|

#2

| |||

| |||

|

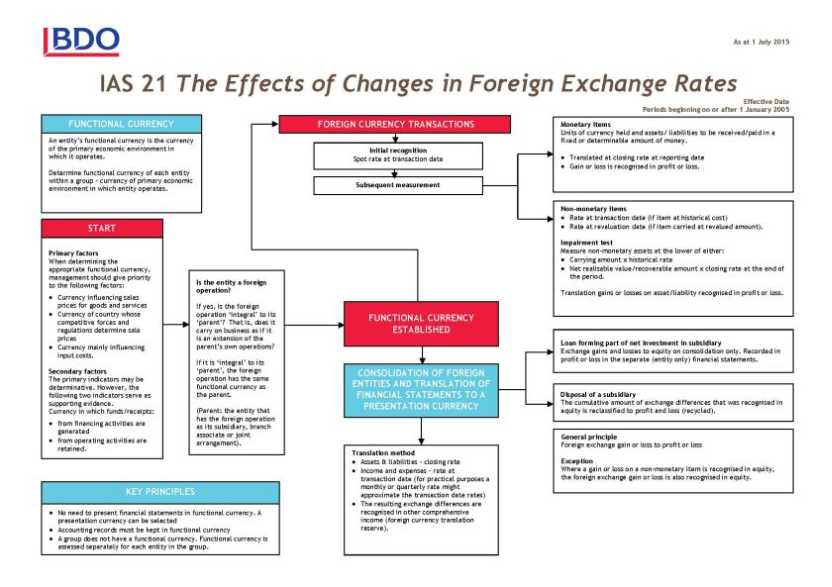

As you are saying you are doing work on IAS 21 The Effects of Changes in Foreign Exchange Rates project , so here I am some inoframtion which I have this time International Accounting Standard (IAS) 21 The Effects of Changes in Foreign Exchange Rates IAS 21 first issued in July 1983 IAS 21 revised in December 2003 Recent amendment: by IAS 27 amended in January 2008 Functional Currency --> currency of primary economic environment --> operations are carried out in functional currency Presentation Currency --> financial statements are prepared in presentation currency Translation from functional currency to presentation currency (1) Assets and liabilities --> closing rate --> spot exchange rate at the end of reporting period (2) Income and expenses --> exchange rates at transaction dates --> average rate for the period is allowed, if reasonable Initial recognition of foreign currency transaction --> recorded in functional currency --> using the spot exchange rate between foreign currency and functional currency --> at transaction date At the end of reporting period (1) foreign currency monetary items --> translated using closing rate (2) non-monetary items measured by historical cost (in a foreign currency) --> translated using exchange rate --> at transaction date (3) non-monetary items measured by fair value (in a foreign currency) --> translated using exchange rate --> at the date --> when the fair value was determined Exchange differences on a monetary item --> recognized in profit or loss For a non-monetary item (1) if a gain or loss is recognized in other comprehensive income --> exchange component of such a gain or loss --> recognized in other comprehensive income (2) if a gain or loss is recognized in profit or loss --> exchange component of such a gain or loss --> recognized in profit or loss Foreign currency derivatives and hedge accounting --> covered by IAS 39 Financial Instruments: Recognition and Measurement. --> not covered by IAS 21 IAS 21 The Effects of Changes in Foreign Exchange Rates

__________________ Answered By StudyChaCha Member |

|

| |