|

#1

| |||

| |||

|

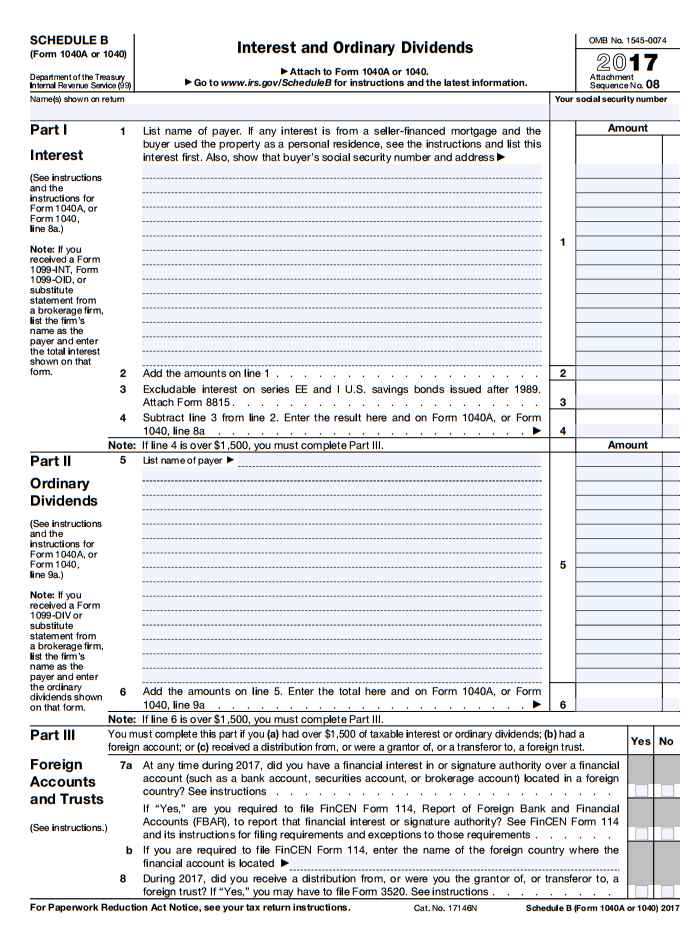

I want the Schedule B form of Internal Revenue Service IRS so will you please provide me?

|

|

#2

| |||

| |||

|

The Internal Revenue Service (IRS) is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue IRS Schedule B form  Use Schedule B (Form 1040A or 1040) if any of the following applies:- You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond. You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID. You are reducing your interest income on a bond by the amount of amortizable bond premium. You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989. You received interest or ordinary dividends as a nominee. You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and trusts.

__________________ Answered By StudyChaCha Member |