|

#1

| |||

| |||

|

Will you please provide me some information of the Direct and indirect tax structure in India characteristic, or tell me from where I can get info about the Direct and indirect tax structure in India characteristic? The difference between a direct and indirect tax is complicated because it truly depends on whether you are asking from a “legal” or an “economic” perspective. From Legal Perspective: A direct tax, according to the U.S. Constitution, applies only to property and poll taxes. These direct taxes are based on simple ownership or existence. Indirect taxes are imposed upon a broad range of abstract ideas, including rights, privileges, and activities. From Economic Perspective: A direct tax will refer to any levy that is both imposed and collected on a specific group of people or organizations. An example of direct taxation would be income taxes that are collected from the people who actually earn their income. Indirect taxes are collected from someone or some organization other than the person or entity that would normally be responsible for the taxes. Direct and indirect tax structure in India Characteristic      Last edited by Aakashd; October 16th, 2019 at 02:40 PM. |

|

#2

| |||

| |||

|

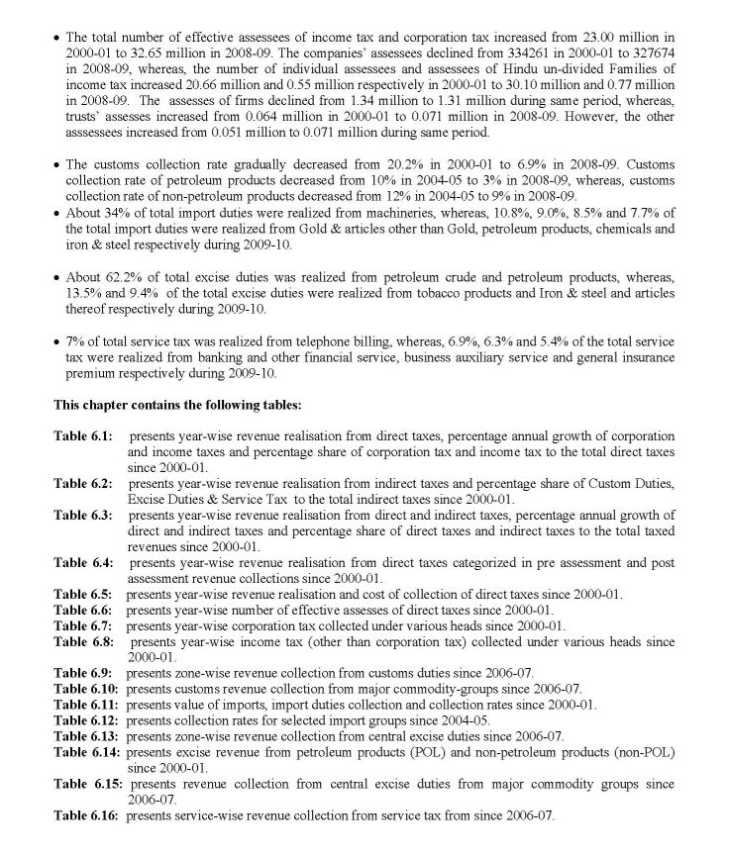

Here I am attaching a file, from where you can download the difference in between Direct and indirect tax structure in India characteristic as a PDF format, the PDF contains the info such as follows: The choice between direct and indirect taxation is one of the “oldest issues of taxation policy” (Atkinson (1977)). It raises challenging theoretical questions and is of significant policy relevance. The theoretical controversy is mirrored by the diverging solutions which have been adopted in various countries. Cross-country comparisons reveal striking differences in the tax mix. Indirect taxes (VAT in particular) represent an important part of tax revenues in European countries, but they play only an insignificant role in the US (at least at the federal level). For the detailed description, here is attachment:

__________________ Answered By StudyChaCha Member |