|

#13

| |||

| |||

|

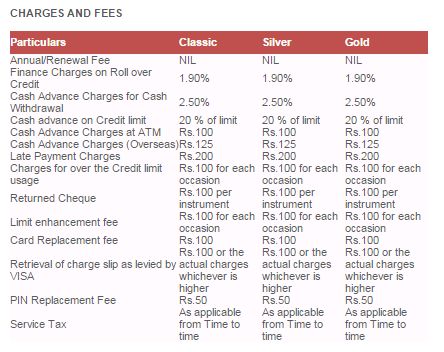

Union Bank of India was founded in 11 November 1919 and it is one of the largest government-owned banks of India. Union Bank of India VISA International Credit Card offers a hassle free and secured shopping experience at an assortment of outlets and websites around the globe Features of Union Bank VISA International Credit Card Photo Signature VISA Card is issued in Three variants – a) Classic b) Silver c) Gold and these are for Domestic use. Non Photo VISA card is issued in one Variant i.e EMV Platinum for International There is no joining fee and annual/renewal charges. Attractive spending limit is 20% of the annual gross salary). Lowest interest rates and free credit period up to 50 days. Flexi payment option. Online Bill payment facility through internet banking account. Attractive reward points and redemption program. Full refund of fuel surcharge. Secured transactions - SMS alerts on all transactions and VbV registration for online transactions. EMI Scheme for the period of 3/6/9/23/28/24 months at attractive interest rate Free Personal Insurance Cover offered to primary as well as add-on card holders for accidental death as mentioned under: Type of Card Other than Air Accident Air Accident Classic Rs. 1 Lakh Rs. 2 Lakh Silver Rs. 2 Lakh Rs. 4 Lakh Gold Rs. 5 Lakh Rs. 8 Lakh 24-hour hot listing facility and lost card liability restricted to Rs.1,000 from the time of reporting the loss. Documents required; For Retail Customers Salaried Self Employed Address Proof Address Proof Copy of PAN Card Copy of PAN Card Income Proof (Salary Slip / Salary certificate/ Form 16 / Latest IT return) Income Proof (Form 16A / Latest IT return) Charges and Fees:

__________________ Answered By StudyChaCha Member |