|

#1

| |||

| |||

|

Will you please provide me question paper for the Common Proficiency Test (CPT) examination??

|

|

#2

| ||||

| ||||

|

here I am giving you question paper for the Common Proficiency Test (CPT) examination in PDF files attached with it so you can download it free of cost .. some questions are given below : 1. Bill is drawn by Mr.Mohan on Mr. Mahesh on 30th January 2012 for one Month, then due date of the bill is_________ a) 28th February, 2012 b) 2nd March, 2012 c) 3rd March, 2012 d) 4th March, 2012 2. The expenditure Rs.2,000 incurred on a trial run of newly purchased machine is_________ a) Preliminary expenses b) Capital expenditure c) Revenue expenditure d) Deferred revenue expenditure 3. Unclaimed dividend is shown under ______ a) Other current liabilities b) Reserves & Surplus c) Secured loans d) Miscellaneous expenditure 4. Proprietor used a rented building both for business purpose and as well as residence equally. The rent paid during the year for the building was Rs.1,32,000 debited to rent expenses A/c in the books of business. One month rent is still outstanding. Liability of the business for rent outstanding ___ a) Rs.11,000 b) Rs.12,000 c) Rs.5,500 d) Rs.6,000 5. Which of the following will not affect trial balance? a) Purchase book was under casted by Rs.5,000 b) White wash charges Rs.10,000 were debited to building A/c c) Cash paid to Briz Binan Rs.500 was debited to Briz Binan A/c as Rs.5,000 d) Credit sales of Rs.2,000 to P correctly recorded in sales book but not posted to P’s account. 6. Which of the following is an event ? a) Purchase of goods worth Rs.4,000 b) Sale of goods worth Rs.2,000 c) Closing stock worth Rs.2,000 d) Rent paid Rs.2,000 7. The normal rate of return is 20%. The total capital employed is Rs.6,00,000. The average profit is Rs.1,50,000. Calculate goodwill as the basis of 3 years purchase of super profits. a) Rs.90,000 b) Rs.1,20,000 c) Rs.1,00,000 d) Rs.60,000 8. Which of the following is not a contingent liability? a) Claim against enterprises not acknowledged as debt b) Guarantee given in respect of third parties c) Liability in respect of bills discounted d) Penalty imposed by excise officer for violation of provisions of Central Excise Act 9. Opening stock 400 units @ Rs.20 each. Purchases during the year 200 units @ Rs.25each. Issues – 250 units In LIFO Method, closing stock will be? a) 8750 b) 7000 c) 7750 d) 8000 10. Which of the following concept shows difference between amount of receipt and right to receive an amount? a) Matching Concept b) Going concern Concept c) Accrual Concept d) Realisation Concept 11. Balance in JLP A/c of partners is________ a) Total premium paid by the firm b) Annual premium paid each year c) Surrender Value d) JLP amount - Surrender Value 12. Goods sent on sale or return basis at a cost of Rs.1 lakh. In that, 50% of goods were accepted and 30% of the goods were returned. The remaining stock was held with customer and the period not yet expired. Then closing stock will be ________ a) 1,00,000 b) 50,000 c) 20,000 d) 30,000 13. Goods costing Rs.5,000 will be distributed as wages for Rs.5,000. Market price is Rs.6,000. Journal entry is _______ a) Wages A/c Dr. 6000 To salary A/c 6000 b) Wages A/c Dr. 6000 To salaries A/c 6000 c) Wages A/c Dr. 5000 To purchases A/c 5000 d) Wages A/c Dr. 6000 To purchases 6000 14. ‘A’ has discounted 3 months bill @ 10% p.a. from bank and given credit of 11,700. On due date, the bill was dishonoured and noting charges of Rs.50 was paid by bank. The amount by which A’s A/c will be debited by bank is__________ a) 13050 b) 12050 c) 11000 d) None 15. Which of the following is true? a) Co-venturers always share profits equally b) They cannot be more than two co-venturers c) The relationship between co-venturers is Principal & Agent d) Co-venturers may provide funds for venture 16. Proprietor’s personal expenditure not recorded in the books of accounts due to_____ a) Materiality b) Conservatism c) Going concern d) Business entity concept 17. The debenture amount Rs.2,000 issued as collecteral security required the following Journal entry a) Debit debenture A/c and credit debenture suspense A/c b) Debit debenture suspense A/c and credit debenture A/c c) Debit collateral security and credit debenture A/c d) Debit collateral security and credit debenture suspense A/c 18. Which of the following is false with respect to debentures? a) Companies can issue irredeemable debentures b) Companies can issue debentures with voting rights c) Companies can issue debentures for consideration other than cash d) Companies can issue convertible debentures 19. Which of the following are not taken into consideration while calculating closing stock a) Insurance of warehouse b) Carriage c) Octroi d) Loading expenses 20. Cost of machinery Rs.60,000. They charged depreciation @ 20% on SLM method. In 2nd year they decided to change method and adopt WDV method @ 20%. If machine was sold for Rs.30,000 at the end of 3rd year. Calculate the amount of loss. a) Loss 4720 b) Loss 4560 c) Loss 720 d) Loss 560 21. A company issued 10,000 shares out of 14,000 applied. Mr.A got 300 shares on pro-rata basis. How many shares he would have applied? a) 420 shares b) 300 shares c) 380 shares d) 500 shares 22. Tree limited forfeited 500 shares of Rs.20 each issued at 5% discount, for non payment of allotment and final call of Rs.9 and Rs.5 respectively. Amount credited to share forfeiture A/c will be a) 3,500 b) 2,500 c) 3,000 d) 4,000 23. ABC partners, each partner has an individual life policy of Rs.50000 on 31st August, partner ‘B’ died and the surrender value of each policy at death is Rs.2,000. Share of ‘B’ partner is (equal sharing) a) 17000 b) 18000 c) 50000 d) 54000 24. Rohan & Sohan are partners in a firm sharing profits & losses in the ratio of 3 : 1. A partner Mohan is admitted and he brought Rs.40,000 as goodwill. New profit sharing ratio of all the partners is equal. The amount of goodwill to be shared by old partners is a) Equally Rs.20,000 each b) Rohan Rs.30,000 & Sohan Rs.10,000 c) Rohan Rs.40,000 d) Rohan received Rs.50,000 & Sohan paid Rs.10,000 25. The directors of E limited made the final call of Rs.50 per share on 1st August 2012 indicating the last date of payment of call money to be 31st August. Mr.White holding 5000 shares paid the call money on October 15th 2012. If the company adopts table ‘A’, the amount of interest on calls-in-arrears to be paid by Mr.White would be _________ a) 3125 b) 1562.50 c) 1875 d) 1500 26. The accounting equation asset = capital + liabilities, which of the following is true. Ram has started business with 5,50,000 and has purchased goods worth 1,50,000 on credit a) 7,00,000 = 5,50,000 + 1,50,000 b) 7,00,000 = 6,50,000 + 50,000 c) 5,50,000 = 7,00,000 - 1,50,000 d) 5,50,000 = 5,00,000 + 50,000 27. A & B are sharing profits in the ratio 2 : 1 . C is admitted as a partner for 1/4th of the share of profits, 3/4th part of his share from A and 1/4th of his share from the B. The new profit sharing ratio is________ a) 2 : 1 : 1 b) 23 : 13 : 12 c) 1 : 1 : 1 d) 3 : 1 : 5 28. Delcredre commission will be given for ______ a) Speedy collection of cash b) Prompt payment of cash c) To cover risk of bad debts d) Sale of goods above invoice price 29. What is the principle of nominal A/c? a) Debit what comes in, credit what goes out. b) Debit all expenses & losses & credit all incomes & gains. c) Debit the receiver, credit the giver. d) Debit all assets, credit all liabilities . 30. X purchased goods on 90 days credit from Y of worth Rs.20,000. Y has given a trade discount of Rs.1,000 on the same. He also allowed a cash discount of Rs.500, if payment is made within 30 days. X availed cash discount and also paid the dues of Y. At the end, goods purchased from Y remained unsold and included in the stock. What is the amount of stock. a) Rs.20,000 b) Rs.19,500 c) Rs.19,000 d) Rs.18,500 31. Opening and closing balances of debtors are 30,000 & 40,000 respectively. Cash collected from debtors 2,40,000. Discount allowed is 15,000 for prompt payment. Bad debts Rs.10,000. The total goods sold on credit are______ a) 2,55,000 b) 2,45,000 c) 2,95,000 d) 2,75,000 32. Goods sent on consignment at a cost of Rs.50,000. 1/4th lost in transit and claim received Rs.10,000. The amount of abnormal loss to be transferred to general P & L A/c is______ a) 12,500 b) 2,500 c) 10,000 d) None 33. All the enterprises should follow the same method of accounting policies for comparability of accounts is due to _______ a) Conservatism b) Consistency c) Matching d) Going concern 34. The Piston & Rings are arranged for increasing fuel efficiency. This is a ______ a) Revenue expenditure b) Deferred revenue expenditure c) Capital expenditure d) None of these 35. Over Draft balance as per Cash Book of ‘X’ Rs.20,500. Direct remittance of his customer is Rs.50,000 and ‘X’ was not aware that Rs.25,000 cheque was deposited, returned unpaid and he was yet to be informed. Balance as per Pass Book is_________ a) 4,500 Cr. b) 4,500 O.D. c) 45,500 Cr. d) None Remaining questions are in the attachment given below

__________________ Answered By StudyChaCha Member |

|

#3

| |||

| |||

|

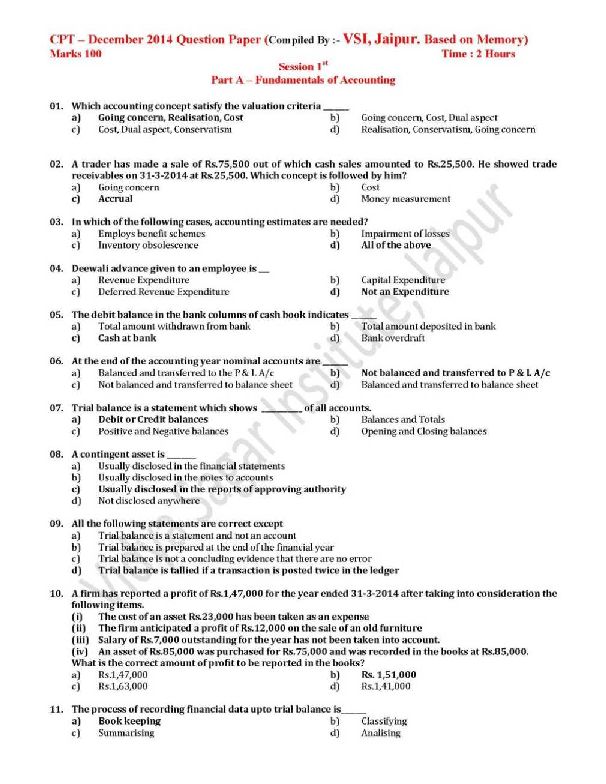

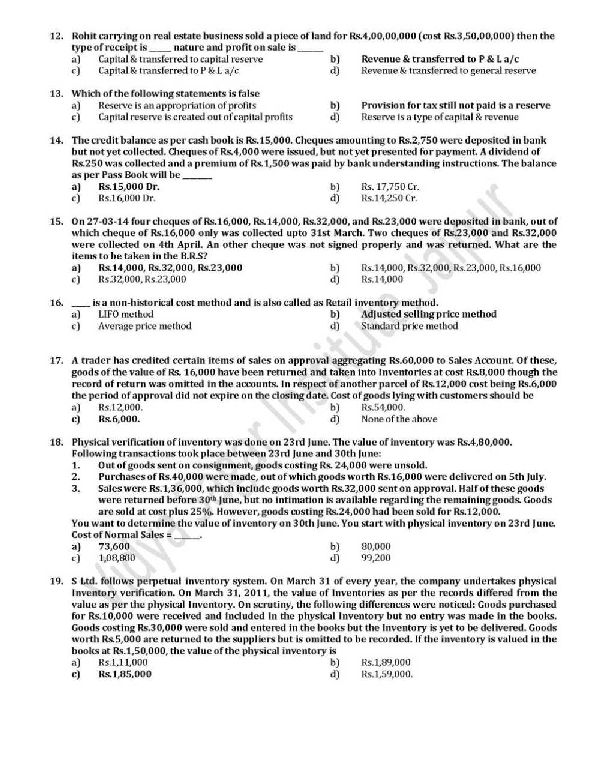

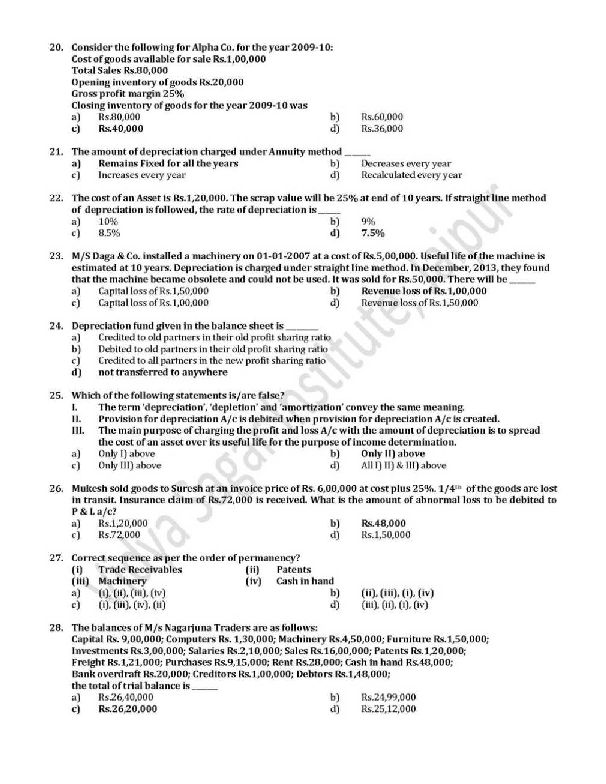

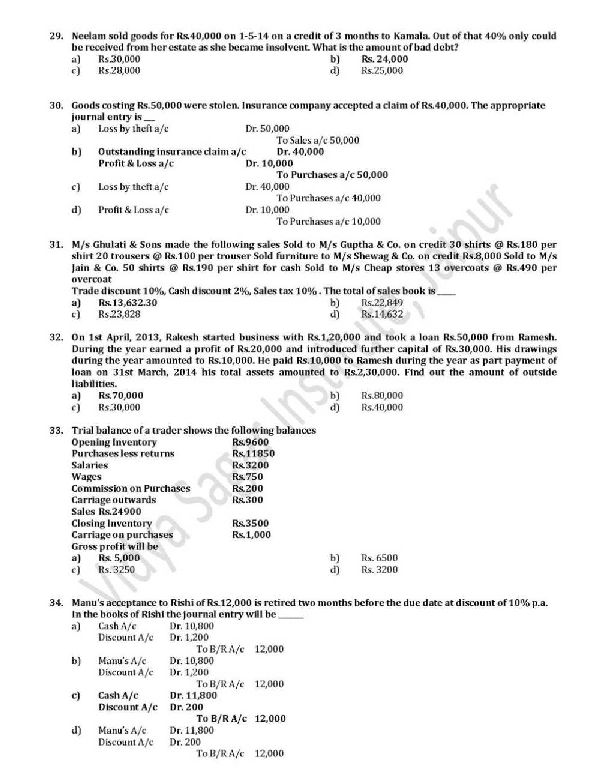

You need CPT Exam Previous Paper, here I am giving: 01. Which accounting concept satisfy the valuation criteria _______ a) Going concern, Realisation, Cost b) Going concern, Cost, Dual aspect c) Cost, Dual aspect, Conservatism d) Realisation, Conservatism, Going concern 02. A trader has made a sale of Rs.75,500 out of which cash sales amounted to Rs.25,500. He showed trade receivables on 31-3-2014 at Rs.25,500. Which concept is followed by him? a) Going concern b) Cost c) Accrual d) Money measurement 03. In which of the following cases, accounting estimates are needed? a) Employs benefit schemes b) Impairment of losses c) Inventory obsolescence d) All of the above 04. Deewali advance given to an employee is ___ a) Revenue Expenditure b) Capital Expenditure c) Deferred Revenue Expenditure d) Not an Expenditure 05. The debit balance in the bank columns of cash book indicates _______ a) Total amount withdrawn from bank b) Total amount deposited in bank c) Cash at bank d) Bank overdraft 06. At the end of the accounting year nominal accounts are _______ a) Balanced and transferred to the P & L A/c b) Not balanced and transferred to P & L A/c c) Not balanced and transferred to balance sheet d) Balanced and transferred to balance sheet 07. Trial balance is a statement which shows ___________ of all accounts. a) Debit or Credit balances b) Balances and Totals c) Positive and Negative balances d) Opening and Closing balances 08. A contingent asset is ________ a) Usually disclosed in the financial statements b) Usually disclosed in the notes to accounts c) Usually disclosed in the reports of approving authority d) Not disclosed anywhere 09. All the following statements are correct except a) Trial balance is a statement and not an account b) Trial balance is prepared at the end of the financial year c) Trial balance is not a concluding evidence that there are no error d) Trial balance is tallied if a transaction is posted twice in the ledger 10. A firm has reported a profit of Rs.1,47,000 for the year ended 31-3-2014 after taking into consideration the following items. (i) The cost of an asset Rs.23,000 has been taken as an expense (ii) The firm anticipated a profit of Rs.12,000 on the sale of an old furniture (iii) Salary of Rs.7,000 outstanding for the year has not been taken into account. (iv) An asset of Rs.85,000 was purchased for Rs.75,000 and was recorded in the books at Rs.85,000. What is the correct amount of profit to be reported in the books? a) Rs.1,47,000 b) Rs. 1,51,000 c) Rs.1,63,000 d) Rs.1,41,000 CPT exam paper     For detailed paper, here is attachment.............................

__________________ Answered By StudyChaCha Member |