|

#1

| |||

| |||

|

What is CDS Finance Term? Give me some detail about it or tell me from where I can get info about it.

|

|

#2

| |||

| |||

|

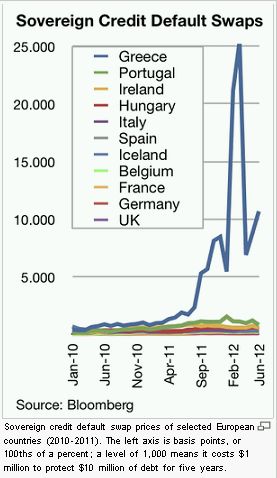

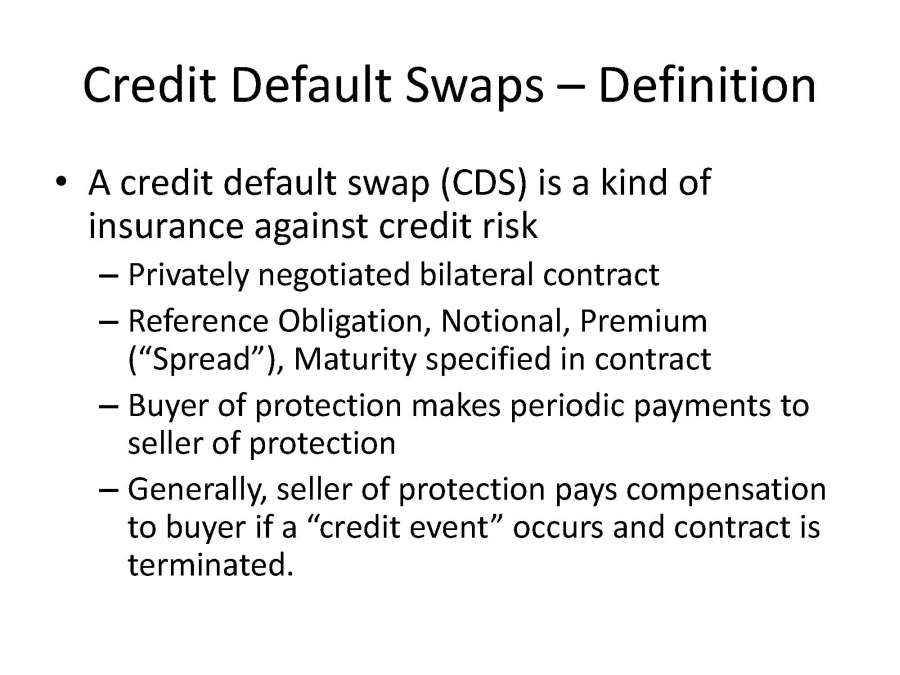

A credit default swap (CDS) is a financial swap contract. A CDS is regarded insurance against non-payment. A is swap planned to transfer the credit exposure between parties. We are attaching a graph of sovereign credit default swap of many countries from January 2010 to June 2012. You can see the graph here.

__________________ https://t.me/pump_upp |

|

#4

| |||

| |||

|

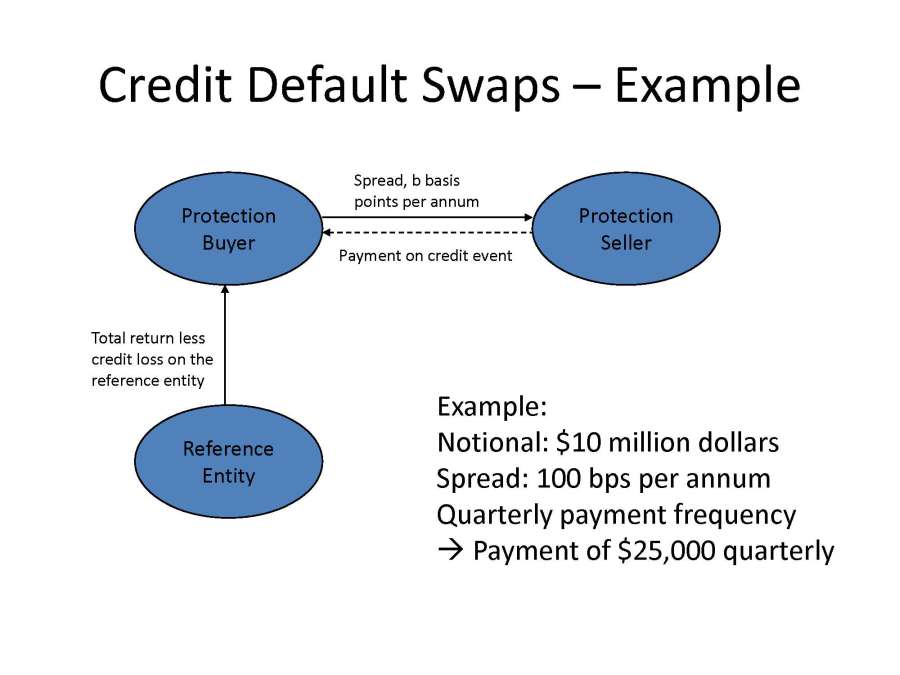

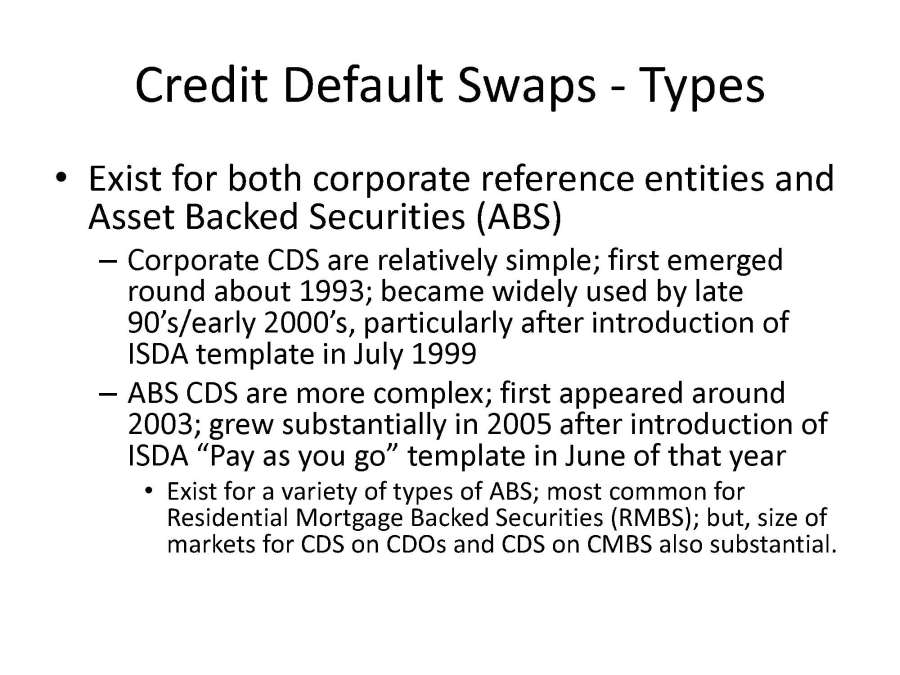

A Credit Default Swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. CDS risk factors: When entering into a CDS, both the buyer and seller of credit protection take on counterparty risk: The buyer takes the risk that the seller may default. If AAA-Bank and Risky Corp. default simultaneously ("double default"), the buyer loses its protection against default by the reference entity. If AAA-Bank defaults but Risky Corp. does not, the buyer might need to replace the defaulted CDS at a higher cost. The seller takes the risk that the buyer may default on the contract, depriving the seller of the expected revenue stream. More important, a seller normally limits its risk by buying offsetting protection from another party — that is, it hedges its exposure. If the original buyer drops out, the seller squares its position by either unwinding the hedge transaction or by selling a new CDS to a third party. Depending on market conditions, that may be at a lower price than the original CDS and may therefore involve a loss to the seller. Please find the below attached file for more details about CDS Finance Term: CDS Finance Term

__________________ Answered By StudyChaCha Member |