|

#2

| |||

| |||

|

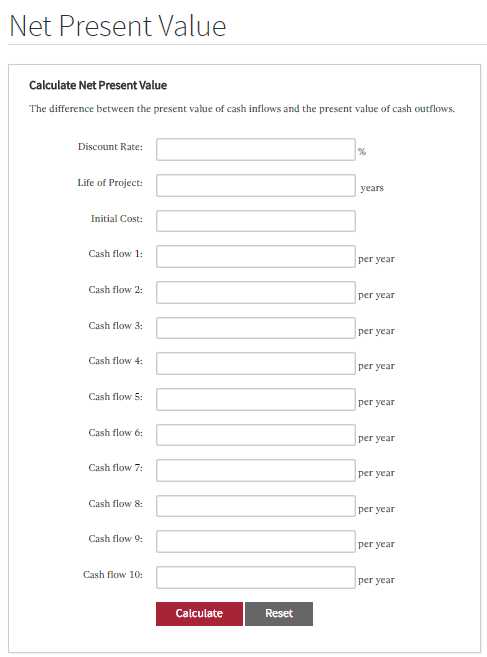

Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows. NPV is used in capital budgeting to analyze the profitability of a projected investment or project. The Use of NPV in MBA is like this that the decision of doing MBA will be analyzed by you from this NPV value if you are earning good salary and you have done MBA it means that you have taken right decision of doing MBA The following is the formula for calculating NPV: Net Present Value (NPV) Where Ct = net cash inflow during the period t Co = total initial investment costs r = discount rate, and t = number of time periods An investment with a positive NPV will be a profitable one and one with a negative NPV will result in a net loss. This concept is the basis for the Net Present Value Rule, which dictates that the only investments that should be made are those with positive NPV values. Apart from the formula itself, net present value can often be calculated using tables, spreadsheets such as Microsoft Excel Net Present Value Calculator  I take an example of a person with following variables to explain how the NPV can be calculated Age – 27 Present Salary – INR 500000 Age of retirement – 60 Years Return on alternate investment opportunity, r – 10 % First, let us calculate the Present Value of the income during the career time when MBA is not pursued. Let us call this PV (No MBA) Assume, Expected growth rate of income without an MBA degree – 5% C1= Current Salary; C1 (1+Gt) = salary during subsequent years; t = 1, 2….32; Gt=growth rate, which is 5 % PV (No MBA) = C1+ C1 (1+G1) / (1+r) +…..C1 (1+G32) / (1+r)^32 = C(1+G) [ 1-(1+G)^32 / (1+r)^32] / [ r – G] => 500000 + 500000(1+0.05) / 1.1 +….+ 500000(1+0.05)/ (1.1)^32 = INR 9017000 Let us now calculate the Present Value of the income during the career when MBA is pursued. Let us call this PV (MBA) Assume, Starting Salary after MBA, C2 – INR 800000; Expected growth rate of income, Gt – 7%; Retirement Age – 60 Years; Cost of MBA at ISB = INR 1500000 PV (MBA) = -1500000 + C2 (1+G1) / (1+r)+…..+ C2(1+G31)/(1+r)^31 = -1500000 + 800000/(1.1) + 800000 (1+0.07) / (1.1)^2+………+ 800000 (1+ 0.07) / (1.1)^31 = INR 15380000 NPV of investment = PV (MBA) Less PV (No MBA) = INR 6368000

__________________ Answered By StudyChaCha Member |