|

#1

| |||

| |||

|

Hi I would like to know about IDBI Intech Limited (IIL) as well as the details of Mobile Banking Solution (I-MBS) service offered by IDBI Intech Limited (IIL)?

|

| Other Discussions related to this topic | ||||

| Thread | ||||

| IDBI CBG | ||||

| IDBI UTR | ||||

| XAT IDBI | ||||

| MD and CEO of IDBI | ||||

| ATM IDBI | ||||

| IDBI Mf NAV | ||||

| VBV IDBI | ||||

| IDBI And IDBI Bank | ||||

| IDBI Chairman IDBI CVV No | ||||

| IDBI URN | ||||

| IDBI Od Against FD | ||||

| IDBI NSE | ||||

| IDBI CIN | ||||

| IDBI JJN | ||||

| IDBI CMD | ||||

| IDBI OTP | ||||

| KCC IDBI | ||||

| IDBI CVO | ||||

| IDBI Tax | ||||

| IDBI MBA | ||||

|

#2

| |||

| |||

|

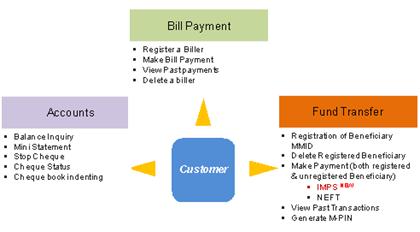

IDBI Intech Limited (IIL) is chief IT Services Company rendering ideal IT Services and Innovative Solutions in the BFSI (Banking, Financial Services and Insurance) area in India, Middle East and East and West Africa. Our solid group of Techno-Functional specialists (Banking and IT Domain) have huge presentation in shifted Core Banking Solutions. IDBI Intech Ltd. (IIL) is set up to tap the IT administrations related open doors emerging in the BFSI area. IIL particularly positions itself in the Information Technology Service Provider Space and works in a multi-dimensional structure. DBI Intech vision is to develop as the most favored IT Solutions and Services Company in the BFSI part to acknowledge an incentive for partners and its main goal is to render ideal IT administrations and inventive answers for BFSI area by utilizing innovation with scholarly capital, to achieve client amuse. Mobile Banking Solution (I-MBS) I-MBS is a NPCI agreeable arrangement and also profoundly secure, quick and adaptable and utilizes ISO-8583 informing principles and would interface be able to with any Core Banking Solution to offer moment between bank and intra-bank cash exchange office and additionally exceptionally compact crosswise over extensive variety of versatile handsets. i-MBS comes in three flavors: Browser based solution that runs on JAVA / GPRS enabled hand sets SMS based solution for low value transactions Thick-client based solution i-MBS offers comprehensive features to customers as well as mobile banking services. Customer Module  Administrator Module.  Advantages Diminished cost of overhauling clients. Have an immediate, positive effect to the primary concern. Enhanced consumer loyalty by offering the cutting edge elective channel to managing an account. Tap in to esteem movement, get new clients, and hold existing ones. Expanded market entrance. Number of versatile clients in India is 852 million in June 2011 which is anticipated to wind up noticeably 1200 million by 2013, with a normal reception rate of 10 million clients for each month. Monetary inclusivity. Bank the unbanked. Plausibility to strategically pitch with authorization from clients. New item development that tends to the requirements of the advancing quality zone of versatile saving money clients. Enhanced client comfort. Chops down the time and cost to cooperate with banks. Clients can do their money related exchanges from anyplace and whenever. Clients will be responsible for dealing with their fund. Shields clients from deceitful exercises with momentary alarms and with continuous data get to capacities. Interbank Mobile Payment Service (IMPS) is bolstered by the arrangement. IMPS offers a moment, 24X7, interbank electronic store exchange benefit through cell phones. Versatile keeping money through SMS offers an unsophisticated and straightforward way to deal with enable clients to acknowledge portable saving money benefits.

__________________ Answered By StudyChaCha Member |