|

#1

| |||

| |||

|

Hi I am interested in knowing about Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL) as wel as the difference between these two companies?

|

|

#2

| |||

| |||

|

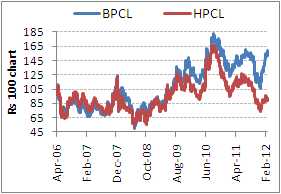

BPCL stands for Bharat Petroleum Corporation Limited (BPCL), an Indian state-controlled oil and gas organization established in the year 1977, and positioned 229th in the Fortune Global rankings for the year 2013. HPCL stands for Hindustan Petroleum Corporation Limited (HPCL), is likewise an Indian state-possessed oil and normal gas organization established in the year 1974, and positioned 260th in the Fortune Global rankings for the year 2013. Bharat Petroleum Corporation Ltd. (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL) are two of the greatest players in state run oil refining industry. Both the organizations are working under a situation where the Government strategies (managed petroleum item costs and adhoc endowment portion) abrogate the basics. However, in the event that one investigates the present market valuations and stock value slant, the stock cost of BPCL is exchanging at a premium to HPCL   Both the organizations are basically in the matter of refining rough, generation and promoting of resultant petroleum items. The accompanying data highlights how organizations admission on the key operational parameters. Operational Parameters BPCL HPCL Refining Capacities (MMT) 21.50 14.80 Crude thruputs (MMT) 24.03 14.75 Market Sales including exports(MMT) 32.19 27.03 Domestic market sales (MMT) 29.58 25.50 Gross refining margins (US$ per barrel) 4.47 5.30 Retail outlets 9,290 10,212 LPG Distributors 23% 25% Market Share in Refining capacity (incl private players) 13% 8% Domestic Sales of Petroleum Products market share (%) 24% 22% Exploration and Production blocks 27 25 Self sufficiency in creating deals As should be obvious from the data, with regards to independence in deals era, BPCL passages better. This is on account of BPCL by virtue of its higher refining limit depends less on different organizations (demonstrated by Products acquired for resales). As far as volumes, while BPCL has around 47% of its business era through items obtained and exchanged, HPCL depends on other organizations' items to the degree of 61%.  The "retail" affectability As observed from the data underneath, HPCL has got retail items deals as a higher rate of the general market deals. Since the costs of key retail items are controlled in India, HPCL is more touchy to the elements that can prompt to increment in under recuperations. This implies HPCL will be more influenced (adversely) by virtue of components, for example, high unrefined costs and deteriorating rupee or deferral in pay. Having said that, the upside will be preferred for HPCL over for BPCL. For instance, if there is any expansion in petroleum item costs, it ought to be more positive for HPCL (keeping different elements consistent).

__________________ Answered By StudyChaCha Member |