|

#1

| |||

| |||

|

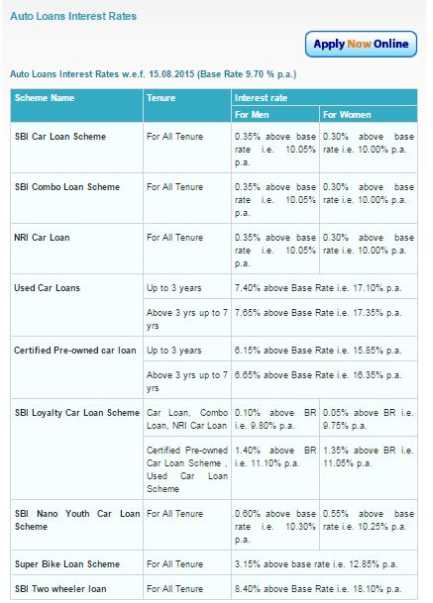

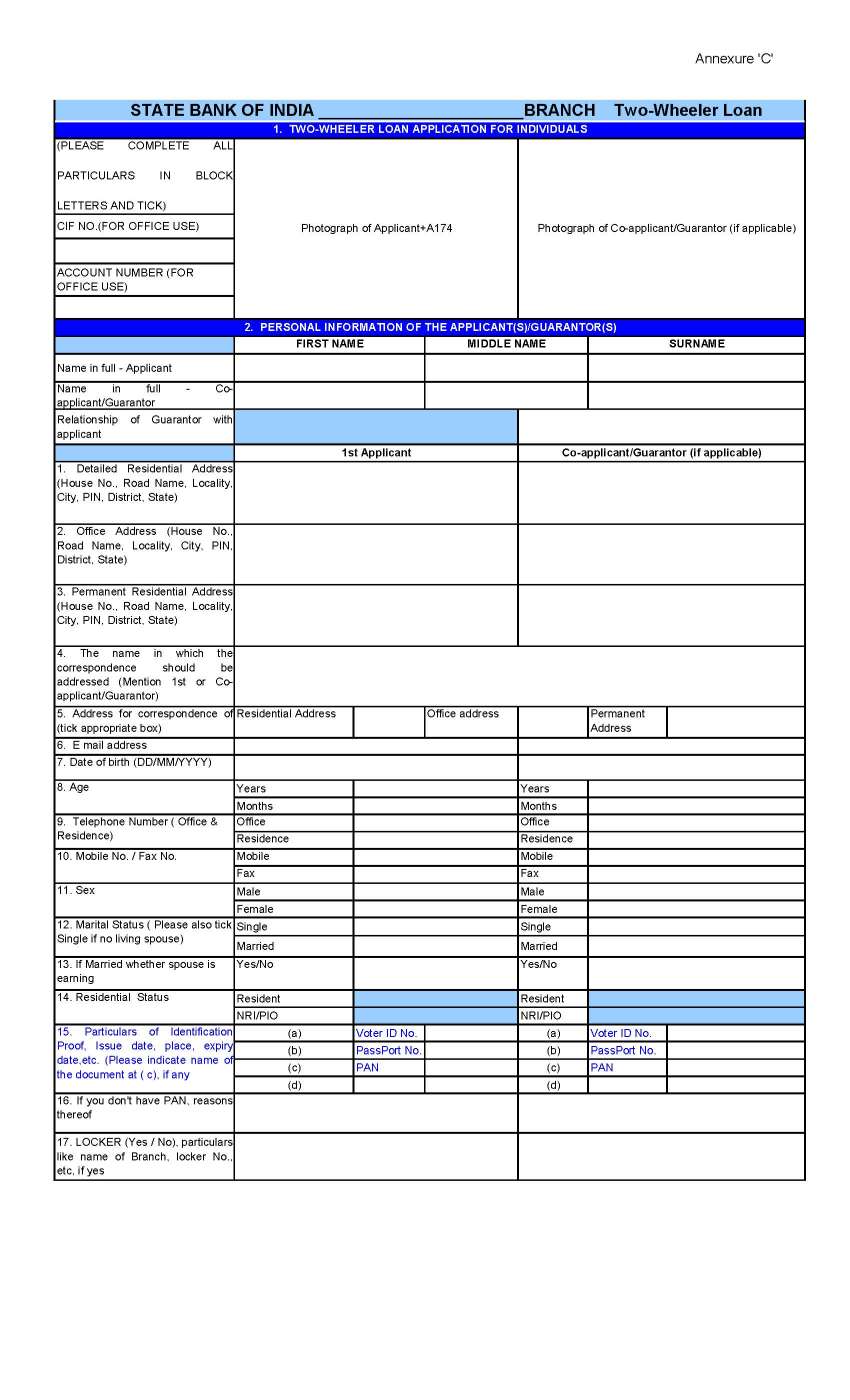

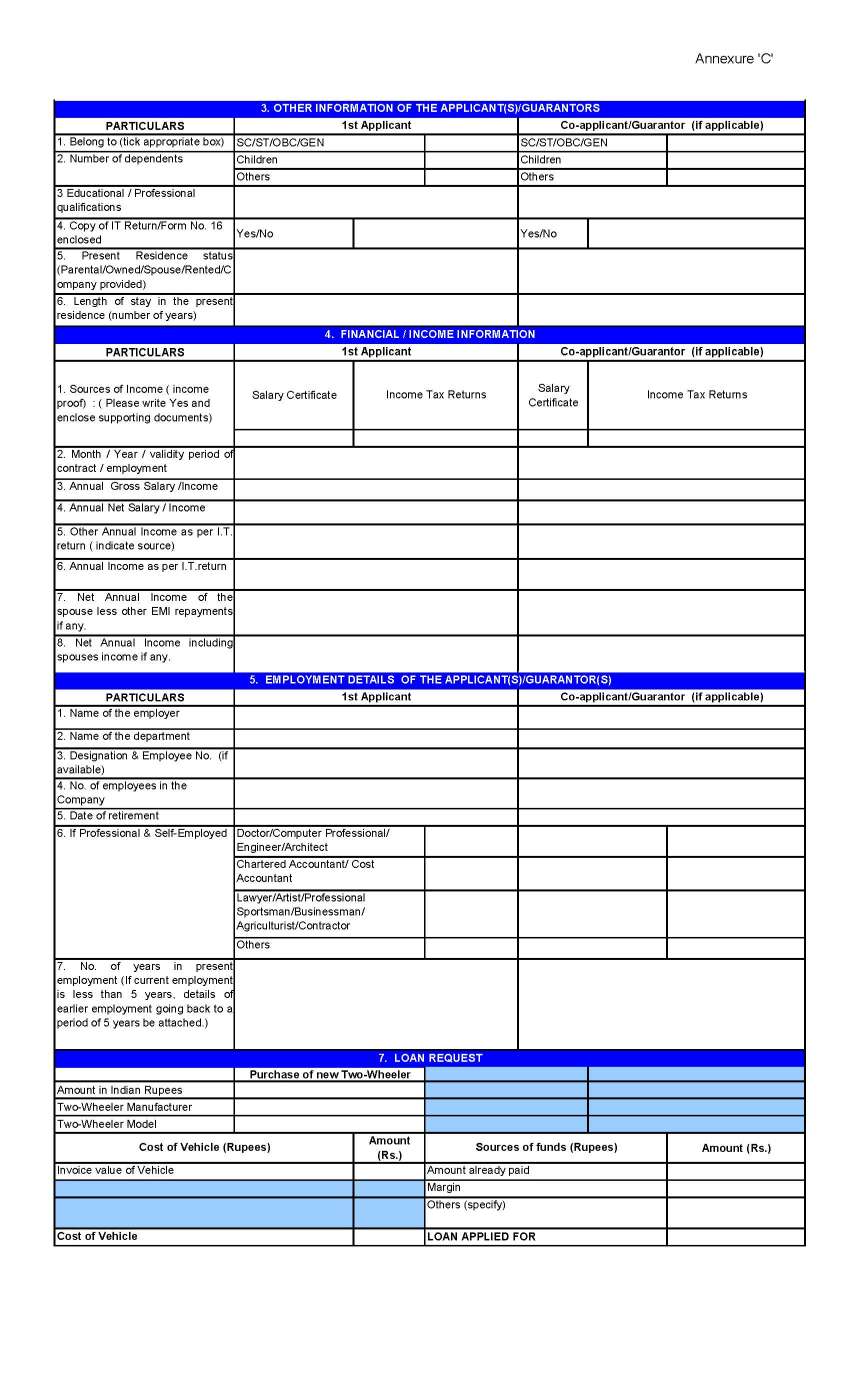

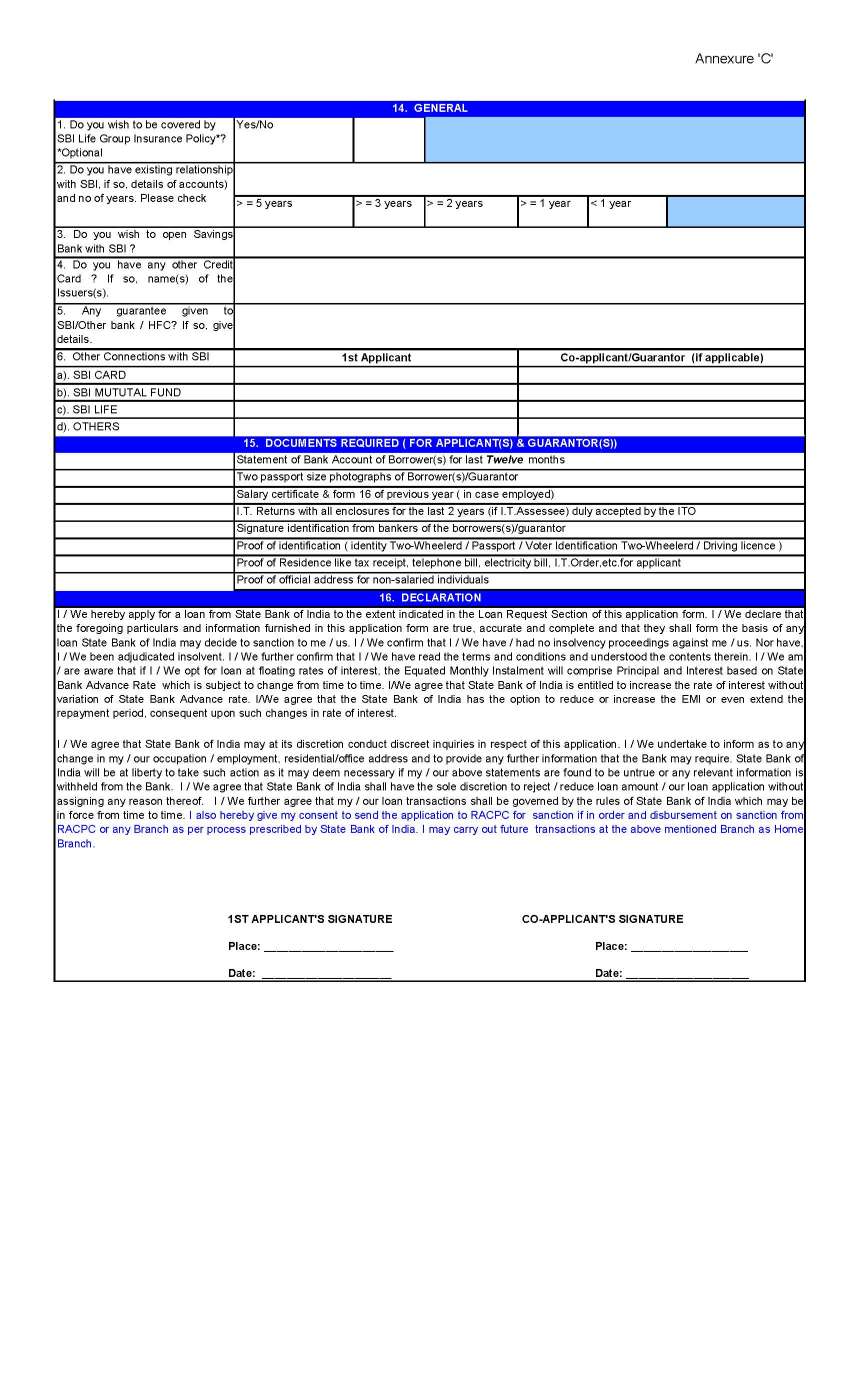

I am interested to take the two wheeler loan from State Bank of India but I don’t have information about the Eligibility and documents required for loan so can you provide me that information and also provide me an application form and official webpage of this bank? >>>>> Answer <<<<<< As you want to get the details of eligibility criteria of State Bank of India Two Wheeler Loan so here is the information of the same for you: Eligibility: Candidates must be in between the age of 21-65 years A Permanent employee of State / Central Government, Public Sector Undertaking, Private company or a reputed establishment or A Professionals or self-employed individual who is an income tax assessee or Person engaged in Agricultural and allied activities. Minimum Net Annual Income Rs. 75,000 (for regular petrol/diesel/gas operated scooters & motor cycles) and Rs. 60,000 (mopeds and battery-operated Two-wheelers Salient Features: For salaried persons, the maximum loan amount is restricted to 6 times Net Monthly Income (NMI), i.e. net of all deductions including actual monthly tax deductions at source. In case of others, the maximum loan amount is restricted to half of Net Annual Income (NAI), i.e. income as per latest income tax return filed less taxes payable. For agriculturists, the net annual income should be arrived based on the nature of their activity (i.e. farming, dairy poultry, orchards, etc) land holding, cropping pattern, yield, etc., and average level of income derived there from in the area. Documents Required The following papers are to be submitted along with loan application: Statement of Bank account of the borrower for last 12 months. 2 passport size photographs of borrower(s). Signature identification from bankers of borrower(s). A copy of passport /voters ID card/PAN card. Proof of residence. Latest salary-slip showing all deductions and TDS certificate-Form 16 in case of salaried persons Copy of Income Tax Return for last two financial years, duly acknowledged by ITO for professionals, self-employed and others. Proof of official address for non-salaried individuals Margin 15% of the on the road price (which includes vehicle registration charges, insurance, one-time road tax). Repayment You can repay the loan within 36 months. Interest Rates:       The eligibility and documents required for taking a Two wheeler loan from State Bank of India are: • Statement of Bank Account of Borrower for last Twelve months • Two passport size photographs of Borrower(s)/Guarantor • Salary certificate & form 16 of previous year ( in case employed) • I.T. Returns with all enclosures for the last 2 years (if I.T.Assessee) duly accepted by the ITO • Signature identification from bankers of the borrowers(s)/guarantor • Proof of identification ( identity two-Wheelerd / Passport / Voter Identification / Driving licence ) • Proof of Residence like tax receipt, telephone bill, electricity bill, I.T.Order,etc.for applicant • Proof of official address for non-salaried individuals SBI Two wheeler loan interest rate for tenure of 3years will be: 8.25% above Base Rate i.e. 18.25% p.a. We are providing you the two-wheeler loan application form of SBI, to get the application from, download the attachment given below. State Bank of India (SBI ) provide best Two- Wheeler loan product for the customers of to take loan to purchase of new Two- Wheeler. Bank offers this loan on low interest rate . Eligibility for SBI 2 Wheeler Loan: Age : 21 to 65 years. Permanent employee of State / Central Government, Public /private Sector Undertaking. Or Professional or self-employed individual . Minimum Net Annual Income : Rs. 75,000 (for regular petrol/diesel/gas operated scooters & motor cycles) Rs. 60,000 (Mopeds and battery-operated Two-wheelers). Interest Rates on SBI Two Wheeler Loan: SBI Two wheeler loan : 17.90% p.a. Super Bike Loan Scheme : 12.65% p.a. Repayment: 36 Months in Normal Bike loans Upto 5 Years in Super Bikes Documents Required: Statement of Bank account for last 12 months. 2 passport size photographs. Signature identification . Copy of passport /voters ID card/PAN card. Proof of residence. Latest salary-slip . Copy of Income Tax Return for last two financial years. Proof of official address for non-salaried individuals. SBI Two Wheeler Loan EMI Calculator:  Contact Details: State Bank of India Sansad Marg Police Colony, Connaught Place New Delhi, Delhi 110001 India Map Location: Last edited by Aakashd; December 6th, 2019 at 11:16 AM. |

|

#6

| |||

| |||

|

State Bank provide loan for 2 Wheeler to their customers. Following is eligibility to apply for this loan: Age must have between 21-65 years. Candidate must have Permanent employee of State / Central Government, Private company, Public Sector Undertaking, or A Professionals or self-employed individual who is an income tax assessee or A Person engaged in agriculture and allied activities. Minimum Net Annual Income Rs. 75,000 for regular diesel/petrol/ gas operated scooters & motor cycles and Rs. 60,000 for mopeds and battery-operated Two-wheelers Features: LTV 85% of ‘On Road Price’ of vehicle Free Accidental insurance Optional SBI Life cover Interest Calculated on Daily Reducing Balance Flexibility of payment of EMI anytime during the month No Advance EMI Lower interest rates Lowest EMI Low processing fee (only 1.22% of loan amount) Processing Fee: 1.22% of Loan amount

__________________ https://t.me/pump_upp |

|

#7

| |||

| |||

| I am studying B.Com III year and I like to get loan to purchase a new 2 wheeler. Please inform whether I am eligible to get loan from SBI. the terms and conditions may be furnished.

|

|

#8

| |||

| |||

|

State Bank of India was established in July 1, 1956. It is recognized as one of the top banks in India. It provides various facilities to the clients like loan, credit cards, debit cards and many more. Following are the details of two wheeler loan: Eligibility: The applicant must be Permanent employee of State / Central Government, Private Company, Public Sector Undertaking, or A Professionals or self-employed individual who is an income tax assessee or A Person engaged in agriculture and allied activities. Two - Wheeler Loan Tenure Rate of Interest Up to 3 years 8.25% above Base Rate i.e. 18.25% p.a. |

|

| |