|

#2

| |||

| |||

|

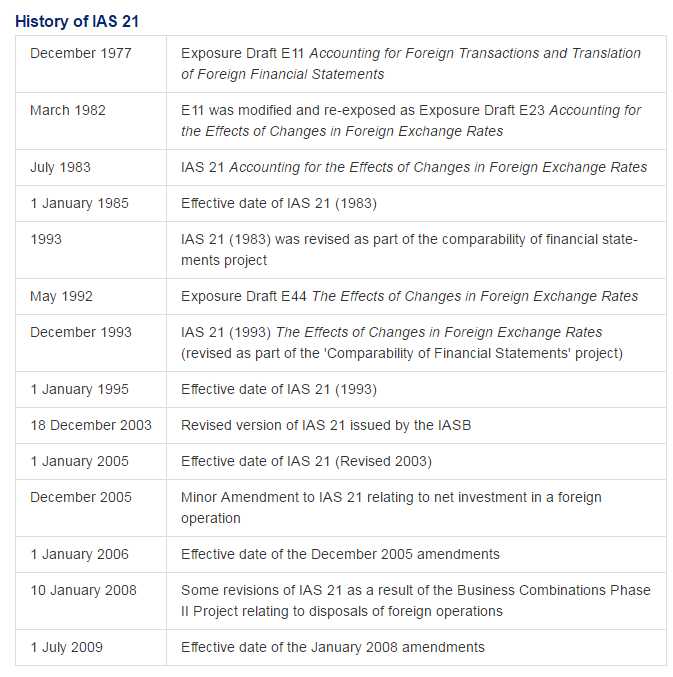

Chicago Transit Authority, also known as CTA, is the operator of mass transit within the City of Chicago, Illinois and some of its surrounding suburbs, The Committee discussed an issue arising in IAS 21 the Effects of Changes in Foreign Exchange Rates related to when the separate foreign currency equity reserve related to the retranslation of the net assets of an investor’ (often referred to as ‘CTA’) should be recycled. The staff presented two alternatives, the ‘proportionate reduction’ approach and the ‘absolute reduction’ approach. Summary of IAS 21 Objective of IAS 21 The objective of IAS 21 is to prescribe how to include foreign currency transactions and foreign operations in the financial statements of an entity and how to translate financial statements into a presentation currency The principal issues are which exchange rate(s) to use and how to report the effects of changes in exchange rates in the financial statements. Key definitions IAS 21 Functional currency: the currency of the primary economic environment in which the entity operates. (The term 'functional currency' was used in the 2003 revision of IAS 21 in place of 'measurement currency' but with essentially the same meaning.) Presentation currency: the currency in which financial statements are presented. Exchange difference: the difference resulting from translating a given number of units of one currency into another currency at different exchange rates. Foreign operation: a subsidiary, associate, joint venture, or branch whose activities are based in a country or currency other than that of the reporting entity. Basic steps for translating foreign currency amounts into the functional currency Steps apply to a stand-alone entity, an entity with foreign operations (such as a parent with foreign subsidiaries), or a foreign operation (such as a foreign subsidiary or branch). 1. The reporting entity determines its functional currency 2. The entity translates all foreign currency items into its functional currency 3. The entity reports the effects of such translation in accordance with paragraphs 20-37 [reporting foreign currency transactions in the functional currency] and 50 [reporting the tax effects of exchange differences]. History of IAS 21

__________________ Answered By StudyChaCha Member |