|

#1

| |||

| |||

|

I want to get admission in ICWAI courses and for that I need to get the syllabus and the fees stricture so can you provide me that?

|

|

#2

| |||

| |||

|

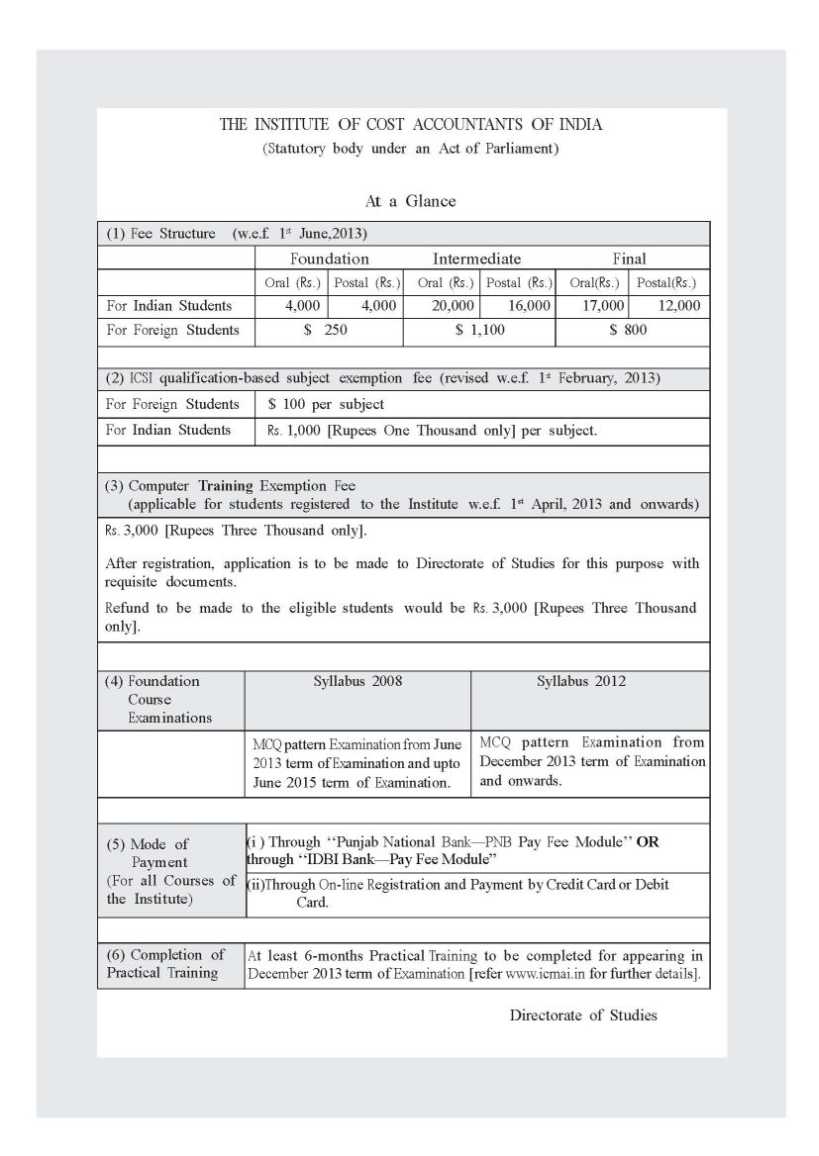

As you want to get the ICWAI syllabus and the fees structure s here is the information of the same for you: Foundation Course Paper 1: Fundamentals of Economics and Management Paper 2: Fundamentals of Accounting Paper 3: Fundamentals of Laws and Ethics Paper 4: Fundamentals of Business Mathematics & Statistic Intermediate Course New Paper 5 : Financial Accounting Paper 6 : Laws, Ethics and Governance Paper 7 : Direct Taxation Paper 8 : Cost Accounting and Financial Management Paper 9 : Operation Management & Information System Paper 10: Cost and Management Accountancy Paper 11 : Indirect Taxation Paper 12 : Company Accounts and Audit Final Course New Paper 13- Corporate Laws and Compliance Paper 14- Advanced Financial Management Paper 15- Business Strategy & Strategic Cost Management Paper 16- Tax Management and Practice Paper 17 : Strategic Performance Management Paper 18- Corporate Financial Reporting Paper 19- Cost and Management Audit Paper 20- Financial Analysis & Business Valuation Documents to be enclosed with application form:- 1. Attested Copy of Matriculation Certificate 2. Attested copy of 10+2 Certificate or Marks Statement 3. 3(Three) Passport size photographs - Pasted on the form One pasted on Identity Card and One to be attached with the application. Fees Structure:  Admission Details: Term of Examination Existing cut-off date Revised cut-off date For December term examination (Example: If for December 2014 term of Examination, the existing cut-off date is 31st May 2014, which shall stand revised to 30th June, 2014) 31st May of the same year 30th June of the same year For June term examination ( Example: If for June 2015 term of Examination, the existing cut-off date is 30th November,2014, which is now revised to 31st December,2014) 30th November of the previous year 31st December of the previous year

__________________ Answered By StudyChaCha Member |

|

#4

| |||

| |||

|

The Institute of Cost and Works Accountants of India (ICWAI) is the professional authority. It was established in order to regulate and control the Cost Accounts practicing all over India. Foundation Course of ICWAI Foundation Course of Institute of Cost and Work Accountants of India (ICWAI) is a course of six months duration. It is the initial level after 10+2. Duration: 6 Months Level: Graduation Type: Degree Eligibility: 10+2 or Equivalent Examinations are held twice a year i.e. in June and in December Syllabus- Subjects of Study 1 Organisation and Management Fundamentals 2 Financial Accounting Fundamentals 3 Economics and Business Fundamentals 4 Basic Mathematics and Statistics Fundamentals Intermediate Course of ICWAI Duration: 12 Months Level: Graduation Type: Degree Eligibility: Graduation or passed the Foundation Course Intermediate Course of ICWAI is a course of twelve months duration. It is the second level after clearing the foundation course Syllabus- Subjects of Study Stage I Business Laws and Communication Skill Business Taxation Cost and Management Accountancy Information Systems and Technology Stage II Advanced Financial Accounting Auditing Management Accounting - Performance Management Quantitative Methods Practical Training Computer Course Group Discussion Business Communication Seminar Final Course for ICWAI Duration: 12 Months Level: Graduation Type: Degree Eligibility: Pass in ICWAI Intermediate Course Final Course for Institute of Cost and Work Accountants of India (ICWAI) is a 12 months course which is minimum duration. It is the final level Syllabus- Subjects of Study Stage I Operations and Project Management and Control Advanced Financial Management and International Finance Strategic Management and Marketing Strategic Tax Management Stage II Management Accounting - Decision Making Management Accounting - Financial Strategy and Reporting Cost Audit and Management Audit Valuation Management and Case Study

__________________ Answered By StudyChaCha Member |