|

#1

| |||

| |||

|

Will you please share the Previous Years Question Paper of CA-Integrated Professional Competence Course Exam- Group II Auditing and Assurance Exam?? |

|

#2

| ||||

| ||||

|

As per your request here I am sharing the Previous Years Question Paper of CA-Integrated Professional Competence Course Exam- Group II Auditing and Assurance Exam 1. State with reasons (in short) whether the following statements are true or false. (Answer any ten): 10x2=20 * * (i) While*auditing*the accounts of a company, it is obligatory that the auditor must adopt sampling technique. * (0) * (ii) Interim dividend is not a part of dividend. * (0) * (iii) A casual vacancy caused by resignation of the auditor can be filled by the Board of Directors. * (0) * (iv) The auditor, in the interest of the users, while explaining the nature of his reservation, can describe the work of the expert with his name, in the*audit*report*without obtaining prior consent of the expert. * (0) * (v) The auditee firm has no right to compel the auditor to provide copies of the working papers. * (0) * (vi) Comptroller and Auditor General of India can be removed by the Prime Minister of India on the recommendation of his Council of Ministers. * (0) * (vii) Provisions of Companies (Auditor’s Report) order 2003 as amended upto date, apply to clubs, chambers of commerce, research institutes etc, which have been established under Section 25 of the Companies Act, 1956. * (0) * (viii) Mr. X, a*Chartered*Accountant, is an employee of M/s M & N Co., a firm of Chartered Accountants of India. The firm is the Auditors of ABC & Co. Ltd. After auditing the accounts of the Company the Auditor firm allowed Mr. X, their employee, to sign the audit report; which he did. * (0) * (ix) The Auditor disagreed with the management with regard to the acceptability of the*Accounting*Policies*and the inadequacy of disclosures in the financial statements and issued a .disclaimer. * (0) * (x) Analytical procedures are unable to help the Auditor in determining the nature, timing and extent of other audit procedures at the planning stage. * (0) * (xi) A Company which has been unable to negotiate borrowings from its bankers claims that it will be able to continue as a 'going concern'. * (0) * (xii) The overall objective of audit changes in Computer Information System (CIS) environment. * (0) 2. Comment on the following situations: * * * (a) XYZ Ltd. Co. gave a donation of Rs.50,000 each to a Charitable Society running a school and a trust set up for the service of Blind during financial year ending on 31st March, 2009. The average net profits of the company for the last three years were 15 lakhs. 8 (0) * (b) Mr. X, a shareholder of the company pointed out that: 6 * * * (i) The goodwill in the Balance Sheet of the company has appeared on same figure during the past three years. * (0) * * (ii) Premium received on issue of shares prior to the date of balance sheet has been transferred to*Profitand*Loss*account*for arriving at the figure of commission payable to the managing director. * (0) * (c) A, B & C Company Ltd. removed its first Auditor before the expiry of his term without obtaining approval of the Central Government. 6 (0) 3. Discuss the basic principles governing an audit. 10 (0) 4. (a) Explain concept of materiality and factors which act as guiding factors to this concept. 6 (0) * (b) Describe a set of instructions, which an auditor has to give to his client before the start of actual audit. 4 (0) 5. (a) What are the six important points that will attract your attention in the case of audit of a Hotel? 5 (0) * (b) State the information to be disclosed in the financial statements according to the requirements of AS 6. 5 (0) 6. (a) State clearly provisions of the Companies Act, 1956 with regard to issue of shares at a discount. 5 (0) * (b) As an auditor, comment on the following situation:* MNR Co. Ltd. did not provide for depreciation during the financial year 2007–08 due to inadequacy of profits. The company declared dividend during the financial year 2008–09 without providing for the previous year’s depreciation. 5 (0) 7. (a) Comment on the following situation:* XYZ Co. Ltd. reappointed A and B as their joint auditors in the Annual General Meeting. The AGM authorised the Board for fillup the vacancy on their own in the event of both or either of auditors declined to accept the assignment. The Board passed a resolution to appoint C if any of the auditors declined to accept the assignment.* B declined to accept the assignment and Board of Directors appointed C in place of B as per its resolution. 5x2=10 (0) * * Note: How would you vouch/verify the following. (Answer anyone) : * * * (b) Leasehold property. * (0) * * Or * * * * Goods sent out on Sale or Return Basis. * (0) * (c) Bank overdraft. * (0) 8. (a) X, a Chartered Accountant was engaged by PQR & Co. Ltd. for auditing their accounts. He sent his letter of engagement to the Board of Directors, which was accepted by the Company. In the course of audit of the company, the auditor was unable to obtain appropriate sufficient audit evidence regarding receivables. The client requested for a change in the terms of engagement.* Offer your comments in this regard. 5x2=10 (0) * * Note: Write short notes on the following. (Answer anyone): * * * (b) Cut–off arrangements * (0) * * Or * * * * Audit*risk*at the account balance level and at the class of transactions level. * (0) * (c) Powers of C & AG in connection with the performance of his duties. * (0)

__________________ Answered By StudyChaCha Member |

|

#4

| |||

| |||

|

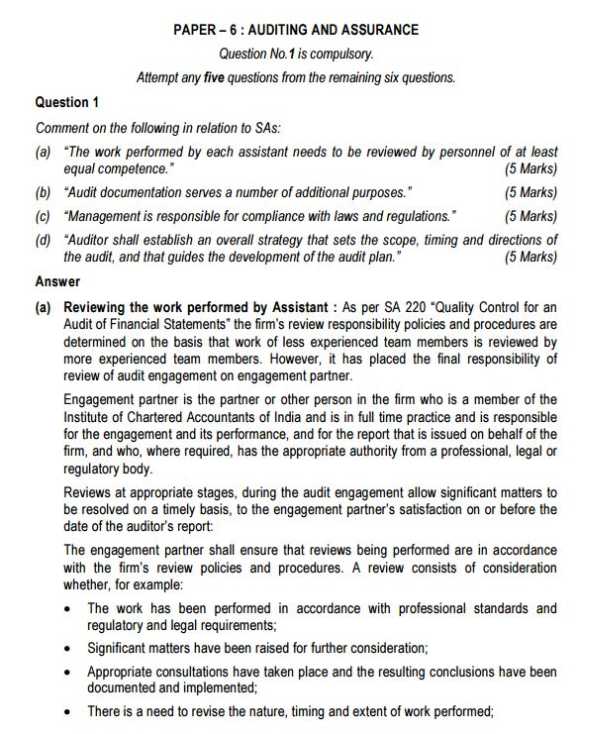

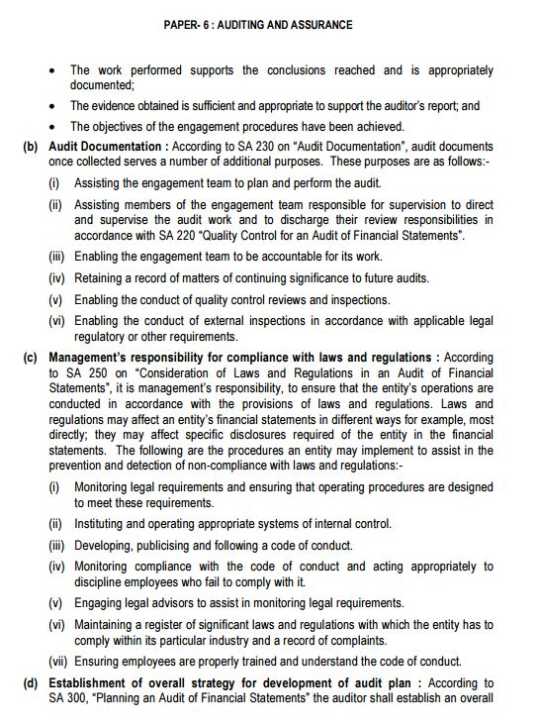

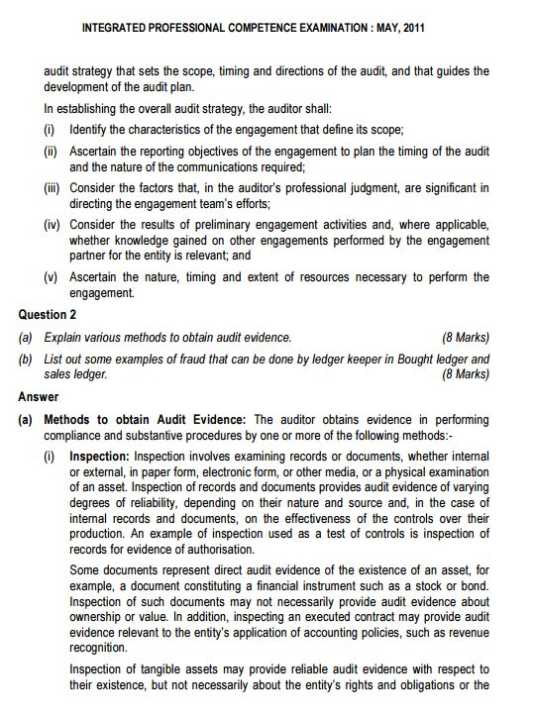

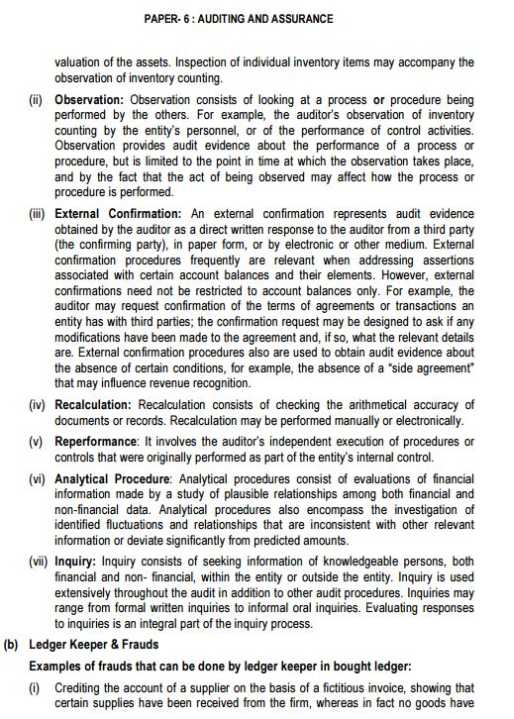

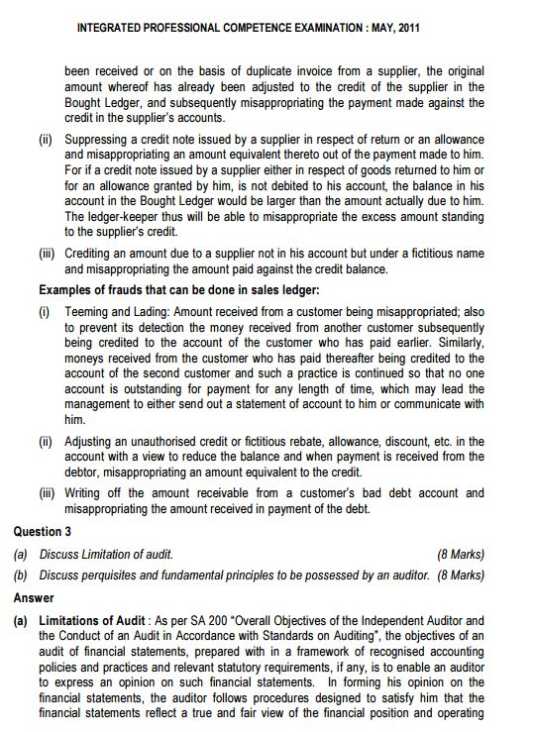

As per your question here I am sharing with you the question paper of Group II Auditing and Assurance Ex of CA-Integrated Professional Competence Course Exam. the questions are: Comment on the following in relation to SAs: (a)The work performed by each assistant needs to be reviewed by personnel of at least equalcompetence.” (bAudit documentation serves a number of additional purposes.” (c)Management is responsible for compliance with laws and regulations.” (d)Auditor shall establish an overall strategy that sets the scope, timing and directions of the audit, and that guides the development of the audit plan.” 2 (a)Explain various methods to obtain audit evidence. (b)List out some examples of fraud that can be done by ledger keeper in Bought ledger and sales ledger. Question 3 (a)Discuss Limitation of audit. (b)Discuss perquisites and fundamental principles to be possessed by an auditor 4 (a)Give various factors which result in increase in Gross profit. (b)Define depreciation and discuss various purposes of providing depreciation. Question paper of Auditing And Assurance EX of CA-Integrated Professional Competence Course Exam      rest of the questions with the Answer you may find in the file given below:

__________________ Answered By StudyChaCha Member |

|

| |