|

#1

| |||

| |||

|

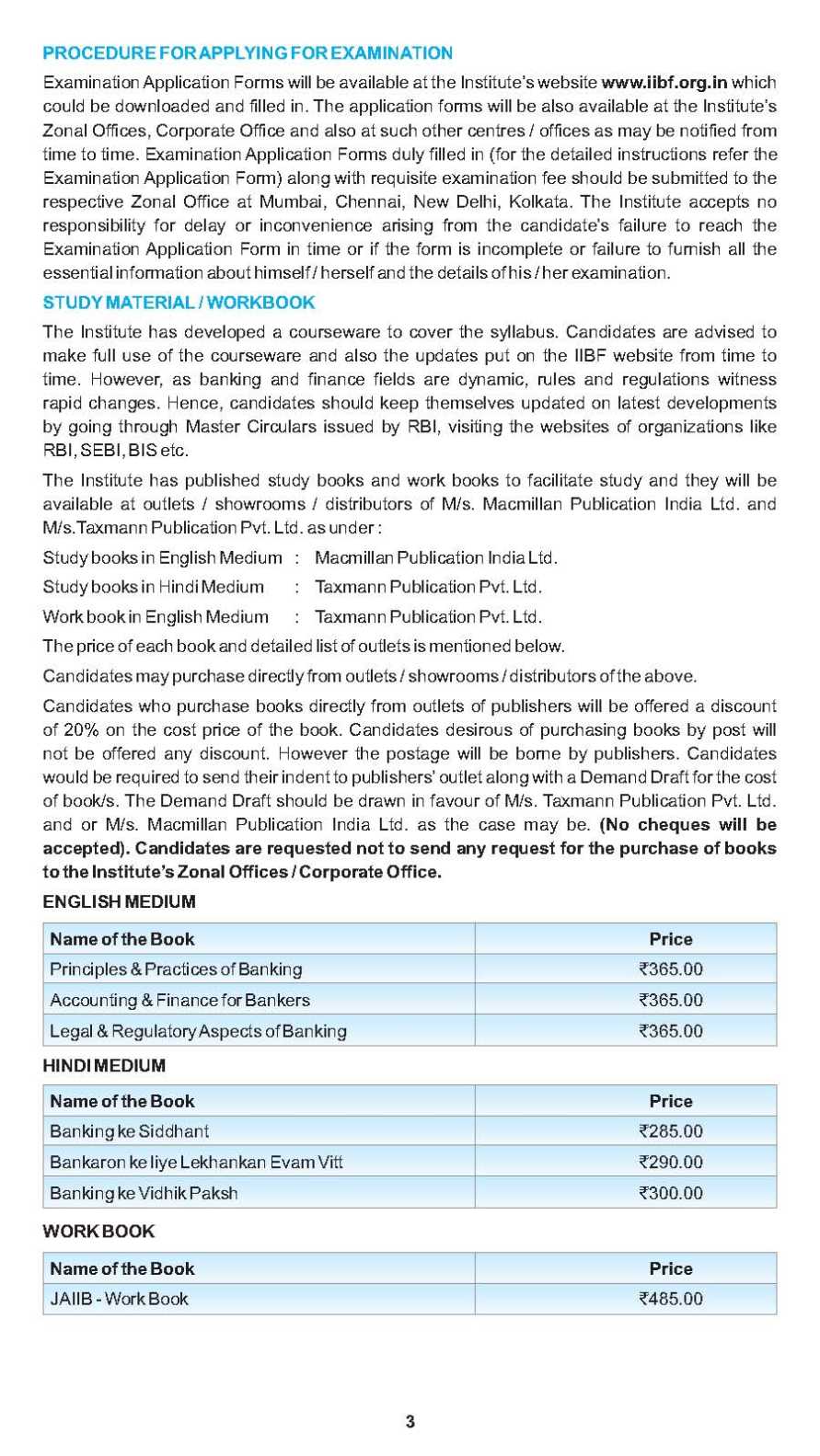

I am looking for syllabus for JAIIB entrance examination organized by Indian Institute of Banking & Finance?? Indian Institute of Banking & Finance JAIIB entrance examination for admission in courses offered by it .. here I am giving you syllabus for JAIIB examination JAIIB Exam (Junior Associate of the Indian Institute of Bankers) Exam Pattern: JAIIB consists of 3 papers namely: (1) Principles & Practices of Banking (2) Accounting & Finance for Bankers (3) Legal & Regulatory Aspects of Banking Syllabus : Subject wise syllabus of JAIIB exam: Principles & Practices of Banking:- Module A: Indian Financial System Module B - Functions of Banks Module C : Banking Technology Module D - Support Services - Marketing of Banking Services Products Accounting & Finance for Bankers:- Module A- Basics of Business Mathematics Module B - Accounting in Banks / Branches Module C - Bank Accounting and Balance Sheet Module D - Other Accounts Module E - Computerized Accounting Legal & Regulatory Aspects of Banking:- Module A- Regulations and Compliance Module B - Legal Aspects of Banking Operations Module C - Banking Related Laws Module D - Commercial Laws with reference to Banking Operations JAIIB Entrance Exam syllabus           Contact details : IIBF JAIIB 2014 Entrance Exam Kirol Road, Off Last edited by Aakashd; June 5th, 2019 at 09:06 AM. |

|

#3

| |||

| |||

|

Junior Associate of the Indian Institute of Bankers JAIIB Exam is conducted by the Indian Institute of Banking & Finance (IIBF). It is open only to ordinary members of the institute This examination will be conducted on Sunday twice a year in May/June and November/December. IIBF JAIIB Entrance Exam syllabus Paper 1 – Principles & Practices of Banking Objective : The candidates would be able to acquire knowledge in the following : Various functions associated with banking. Practice and procedures relating to deposit and credit, documentation, monitoring and control. An insight into marketing of banking services and banking technology. Module A : Indian Financial System Indian Financial System – An Overview : Role of RBI, Commercial Banks, NBFCs, PDs, FIs, Cooperative Banks, CRR, SLR; Equity & Debt Market; IRDA. Banking Regulation : Constitution, Objectives, Functions of RBI; Tools of Monetary Control; Regulatory Restrictions on Lending. Retail Banking, Wholesale and International Banking : Retail Banking- Products, Opportunities; Wholesale Banking, Products; International Banking, Requirements of Importers & Exporters, Remittance Services; Universal Banking; ADRs; GDRs; Participatory Notes. Role Of Money Markets, Debt Markets & Forex Market : Types of Money & Debt Market Instruments incl. G-Secs; ADs, FEMA, LIBOR, MIBOR, etc. Role and Functions of Capital Markets, SEBI : Overview of Capital Market; Stock Exchange; Commonly used Terms; Types of Capital Issues; Financial Products/Instruments including ASBA, QIP; SEBI; Registration of Stock Brokers, Subbrokers, Share Transfer Agents, etc; QIBs; Mutual Funds & Insurance Companies, Bancassurance & IRDA : Types of Mutual Funds, its Management & its Role; Role & Functions of Insurance Companies; Bancassurance; IRDA. Factoring, Forfaiting Services and Off-Balance Sheet items : Types & advantages of Factoring & forfaiting services; Types of off balance sheet items. Risk Management, Basel Accords : Introduction to Risk Management; Basel I, II & III Accords. CIBIL, Fair Practices Code for Debt Collection, BCSBI : Role and Functions of CIBIL; Fair Practices Code for Debt Collection; Codes of BCSBI. Recent Developments in the Financial System : Structure, Reforms in the Indian Financial System; recent developments in Money, Debt, Forex Markets; Regulatory Framework; Payments and Settlement System. Module B : Functions of Banks Banker Customer Relationship : Types; Different Deposit Products & Services; Services to Customers & Investors. KYC/ AML / CFT norms : PMLA Act; KYC Norms. Bankers’ Special Relationship : Mandate; POA; Garnishee Orders; Banker’s Lien; Right of Set off. Consumer Protection – COPRA, Banking Ombudsman Scheme : Operational Aspects of COPRA Act & Banking Ombudsman Scheme. Payment and Collection of Cheques and Other Negotiable Instruments : NI Act; Role & Duties of Paying & Collecting Banks; Endorsements; Forged Instruments; Bouncing of Cheques; Its Implications; Return of Cheques; Cheque Truncation System. Opening accounts of various types of customers : Operational Aspects of opening and Maintaining Accounts of Different Types of Customers including Aadhar, SB Rate Deregulation. Ancillary Services : Remittances; Safe Deposit Lockers; Govt. Business; EBT. Cash Operations : Cash Management Services and its Importance. Principles of lending, Working Capital Assessment and Credit Monitoring : Cardinal Principles; Non-fund Based Limits; WC; Term Loans; Credit Appraisal Techniques; Sources of WC Funds & its Estimation; Operating Cycle; Projected Net WC; Turnover Method; Cash Budget; Credit Monitoring & Its Management; Base Rate. Priority Sector Advances : Targets; Sub-Targets; Recent Developments. Agricultural Finance : Types of Agricultural Loans; Risk Mitigation in agriculture ( NAIS, MSP etc ). Micro, Small and Medium Enterprises : MSMED Act, 2006 Policy Package for MSMEs; Performance and Credit Rating Scheme; Latest Developments. Government Sponsored Schemes : SGSY; SJSRY; PMRY; SLRS. Self Help Groups : Need for & Functions of SHGs; Role of NGOs in Indirect Finance to SHGs; SHGs & SGSY Scheme; Capacity Building. Credit Cards, Home Loans, Personal Loans, Consumer Loans : Operational Aspects, Advantages, Disadvantages & Guidelines of Credit Cards; Procedure and Practices for Home Loans, Personal Loans and Consumer Loans. Documentation : Types of Documents; Procedure; Stamping; Securitisation. Different Modes of Charging Securities : Assignment; Lien; Set-off; Hypothecation; Pledge; Mortgage. Types of collaterals and their characteristics : Land & Buildings; Goods; Documents of Title to Goods; Advances against Insurance Policies, Shares, Book Debts, Term Deposits, Gold, etc; Supply Bills. Non Performing Assets : Definition; Income Recognition; Asset Classification; Provisioning Norms; CDR. Financial Inclusion : BC; BF; Role of ICT in Financial Inclusion, Mobile based transactions, R SETI. Financial Literacy : Importance of financial literacy, customer awareness. Module C : Banking Technology Essentials of Bank Computerization : Computer Systems; LANs; WANs; UPS; Core Banking. Payment Systems and Electronic Banking : ATMs; HWAK; PIN; Electromagnetic Cards; Electronic Banking; Signature Storage & Retrieval System; CTS; Note & Coin Counting Machines; Microfiche; NPC; RUPAY. Data Communication Network and EFT systems : Components & Modes of Transmission; Major Networks in India; Emerging Trends in Communication Networks for Banking; Evolution of EFT System; SWIFT; Automated Clearing Systems; Funds Transfer Systems; Recent Developments in India. Role of Technology Upgradation and its impact on Banks : Trends in Technology Developments; Role & Uses of Technology Upgradation; Global Trends; Impact of IT on Banks. Security Considerations : Risk Concern Areas; Types of Threats; Control Mechanism; Computer Audit; IS Security; IS Audit; Evaluation Requirements. Overview of IT Act : Gopalakrishna Committee Recommendations. Preventive Vigilance in Electronic Banking : Phishing; Customer Education; Safety Checks; Precautions. Module D : Support Services – Marketing of Banking Services / Products. Marketing – An Introduction : Concept; Management; Products & Services; Marketing Mix; Brand Image. Social Marketing / Networking : Evolution, Importance & Relevance of Social Marketing / Networking. Consumer Behaviour and Product : Consumer Behaviour; Product Planning, Development, Strategies, etc; CRM. Pricing : Importance, Objectives, Factors, Methods, Strategies of Pricing; Bank Pricing. Distribution : Distribution Channels; Channels for Banking Services; Net Banking; Mobile Banking. Channel Management : Meaning, Levels, Dynamics, Advantages. Promotion : Role of Promotion in Marketing; Promotion Mix. Role Of Direct Selling Agent / Direct Marketing Agent in a bank : Definition; Relevance; Banker as DSA / DMA; Delivery Channels in Banks; Benefits. Marketing Information Systems – a longitudinal analysis : Functions & Components of MKIS; MKIS Model; Use of Computers & Decision Models; Performance of MKIS; Advantages. Contact address Indian Institute of Banking and Finance 109 - 113, Vikrant towers,Ist floor, 4, Rajendra place Prasad Nagar, Karol Bagh New Delhi, Delhi 110008

__________________ Answered By StudyChaCha Member |