|

#1

| |||

| |||

|

Hi I would like to have the details of the establishment as well as the objectives and functions of Securities and Exchange Board of India?

|

|

#2

| |||

| |||

|

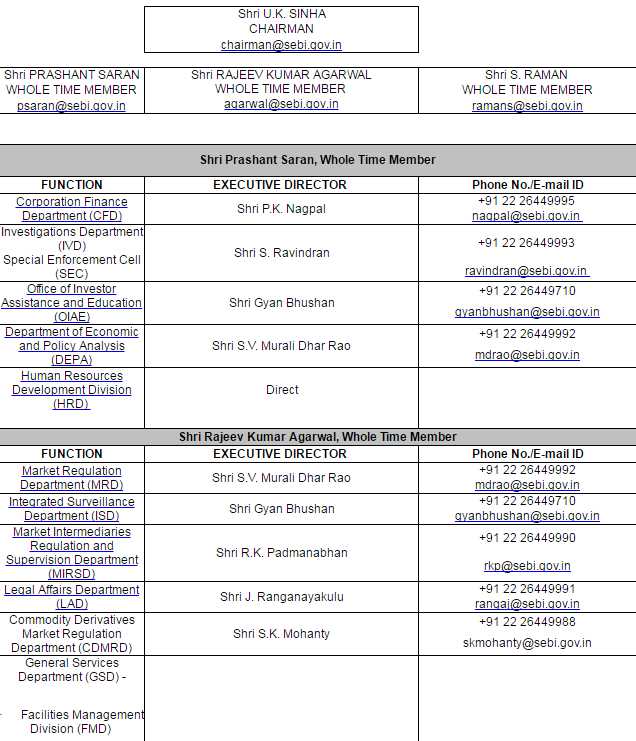

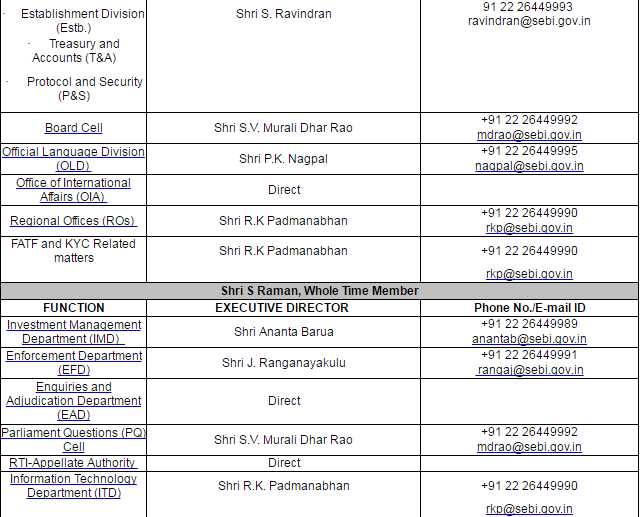

The Securities and Exchange Board of India (SEBI) is the controller for the securities market in India. It was built up in the year 1988 and given statutory forces on 12 April 1992 through the SEBI Act, 1992 The Preamble of the Securities and Exchange Board of India portrays the fundamental elements of the Securities and Exchange Board of India as "...to ensure the premiums of financial specialists in securities and to advance the improvement of, and to manage the securities market and for matters associated therewith or coincidental thereto" Securities Appellate Tribunal is a statutory body built up under the procurements of Section 15K of the Securities and Exchange Board of India Act, 1992 to hear and discard bids against requests went by the Securities and Exchange Board of India or by a mediating officer under the Act and to practice ward, forces and power gave on the Tribunal by or under this Act or some other law until further notice in power. Targets of SEBI: As a vital element in the business sector it works with taking after destinations: 1. It tries to build up the securities market. 2. Promotes Investors Interest. 3. Makes tenets and regulations for the securities market. Elements Of SEBI: Find underneath SEBI's critical capacities: 1. Regulates Capital Market 2. Checks Trading of securities. 3. Checks the acts of neglect in securities market. 4. It improves financial specialist's information on business sector by giving instruction. 5. It manages the stockbrokers and sub-specialists. 6. To advance Research and Investigation SEBI In India's Capital Market: SEBI now and again have embraced numerous standards and regulations for improving the Indian capital business sector. The late activities attempted are as per the following: Sole Control on Brokers: Under this administer each agents and sub specialists need to get enrollment with SEBI and any stock trade in India. For Underwriters: For filling in as a financier an advantage point of confinement of 20 lakhs has been settled. At Share Costs As indicated by this law every single Indian companie are allowed to decide their separate offer costs and premiums on the offer costs. Organization Structure:   Contact Details: Securities and Exchange Board of India Mittal court 'A' Wing, Ground floor 224, Nariman Point, Mumbai - 400 021 PH: 2850451,52,53,54,55 FAX:204 5633

__________________ Answered By StudyChaCha Member |