||

| |||

|

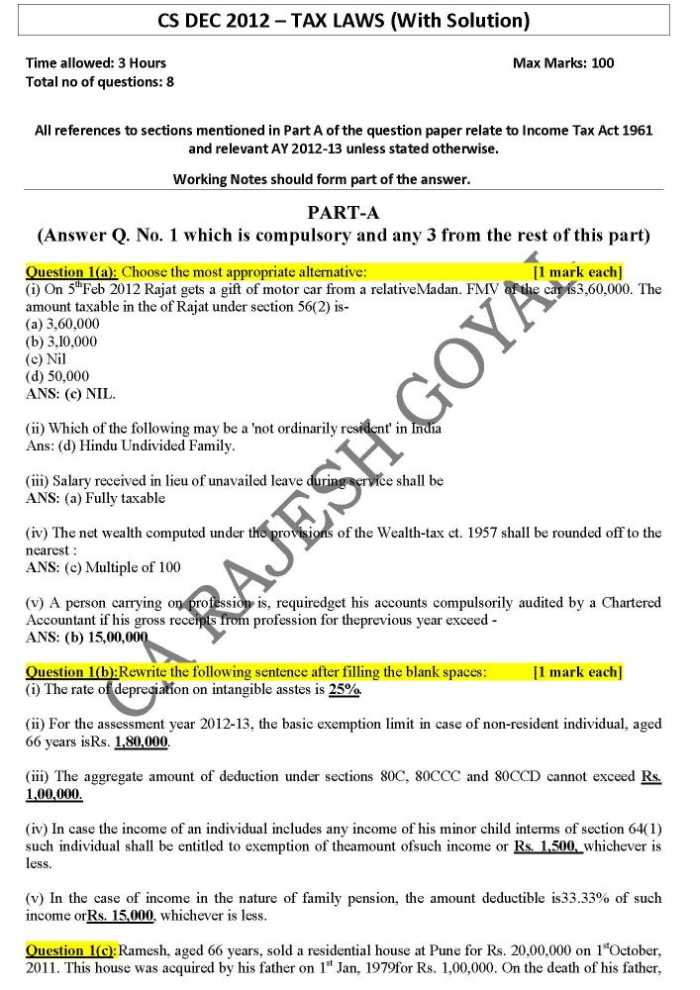

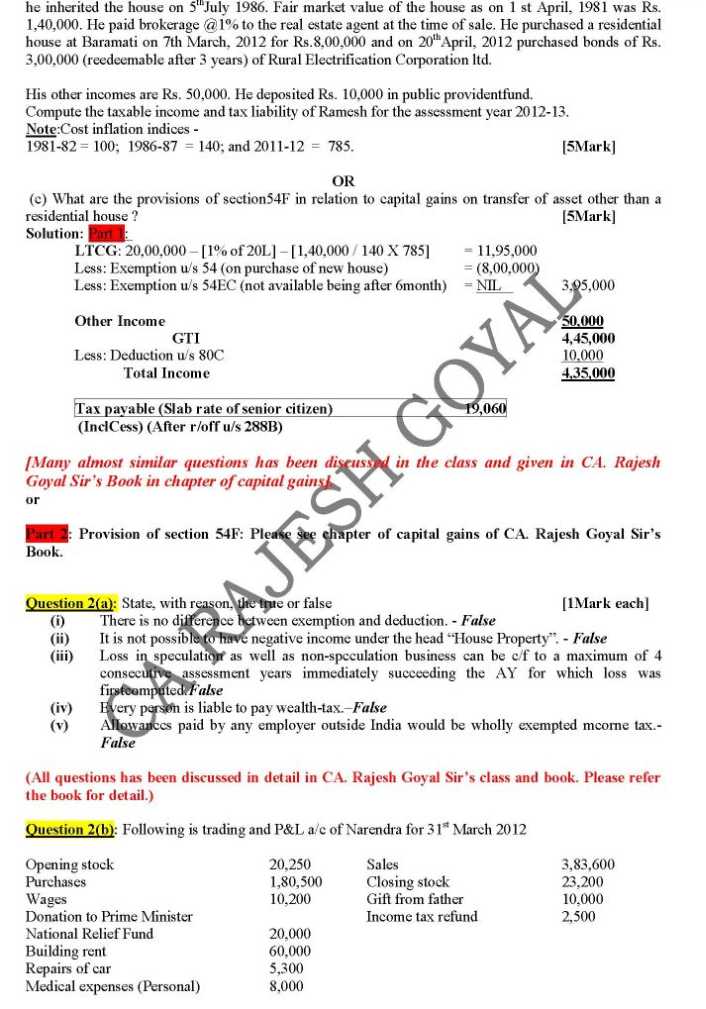

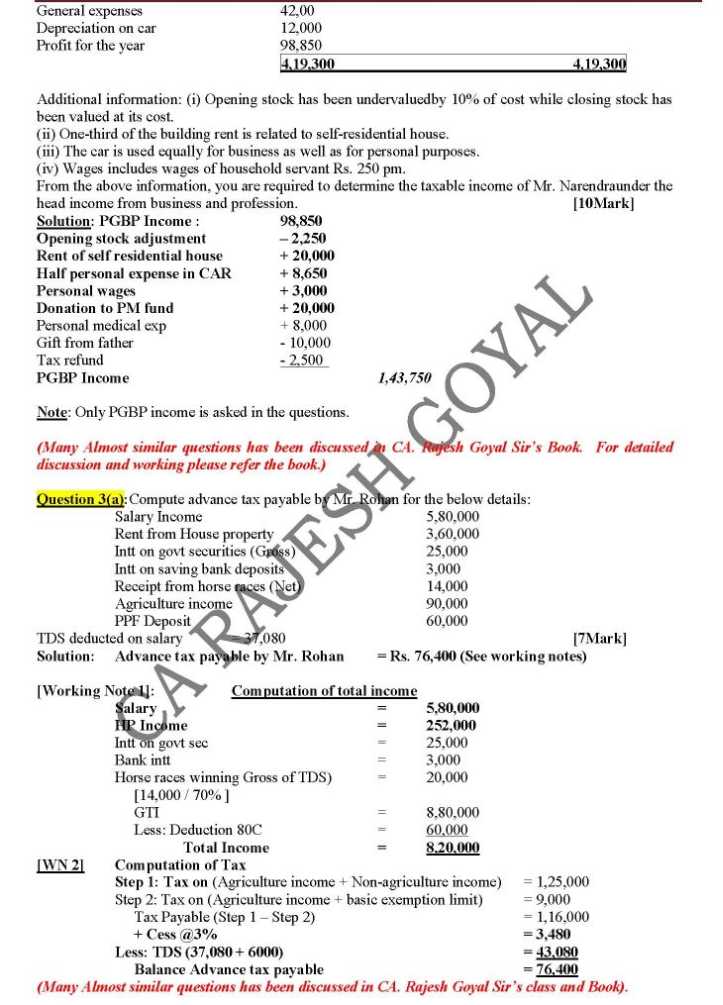

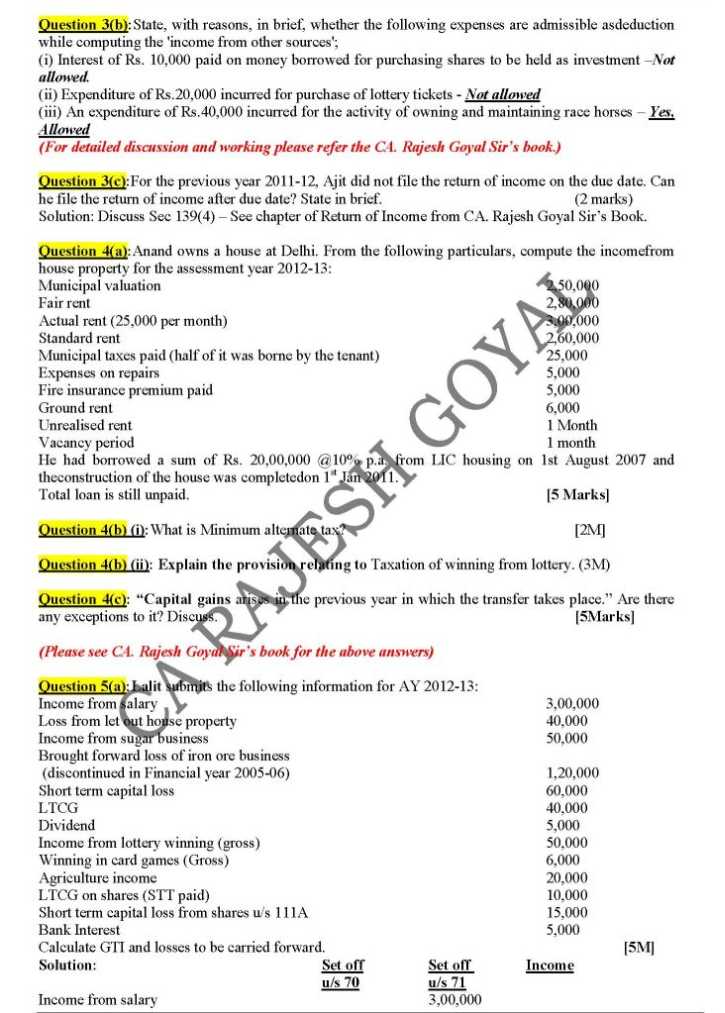

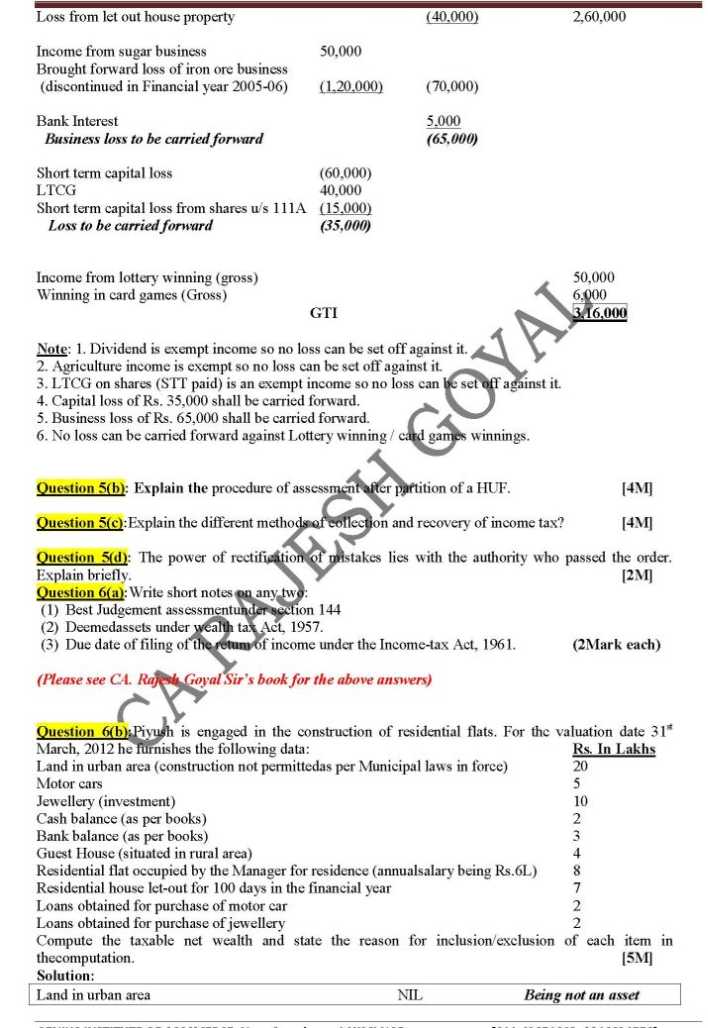

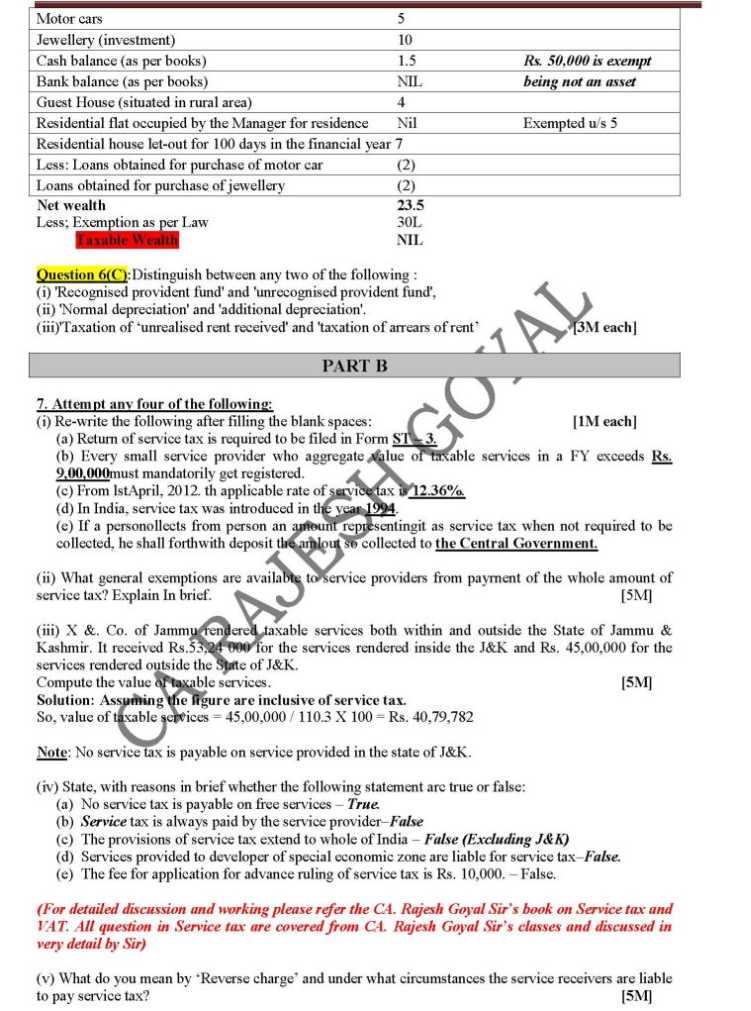

Can you provide me the CS Executive Tax Laws Question Paper with Solution as I am preparing for the exam? Below I am listing some of the questions from the question paper of CS Executive Tax Laws Question Paper with Solution and for detailed question paper: PART-A (Answer Q. No. 1 which is compulsory and any 3 from the rest of this part) Question 1(a): Choose the most appropriate alternative: [1 mark each] (i) On 5thFeb 2012 Rajat gets a gift of motor car from a relativeMadan. FMV of the car is3,60,000. The amount taxable in the of Rajat under section 56(2) is- (a) 3,60,000 (b) 3,l0,000 (c) Nil (d) 50,000 ANS: (c) NIL. (ii) Which of the following may be a 'not ordinarily resident' in India Ans: (d) Hindu Undivided Family. (iii) Salary received in lieu of unavailed leave during service shall be ANS: (a) Fully taxable (iv) The net wealth computed under the provisions of the Wealth-tax ct. 1957 shall be rounded off to the nearest : ANS: (c) Multiple of 100 (v) A person carrying on profession is, requiredget his accounts compulsorily audited by a Chartered Accountant if his gross receipts from profession for theprevious year exceed ANS: (b) 15,00,000 Question 1(b):Rewrite the following sentence after filling the blank spaces: [1 mark each] (i) The rate of depreciation on intangible asstes is 25%. (ii) For the assessment year 2012-13, the basic exemption limit in case of non-resident individual, aged 66 years isRs. 1,80,000. (iii) The aggregate amount of deduction under sections 80C, 80CCC and 80CCD cannot exceed Rs. 1,00,000. (iv) In case the income of an individual includes any income of his minor child interms of section 64(1) such individual shall be entitled to exemption of theamount ofsuch income or Rs. 1,500, whichever is less. (v) In the case of income in the nature of family pension, the amount deductible is33.33% of such income orRs. 15,000, whichever is less. Question 1(c):Ramesh, aged 66 years, sold a residential house at Pune for Rs. 20,00,000 on 1stOctober, 2011. This house was acquired by his father on 1st Jan, 1979for Rs. 1,00,000. On the death of his father, he inherited the house on 5thJuly 1986. Fair market value of the house as on 1 st April, 1981 was Rs.1,40,000. He paid brokerage @1% to the real estate agent at the time of sale. He purchased a residential house at Baramati on 7th March, 2012 for Rs.8,00,000 and on 20thApril, 2012 purchased bonds of Rs.3,00,000 (reedeemable after 3 years) of Rural Electrification Corporation ltd. His other incomes are Rs. 50,000. He deposited Rs. 10,000 in public provident fund. Compute the taxable income and tax liability of Ramesh for the assessment year 2012-13. Note: Cost inflation indices - 1981-82 = 100; 1986-87 = 140; and 2011-12 = 785. [5Mark] CS Executive Tax Laws Question Paper with Solution        Last edited by Aakashd; February 13th, 2020 at 10:02 AM. |

|

#3

| |||

| |||

|

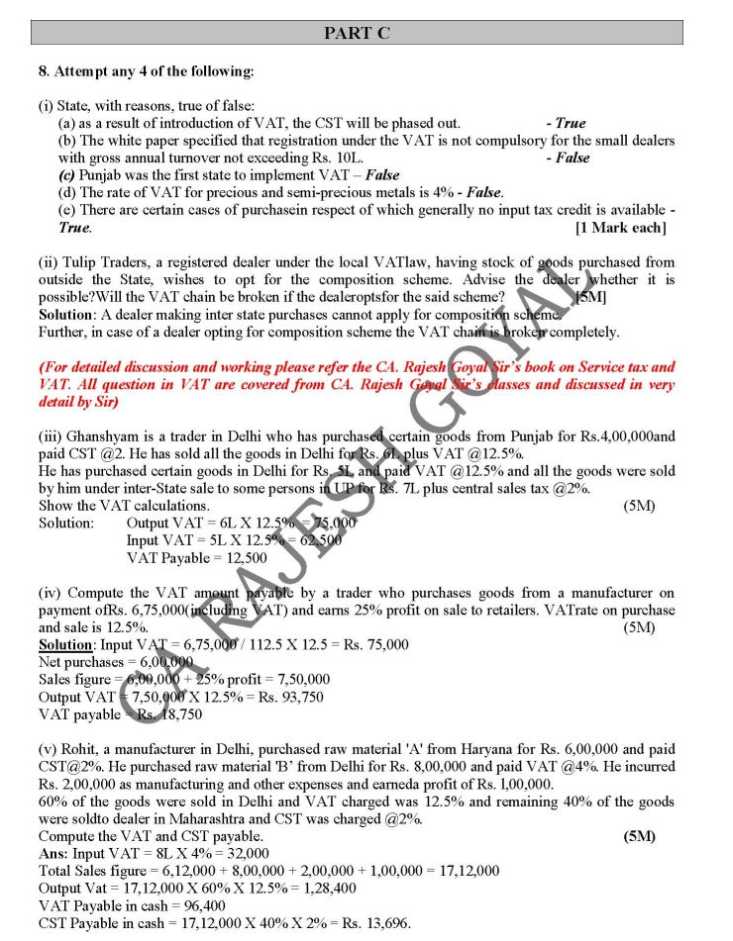

As you want question papers and solutions of CS Executive Tax Laws, so here I am giving following papers: CS Executive Tax Laws Question Paper 2015 1. Which of the following assessee is not liable to pay advance tax under section 207 during the financial year 2014 - 15 — (A) A senior citizen having income chargeable under the head 'profits and gains of business or profession' (B) A senior citizen not having income chargeable under the head 'profits and gains of business or profession' (C) A super senior citizen having income chargeable under the head 'profits and gains of business or profession' (D) A resident individual not being senior citizen having income chargeable under the head 'profits and gains of business or profession'. 2. The total income of Atul, a resident individual, is _2,65,000. The rebate allowable under section 87A would be — (A) _2,000 (B) Nil (C) _1,500 (D) _1,545. 3. Under the Income-tax Act, 1961, LLP is chargeable to tax @ — (A) 30% plus cess and SHEC or AMT @ 18.5% plus cess and SHEC (B) 30% plus cess and SHEC or AMT @ 18.5% (C) 30% plus cess and SHEC or MAT @ 18.5% plus cess and SHEC (D) 30% plus cess and SHEC or MAT @ 18.5%. 4. The year in which the income is earned is known as — (A) Previous year (B) Financial year (C) Both (A) and (B) (D) None of the above. 5. For the previous year 2014 - 15, taxable income of A Ltd., a domestic company is _10,86,920. Its tax liability would be — (A) _2,47,822 (B) _4,47,811 (C) _3,32,770 (D) _3,35,860. 6. Which of the following is not a requisite for charging income-tax on capital gains — (A) The transfer must have been effected in the relevant assessment year (B) There must be a gain arising on transfer of capital asset (C) Capital gains should not be exempt under section 54 (D) Capital gains should not be exempt under section 54EC. 7. In order to enjoy exemption under section 54EC, the resultant long-term capital gains should be invested in specified bonds within a period of _________ from the date of transfer. (A) 36 Months (B) 4 Months (C) 6 Months (D) 12 Months. 8. Which of the following is not correct about the approved superannuation fund — (A) Employees' contribution qualifies for deduction under section 80C (B) Any amount contributed by the employer is exempt from tax (C) Interest on accumulated balance is exempt from income-tax (D) Under some circumstances, payments from the fund are chargeable to income-tax. 9. Ashraf is an employee of Moon Public School. His daughter, Zara, is studying in the said school at a concessional fees of _600 per month (Actual fee : _4,000 per month). The amount taxable in the hands of Ashraf will be — (A) _48,000 (B) _7,200 (C) Nil (D) _40,800. 10. Ashok took an interest-free loan of _15,000 from B Ltd. (the employer). Assuming that the market rate of interest on similar loan is 10%, the taxable value of the perquisite in the hands of Ashok will be — (A) _150 (B) _1,500 (C) Nil (D) None of the above. 11. During the previous year 2014-15, Barun received a watch worth _20,000 from his employer. The taxable value of the watch will be — (A) _15,000 (B) _20,000 (C) Nil (D) None of the above. 12. Shyam transferred 2,000 shares of X Ltd. to Ms. Babita without any consideration. Later, Shyam and Ms. Babita got married to each other. The dividend income from the shares transferred would be — (A) Taxable in the hands of Shyam both before and after marriage (B) Taxable in the hands of Shyam before marriage but not after marriage (C) Taxable in the hands of Shyam after marriage but not before marriage (D) Never taxable in the hands of Shyam. 13. Arjun has a salary income of _4,60,000. He also received an interest of _18,000 on his fixed deposit (after deducting TDS @ 10%) and _2,000 on his savings account with SBI. He deposited _50,000 in PPF account. The net income-tax liability of Arjun for the assessment year 2015-16 is — (A) _16,480 (B) _15,330 (C) _16,270 (D) None of the above. 14. Deduction under section 80CCG is available to an eligible resident individual whose gross total income does not exceed — (A) _10,00,000 (B) _12,00,000 (C) _5,00,000 (D) No such limit. 15. Sahil works in a technology company. On 1st January, 2013, he took a loan of _2,40,000 from his company for the education of his daughter. During the year 2014-15, he paid an interest of _26,000 towards the said loan and repaid principal component of _10,000. The deduction that he can claim under section 80E would be — (A) Nil (B) _24,000 (C) _46,000 (D) _10,000. 16. Under the Income-tax Act, 1961, which of the following can claim deduction for any sum contributed during the previous year to a political party or electoral trust — (A) Local authority (B) Individual (C) Artificial juridical person (D) None of the above. 17. Under the Income-tax Act,1961, interest on capital received by a partner from a partnership firm is chargeable under the head — (A) Profits and gains of business or profession (B) Income from other sources (C) Capital gains (D) None of the above. 18. Zen Ltd. made a payment of _11,00,000 to Amar, a resident transport contractor who has intimated his PAN details. The tax to be deducted at source under section 194C will be — (A) _10,000 (B) _200 (C) Nil (D) _11,000. 19. 'Income' under section 2(24) includes — (i) The profits and gains of a banking business carried on by a co-operative society with its members. (ii) Any advance money forfeited in the course of negotiations for transfer of capital asset. Choose the correct option with reference to the above statements — (A) Both (i) and (ii) (B) Only (i) (C) Only (ii) (D) Neither (i) nor (ii). 20. Interest payable under section 234C is computed at — (A) Compound interest @ 1% per month (B) Simple interest @ 1% per annum (C) Compound interest @ 1% per annum (D) Simple interest @ 1% per month. 21. Deduction in respect of donations to National Defence Fund is allowed under section — (A) 80G (B) 80CCG (C) 80C (D) None of the above. 22. Interest for default in payment of installment(s) of advance tax is levied under section — (A) 234A (B) 234B (C) 234C (D) 234D. 23. Raman purchased a residential house property in Ahmedabad on loan for which he paid an interest of _50,000 during the previous year. He is working in Delhi and getting an HRA of _4,000 per month. He can claim exemption/deduction for — (A) Only HRA (B) Only interest paid (C) Either interest paid or HRA but not both (D) Both HRA and interest paid. 24. The Income-tax Act, 1961 empowers the Central Government to enter into double taxation avoidance agreements with other countries under section — (A) 87 (B) 88 (C) 90 (D) None of the above. 25. Maximum penalty leviable for concealment of wealth under Wealth-tax Act, 1957 is — (A) 100% of tax avoided (B) 300% of tax avoided (C) 500% of tax avoided (D) None of the above. 26. Rahul has purchased an aircraft for _120 lakh. He has taken loan of _20 lakh to purchase the same. He does not own any other asset. The wealth-tax on the above asset will be — (A) _70,000 (B) _90,000 (C) _1,00,000 (D) None of the above. 27. Lalit, a resident individual of 81 years works as a consultant. If his taxable income is _5,20,000, the tax payable by him would be — (A) _22,660 (B) Nil (C) _2,060 (D) _12,460. 28. An Indian repatriate came to India on 1st October, 2014. Out of the balance in his non-resident external account (NREA) of _20 lakh, he purchased a car for _15 lakh. What would be tax treatment under the Wealth-tax Act, 1957 — (A) Both car and balance in NREA will be exempt (B) Both car and balance in NREA will be taxable (C) Only car will be taxable (D) Car will be exempt but balance in NREA will be taxable. 29. Wealth-tax return is to be filed in — (A) Form BA (B) Form BB (C) Form AB (D) Form AA. 30. According to Wealth-tax Rules, 1957, the notice of demand for recovery of wealthtax shall be in — (A) Form C (B) Form BB (C) Form A (D) Form B. 31. Sarath has received a sum of _3,40,000 as interest on enhanced compensation for compulsory acquisition of land by State Government in May, 2014. Of this, only _12,000 pertains to the current year and the rest pertains to earlier years. The amount chargeable to tax for the assessment year 2015-16 would be — (A) _12,000 (B) _6,000 (C) _3,40,000 (D) _1,70,000. 32. Which of the following double taxation avoidance agreement (DTAA) emphasises on residence principle — (A) UN Model (B) US Model (C) OECD Model (D) Andean Model. 33. Under section 208, it is obligatory for an assessee to pay advance tax where the tax payable is — (A) _10,000 or more (B) _20,000 or more (C) _5,000 or more (D) _8,000 or more. 34. Which of the following cannot claim deduction for the loan taken to purchase a house property — (A) Karta, in respect of property purchased by HUF (B) An individual, in respect of property purchased by him (C) Partner, in respect of property purchased by the firm (D) Spouse of an individual, in respect of property purchased jointly by the individual and his/her spouse. 35. Rohit owns a house property in Delhi which he wants to give on rent. He seeks your help to determine the reasonable expected rent when monthly municipal value is _20,000, fair rent _25,000 and standard rent _22,000. The reasonable expected rent will be computed with reference to following amount per month— (A) _22,000 (B) _20,000 (C) _25,000 (D) None of the above. 36. Under the Income-tax Act,1961, dividend derived from the shares held as stock-intrade are taxable under the head — (A) Income from other sources (B) Income from profits and gains of business or profession (C) Capital gains (D) Either capital gains or income from profits and gains of business or profession. 37. Under the Income-tax Act,1961, 'notional profit' from speculative business is — (A) Taxable under the head 'income from profits and gains of business and profession' (B) Taxable under the head 'income from other sources' (C) Taxable either as income from other sources or as income from profits and gains of business and profession (D) Not taxable. 38. A person carrying specified profession will have to maintain books of account prescribed by Rule 6F of the Income-tax Rules, 1962, if gross receipts are more than _1,50,000 for — (A) All preceding 5 years (B) Any of the preceding 5 years (C) All preceding 3 years (D) Any of the preceding 3 years. 39. If a block of assets ceases to exist on the last day of the previous year, depreciation admissible for the block of assets will be— (A) Nil (B) 50% of the value of the block of assets on the first day of the previous year (C) The total value of the block of assets on the first day of the previous year (D) 50% of the value of the block of assets on the last day of the previous year. 40. Under section 40A(3) which of the following payment for an expenditure incurred would not be admissible as deduction from business income — (A) _15,000 paid in cash to a transporter (B) _15,000 paid in cash to a dealer in the morning and _10,000 paid in cash to the same dealer in the evening (C) _40,000 sent through NEFT to the bank account of the dealer for goods purchased (D) _19,000 paid through bearer cheque to the dealer for goods purchased. 41. If an individual, having a sales turnover of _60 lakh files his return of income for the assessment year 2015-16 after the due date, showing unabsorbed business loss of _23,000 and unabsorbed depreciation of _45,000, he can carry forward to the subsequent assessment years — (A) Both unabsorbed business loss of _23,000 and unabsorbed depreciation of _45,000 (B) Only unabsorbed business loss of _23,000 (C) Only unabsorbed depreciation of _45,000 (D) Neither unabsorbed business loss of _23,000 nor unabsorbed depreciation of _45,000. 42. Sameer sold goods worth _50,000 at credit on 1st April, 2011. However, he has written off _10,000 of it as bad debts and claimed deduction for the same during the year 2013-14. On 4th April, 2014, the defaulting debtor made payment of _45,000. The taxable amount of bad debts recovered for the year 2014-15 would be — (A) _5,000 (B) _50,000 (C) _45,000 (D) _10,000. 43. Under the Income-tax Act,1961, which of the following outlays incurred by Sun Ltd. during the previous year ended 31st March, 2015 will not be admissible as deduction while computing its business income — (A) Contribution to a political party in cash (B) Interest on loan taken for payment of income-tax (C) Capital expenditure on advertisement (D) All of the above. 44. Which of the following business commenced during August, 2014 will not be eligible for deduction under section 35AD — (A) Setting-up and operating a cold chain facility (B) A production unit of fertilizer in India (C) Operating of a 1 star hotel in a village (D) Building a hospital of 200 beds. 45. Provisions of section 115JC are not at all applicable to — (A) LLPs (B) Companies (C) Partnership firms (D) Individuals. 46. Paresh, a software engineer at ABC Ltd. left India on 10th August, 2014 for the treatment of his wife. For income-tax purpose, his residential status for the assessment year 2015-16 will be — (A) Resident (B) Non-resident (C) Not ordinarily resident (D) Cannot be determined from the given information. 47. A non-professional firm M/s Bright has book profits of _9,36,000. The admissible remuneration to working partners for income-tax purpose shall be — (A) _6,51,600 (B) _6,81,600 (C) _2,70,000 (D) None of the above. 48. MAT credit in respect of excess taxes paid under section 115JB can be carried forward for — (A) 7 Assessment years (B) 10 Financial years (C) 10 Assessment years (D) 7 Financial years. 49. Provisions of section 44AD for computation of presumptive income are not applicable to — (A) Limited liability partnership (B) Partnership firm (C) Resident Hindu Undivided Family (D) Resident individual. 50. A partnership firm whose sales turnover is _90 lakh has derived income from an industrial undertaking entitled to deduction under section 80-IB. The due date for filing the return of income for the assessment year 2015-16 will be — (A) 31st July, 2015 (B) 30th September, 2015 (C) 31st October, 2015 (D) None of the above. more papers detail attached pdf files;

__________________ Answered By StudyChaCha Member |