|

#1

| |||

| |||

|

Can you provide me the Revised Examination Time Table of May 2013 of Insurance Institute of India? Insurance Institute of India was founded in 1955 in Mumbai. Through the following information I am providing you the Revised Examination Time Table of May 2013 11th May, 2013 Saturday (Morning 9.30 A.M. TO 12.30 P.M.) Sub. No. Subject Title 23 Application of Life Insurance 74 Liability Insurance 89 Management Accounting 88 Marketing & Public Relations S01 Principles & Practice of General Insurance & Survey and Loss Assessment A-3 Basic Ratemaking ( Diploma in Actuarial Science) 11th May, 2013 Saturday (Afternoon 2.00 P.M. TO 5.00 P.M.) Sub. No. Subject Title 24 Legal Aspects of Life Assurance 57 Fire & Consequential Loss Insurance 67 Marine Insurance 71 Agricultural Insurance 90 Human Resource Management A-2 Foundations of Casualty Actuarial Science Part-II ( Certificate and Diploma in Actuarial Science) S04 Marine Hull 12th May, 2013 Sunday (Morning 9.30 A.M. TO 12.30 P.M.) Sub. No. Subject Title 01 Principles of Insurance (This paper is 2 Hours, Morning 9.30 A.M. to 11.30.A.M.) 69 Marine Insurance Rating and Underwriting 83 Group Insurance & Retirement Benefit Schemes 86 Risk Management A-1 Foundation of Casualty Actuarial Science-Part –I ( Certificate and Diploma in Actuarial Science) S02 Fire Insurance 12th May, 2013 Sunday (Afternoon 2.00 P.M. TO 5.00 P.M.) Sub. No. Subject Title 14 Regulation of Insurance Business (This paper is 2 Hours, Afternoon 2.00 P.M. to 4.00 P.M.) 77 Engineering Insurance 81 Mathematical Basis of Life Assurance 84 Foundation of Casualty Actuarial Science Part II A-4 Estimating Unpaid Claims Using Basic Techniques (Diploma in Actuarial Science) S03 Marine Cargo Insurance 18thMay, 2013 –Saturday (Morning 9.30 P.M. to 12.30 P.M.) Sub. No. Subject Title 26 Life Insurance Finance 31 Insurance Salesmanship 46 General Insurance Accounts preparation and Regulation of Investment 59 Fire Insurance Rating and Underwriting 66 Marine Insurance Claims 85 Reinsurance S07 Miscellaneous Insurance 18thMay, 2013 Saturday (Afternoon 2.00 P.M. TO 5.00 P.M.) Sub. No. Subject Title 27 Health Insurance 28 Foundation of Actuarial Science (Life) 47 Foundation of Casualty Actuarial Science-Part-I (Associateship/Fellowship) 56 Fire Insurance Claims 72 Motor Insurance 99 Asset Management S08 Loss of Profit Insurance 19thMay, 2013 Sunday (Morning 9.30 A.M. TO 12.30 P.M.) Sub. No. Subject Title 02 Practice of Life Insurance (This paper is 2 hours, Morning 9.30 A.M. to 11.30 A.M.) 22 Life Insurance Underwriting 30 Practice of Life Insurance 45 General Insurance Underwriting 58 Fire Insurance Coverage’s 68 Marine Insurance Coverage’s 82 Statistics S06 Motor Insurance (Surveyor Exam) 19th May, 2013 Sunday (Afternoon 2.00 P.M. TO 5.00 P.M.) Sub. No. Subject Title 11 Practice of General Insurance (This paper is 2 hours, Afternoon 2.00 P.M. to 4.00 P.M.) 32 Practice of General Insurance 78 Miscellaneous Insurance 92 Actuarial Aspects of Product Development S05 Engineering Insurance Address: Insurance Institute of India Plot no. C-46,G-Block, Near US Consulate, Bandra Kurla Complex, Mumbai – 400051. Map: Last edited by Aakashd; June 5th, 2019 at 04:54 PM. |

|

#3

| |||

| |||

|

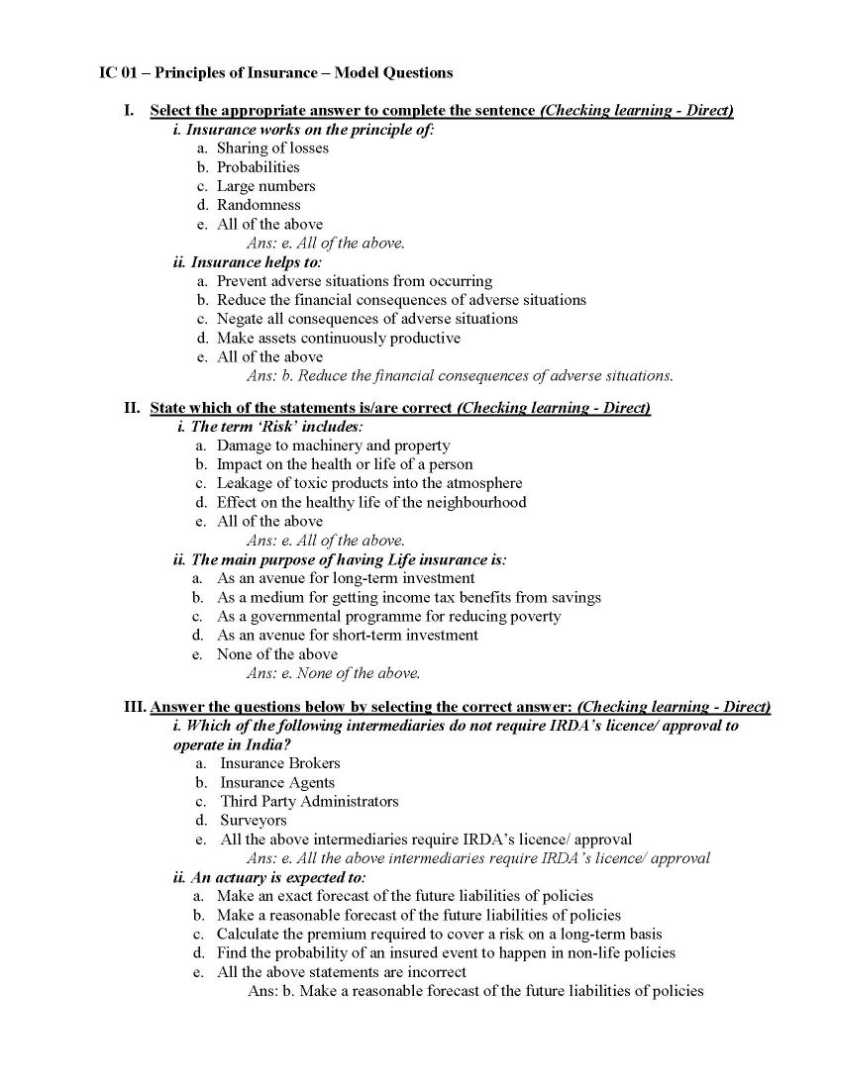

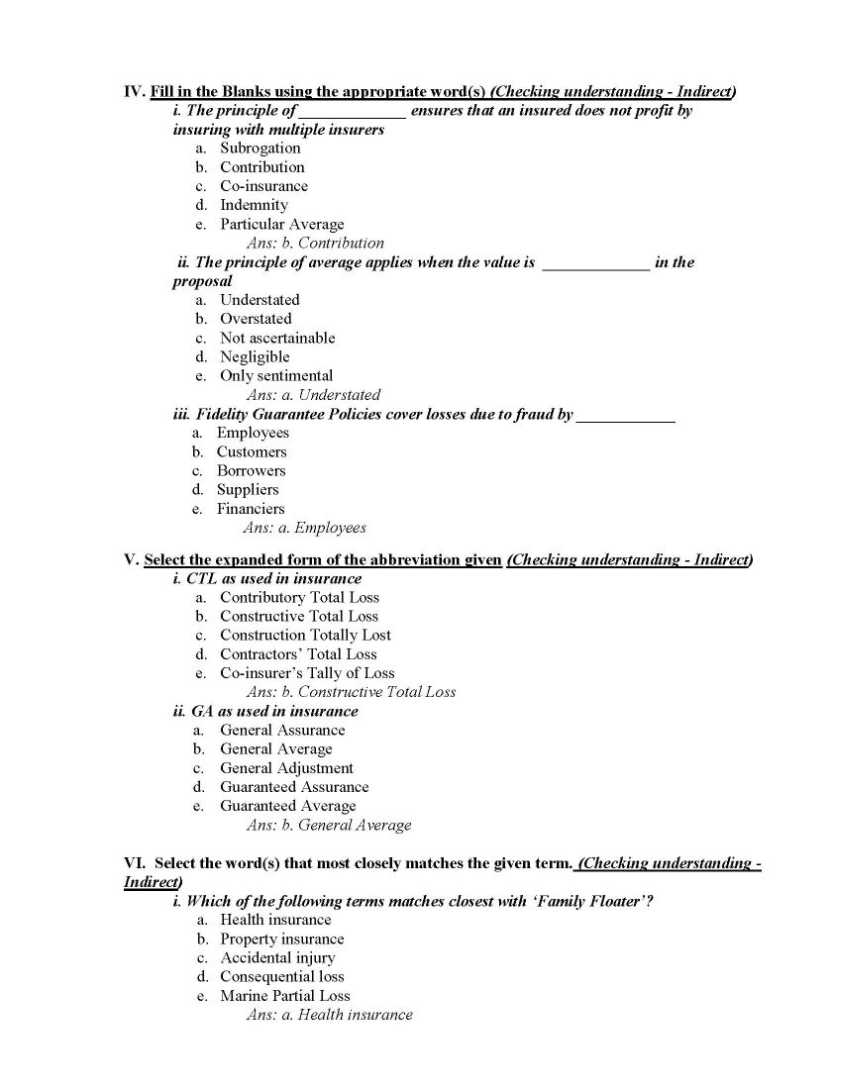

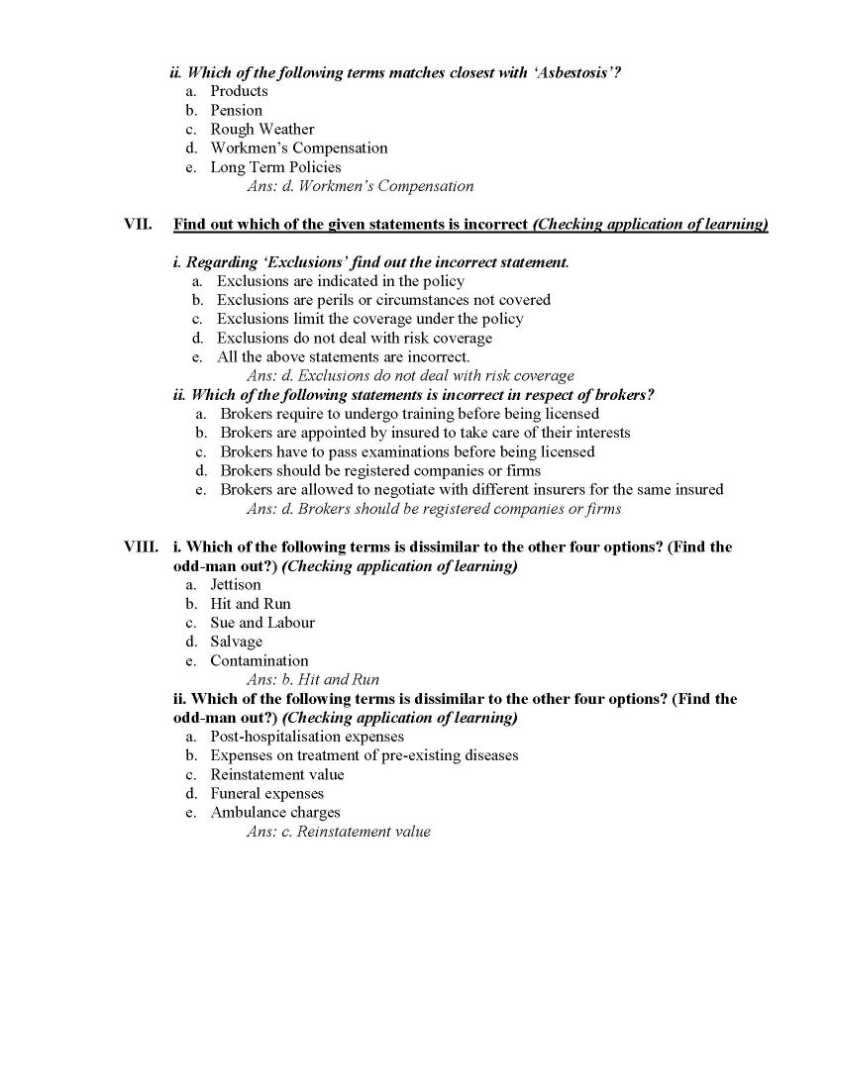

Insurance Institute of India is an insurance education society of professionals . It was established in 1955 in Mumbai. Institute conducts examinations at various levels. Certificate / Diploma Examinations: Licentiate / Associateship / Fellowship Specialised Diploma Examinations Other Examinations: Postal Life Insurance exam Model Question paper for Licentiate Examination-(ENGLISH): Select the appropriate answer to complete the sentence (Checking learning – Direct ) i. Insurance works on the principle of: a. Sharing of losses b. Probabilities c. Large numbers d. Randomness e. All of the above Ans: e. All of the above. ii. Insurance helps to: a. Prevent adverse situations from occurring b. Reduce the financial consequences of adverse situations c. Negate all consequences of adverse situations d. Make assets continuously productive e. All of the above Ans: b. Reduce the financial consequences of adverse situations. II. State which of the statements is/are correct (Checking learning - Direct) i. The term ‘Risk’ includes: a. Damage to machinery and property b. Impact on the health or life of a person c. Leakage of toxic products into the atmosphere d. Effect on the healthy life of the neighbourhood e. All of the above Ans: e. All of the above. ii. The main purpose of having Life insurance is: a. As an avenue for long-term investment b. As a medium for getting income tax benefits from savings c. As a governmental programme for reducing poverty d. As an avenue for short-term investment e. None of the above Ans: e. None of the above. III. Answer the questions below by selecting the correct answer: (Checking learning - Direct) i. Which of the following intermediaries do not require IRDA’s licence/ approval to operate in India? a. Insurance Brokers b. Insurance Agents c. Third Party Administrators d. Surveyors e. All the above intermediaries require IRDA’s licence/ approval Ans: e. All the above intermediaries require IRDA’s licence/ approval ii. ii. An actuary is expected to: a. Make an exact forecast of the future liabilities of policies b. Make a reasonable forecast of the future liabilities of policies c. Calculate the premium required to cover a risk on a long-term basis d. Find the probability of an insured event to happen in non-life policies e. All the above statements are incorrect Ans: b. Make a reasonable forecast of the future liabilities of policies IV. Fill in the Blanks using the appropriate word(s) (Checking understanding - Indirect) i. The principle of _____________ ensures that an insured does not profit by insuring with multiple insurers a. Subrogation b. Contribution c. Co-insurance d. Indemnity e. Particular Average Ans: b. Contribution ii. The principle of average applies when the value is _____________ in the proposal a. Understated b. Overstated c. Not ascertainable d. Negligible e. Only sentimental Ans: a. Understated iii. Fidelity Guarantee Policies cover losses due to fraud by ____________ a. Employees b. Customers c. Borrowers d. Suppliers e. Financiers Ans: a. Employees VIII. i. Which of the following terms is dissimilar to the other four options? (Find the odd-man out?) (Checking application of learning) a. Jettison b. Hit and Run c. Sue and Labour d. Salvage e. Contamination Ans: b. Hit and Run ii. Which of the following terms is dissimilar to the other four options? (Find the odd-man out?) (Checking application of learning) a. Post-hospitalisation expenses b. Expenses on treatment of pre-existing diseases c. Reinstatement value d. Funeral expenses e. Ambulance charges Ans: c. Reinstatement value Model Question paper for Licentiate Examination    Address: Insurance Institute Of India, Plot no. C-46,G-Block, Near US Consulate, Bandra Kurla Complex, Mumbai – 400051. Reception no1: 022-26544200 Reception no2: 022-26541154 Reception no3: 022-26541156 Map: Here is the attachment for the syllabus of Licentiate / Associateship / Fellowship exam....................

__________________ Answered By StudyChaCha Member Last edited by Aakashd; August 4th, 2018 at 11:36 AM. |