|

#1

| |||

| |||

|

Hi I would like to have the details of the loan against property which is offered by the Punjab & Sind Bank as well as the application form?

|

|

#2

| |||

| |||

|

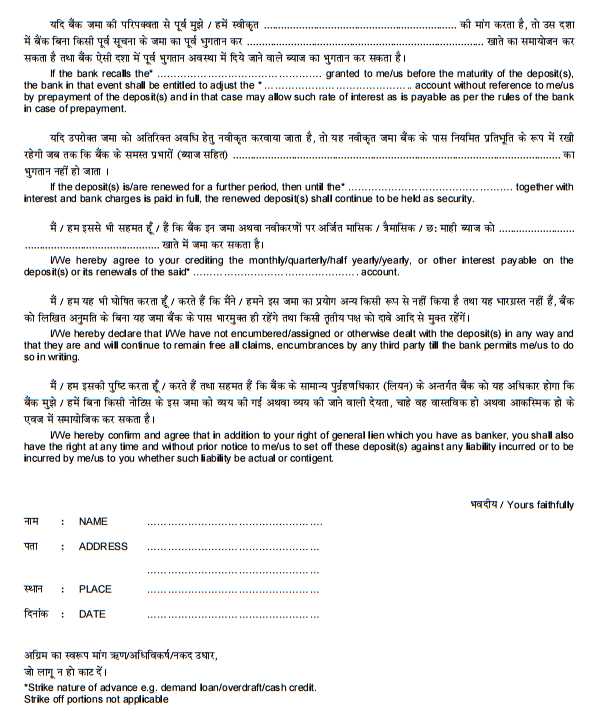

the details of the loan against property which is offered by the Punjab & Sind Bank as well as the application form has been mentioned below. Loan against Property (LAP) Qualification i)Individuals who are wage charge evaluates; ii)Age limit: Minimum 21 years and Maximum 65 years. Quantum of Loan Least Rs.1.00 lac and greatest Rs.500.00 lac. Greatest external breaking point for account would be liable to: (i) For salaried personsMaximum 48 times the net month to month pay (Net of all derivations including TDS) (ii) For others: Maximum 4 times the net yearly salary (wage according to most recent IT return less assessments payable) The salary of the companion/significant child might be included on the off chance that he/she is a co-borrower. Edge Money up-to half of the feasible estimation of the property, subject to advance sum and external breaking point. (i.e. borrowers offering security @200% of the credit sum). Rate of Interest It would be ideal if you click here For rate of interest Reimbursement of credit Greatest 12 years taking into account reimbursing limit of the borrower subject to 40% take home pay/wage after all reasonings. Reimbursement to be planned in a way so that the credit is balanced by the age of 70 years of the borrower. On the off chance that any more youthful Co-borrower is proposed having half or more commitment towards IIR (Installment to wage proportion), the qualification model w.r.t. age of the more youthful Co-borrower might be considered. Preparing Fee 1%of the credit sum with Minimum of Rs.2000 and a most extreme of Rs.50000/ - Documentation charges Real costs as for charges for property lawful sentiment, record, valuation, contract expense and stamp papers and so forth. Security Home loan of the Immovable property worthy to the Bank subject to credit sum and external utmost according to point 2 above. Ensure Mate/Major child/Third gathering (In the event that life partner or significant child is co-borrower then ensure might be waived). Prepayment The borrower may select to prepay/modify the advance from his own particular undeniable true blue sources or honest to goodness deal without drawing in any punishment, aside from assume control of the credit by other bank/FI/NBFC, which would pull in prepayment @1% of the equalization advance sum the Loan against Security for the Punjab & Sind Bank

__________________ Answered By StudyChaCha Member |