|

#1

| |||

| |||

|

Can you help me by giving the TNOU MBA-Second Year-Tax Management (MSP-32) Exam Previous Years Question Papers????

|

|

#2

| |||

| |||

|

Here is the TNOU MBA-Second Year-Tax Management (MSP-32) Exam Previous Years Question Paper: 2. What do you understand by the term ‘business’ and ‘profession’? 3. What are the provisions of law relating to preliminary expenses? 4. How will you assess the taxable income of an individual? 5. What are the salient features of the taxation scheme for a firm? 6. Distinguish between capital and revenue expenditure. 7. What are the exceptions to the rule that the income of the previous year is assessed to tax in the assessment year? 8. Mr. Babu received the following income during 2006-07. Compute taxable income under ‘other sources’ separately for each case : (a) (i) Winning from Sikkim Lottery (Net) Rs. 13,880 (ii) Winning from Horse races Rs. 2,000 (iii) Winning from cross word puzzle Rs. 4,000 (iv) Winning from card games Rs. 10,000. (b) (i) Winning from lottery Rs. 2,000 (ii) Winning from horse races (Net) Rs. 20,820. 9. Give at least 10 examples of income from other sources. 10. How will you distinguish between capital gain and income? Why is it important to make this distinction? 11. Explain the different types of companies. 12. How would you compute the taxable income of a firm?

__________________ Answered By StudyChaCha Member |

|

#3

| |||

| |||

|

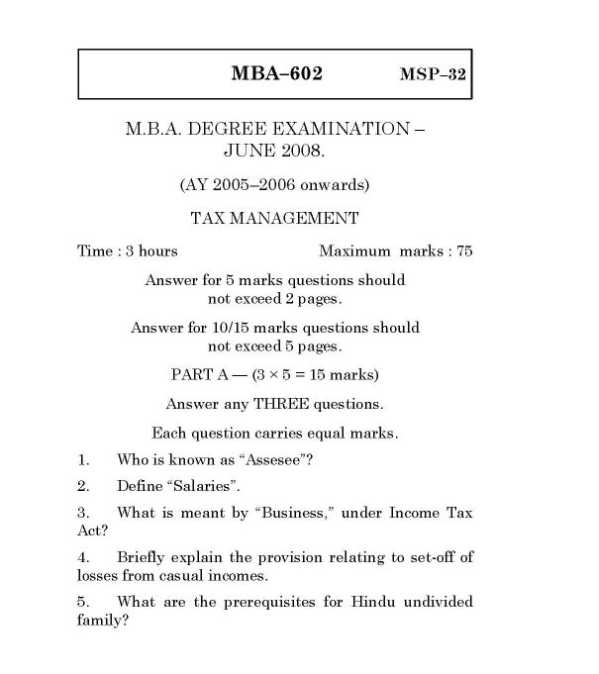

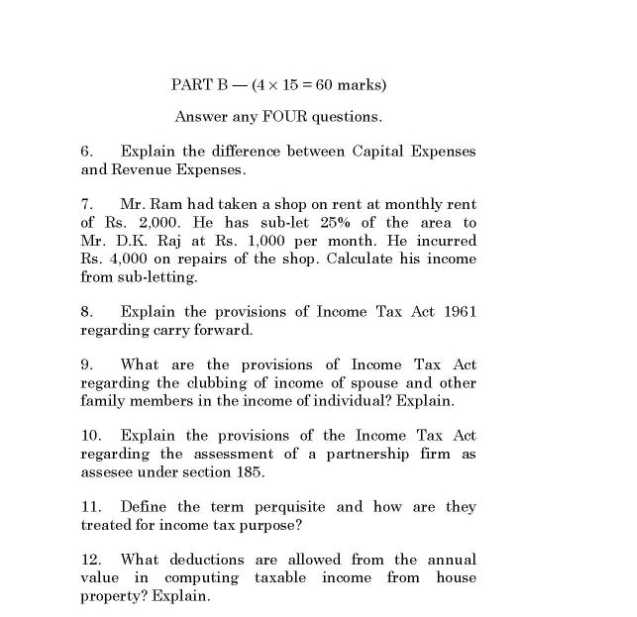

You need Tamil Nadu Open University M.B.A 2nd Year Tax Management question paper, here I am giving: 1. Who is known as “Assesee”? 2. Define “Salaries”. 3. What is meant by “Business,” under Income Tax Act? 4. Briefly explain the provision relating to set-off of losses from casual incomes. 5. What are the prerequisites for Hindu undivided family? 6. Explain the difference between Capital Expenses and Revenue Expenses. 7. Mr. Ram had taken a shop on rent at monthly rent of Rs. 2,000. He has sub-let 25% of the area to Mr. D.K. Raj at Rs. 1,000 per month. He incurred Rs. 4,000 on repairs of the shop. Calculate his income from sub-letting. 8. Explain the provisions of Income Tax Act 1961 regarding carry forward. 9. What are the provisions of Income Tax Act regarding the clubbing of income of spouse and other family members in the income of individual? Explain. 10. Explain the provisions of the Income Tax Act regarding the assessment of a partnership firm as assesee under section 185.

__________________ Answered By StudyChaCha Member |