|

#2

| |||

| |||

|

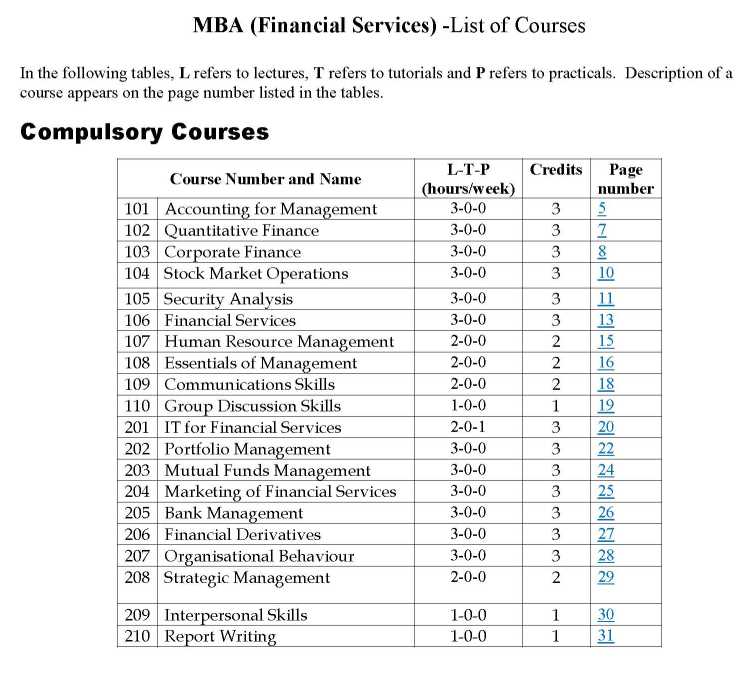

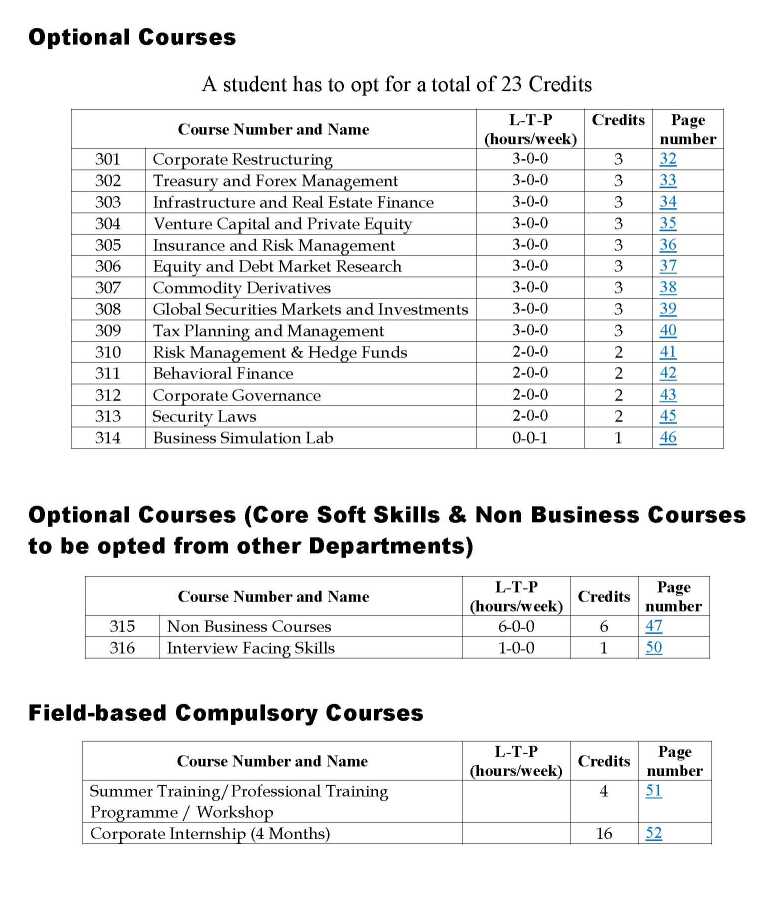

The syllabus of MBA FS (Master in Business Administration Financial Services) Programme offered at the Department of Commerce of Goa University is as follows: 101 ACCOUNTING FOR MANAGEMENT (3 Credits) MODULE I - PRINCIPLES OF ACCOUNTING (15 hours) UNIT 1 Management accounting: Meaning – Purpose – Scope – Characteristics – Functions and significance – Distinction amongst Management Accounting, Financial Accounting and Cost Accounting – Generally accepted accounting principles 9AAP) – Accounting concepts and conventions – Accounting Standards Utility of management accounting as an information system in assisting the management in decision-making. UNIT 2 Financial Statements: Meaning - Nature and objectives – Types of financial statements (Balance Sheet, Income Statement, statement of changes in owner's equity and statement of changes in financial position) UNIT 3 Balance sheet: Form and contents – Income statement, form and contents- Characteristics of an ideal financial statements- Use and significance of financial statements – Limitations of financial statements. MODULE II - ANALYSIS OF FINANCIAL STATEMENTS AND COST ANALYSIS FOR DECISION MAKING (20 hours) UNIT 1 Meaning and Importance – Types of financial analysis: (external, internal, horizontal and vertical analysis – methods/devices of financial analysis UNIT 2 Comparative statements, Trend analysis, Common size statement. UNIT 3 Funds flow analysis, Cash flow analysis and Ratio analysis – Utility of the findings of analysis of financial statements in managerial decision making UNIT 4 Marginal Costing: Meaning – objective, characteristics and assumptions – Difference between marginal cost and marginal costing – Marginal Cost equation: (Contribution; Profit – Volume ratio (p/v ratio); Breakeven / Cost volume profit analysis, Breakeven point and Margin of safety UNIT 5 Application of marginal costing in decision – making: Fixation of selling price, make or buy decision, selection of suitable product mix and Maintaining desired level of profits- Merits and demerits of marginal costing. UNIT 6 Activity Based Costing, Life Cycle Costing, Target Costing, Balanced Score Card, Economic Value Added. MBA FS Syllabus

__________________ Answered By StudyChaCha Member |