|

#1

| |||

| |||

|

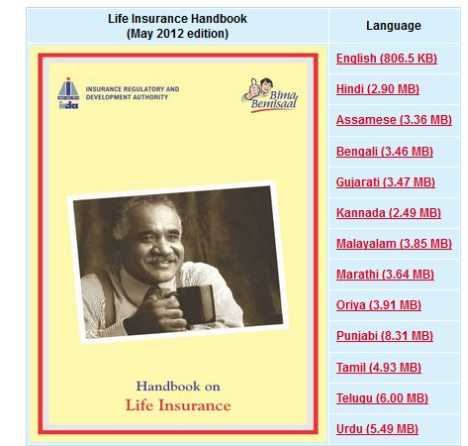

I am looking for the previous year papers of the IRDA exam. Can you please provide the links for the papers? As per your demand I will help you to gather study material and question paper of IRDA so that you can start preparing for the exam and secure good marks in the exam. Here is the IRDA exam paper you are looking for. IRDA Exam paper 2 1 Insurance works on the principle of a Trust b Sharing c Randomness d All of the above 2 Insurance is legitimate a when an adverse happening is likely b When an adverse happening is unlikely c When an adverse happening is certain d In all the above three situations 3 Insurance benefits replace a All physical losses, in full b All physical losses, partly c All monetary losses, in full d The monetary losses, but only to some extent 4 Which one of the following statements is correct? a People hesitate to buy life insurance because they are not aware of their needs b People hesitate to buy life insurance because they prefer to enjoy the present c Both the statements are correct d Both the statements are wrong 5 Which is the right time for taking life insurance? a When you are about to get married b Soon after you have got married c Just when you are joined a new job d All the three ‘times’ are right 6 Retention of risk may be done conveniently by a Large corporations b Small companies c Single individuals d None of the three 7 A valuation is done by a life insurer because a It is a statutory requirement b It is necessary to be able to declare dividends to shareholders c It tells the insurer how well it is managing the business d All of the above 8 The reason for charging level premiums is a Risk increases as age increases b It is convenient to the policyholder c It is convenient to the insurer d All the above reasons 9 What does a premium depend upon? a The place of worship visited by the person to be insured b The state of health of the policyholder c The decision of the underwriter d The report of the agent 10 State which one of the following statements is correct? a In group insurance, a single policy is issued covering many persons b A master policy covers servants of a master c Both the statements above are correct d Both the statements above are wrong 11 Which one of the following statements is correct? a In a limited payment policy, there is a maximum limit to the SA b In a limited payment policy, there is a maximum limit to the term c Both the statements above are wrong d Both the statements above are correct 12 Which one of the following statements is true with regard to Children’s policies? a On vesting, the insured person has an option to change the term of the policy b On vesting the insured person has an option to increase the SA c Both the statements above are wrong d Both the statements above are correct 13 Which of the following could be the basis of the cover in a group policy? a Height of the life insured b Age of the life insured c Size of the insured’s family d All the three above 14 Which one of the following statements is true with regard to Children’s policies? a On vesting, the insured person has an option to change the term of the policy b On vesting the insured person has an option to increase the SA c Both the statements above are wrong d Both the statements above are correct 15 Which one of the following statements is correct? a Every plan of insurance is a combination of two basic plans b The name given to a plan indicates the benefits available under the plan c Both the statements above are correct d Both the statement s above are wrong 16 Which one of the following statements is correct? a Underwriting is done only when there is a medical examination b Medical examination is necessary before a policy can be issued c Both the statements above are correct d Both the statements above are wrong 17 Which one of the following statements is correct? a The underwriter determines the premium to be charged b The underwriter is an employee of the insurer c Both the statements above are correct d Both the statements above are wrong 18 Which one of the following statements is correct? a If the underwriter feels that the risk is more, he will accept at OR b If the underwriter feels that the risk is more, he may impose a lien c Both the statements above are correct d Both the statements above are wrong 19 Which one of the following statements is correct? a The schedule of a policy is not altered after the policy is issued b Changes in the terms of the policy are made through endorsements c Both the statements above are correct d Both the statements above are wrong 20 The date of issue of the FPR indicates a The date when the risk effectively begins b The date when the next premium falls due c The date when the policy will commence d None of the above 21 Which one of the following statements is correct? a In the case of SSS policies, renewal premium receipts are issued b In the case of SSS policies, FPRs are issued c Both the statements above are correct d Both the statements above are wrong 22 Which one of the following statements is correct? a Assignee is free from the assignor’s obligations under the policy b A nomination is automatically cancelled when a loan is taken under the policy c Both the statements above are correct d Both the statements above are wrong 23 Which one of the following statements is correct? a The beneficiaries under the MWP Act can be any member of the family b A policy can be taken under the MMWP Act for the benefit of parents c Both the statements above are correct d Both the statements above are wrong 24 Which one of the following statements is correct? a Foreclosure can be done only with the consent of the policyholder b Foreclosure can be done only after informing the policyholder c Both the statements above are correct d Both the statements above are wrong 25 Which one of the following statements is correct? a Revivals are not done unless the entire outstanding premium is paid b Revivals are not done unless the underwriter agrees c Both the statements above are correct d Both the statements above are wrong 26 Which one of the following statements is correct? a Foreclosure action cannot be taken till a notice is served on the policyholder b When a foreclosure action is taken, nothing is payable to the policyholder c Both the statements above are correct d Both the statements above are wrong 27 Which one of the following statements is correct? a The beneficiaries under the MWP Act can be any member of the family b A policy can be taken under the MMWP Act for the benefit of parents c Both the statements above are correct d Both the statements above are wrong 28 Which one of the following statements is correct? a A presumption of death is not the same as proof of death b Presumption of death allows inheritance of property c Both the statements above are correct d Both the statements above are wrong 29 When does a claim arise under an insurance policy? a Whenever the policyholder feels the need for money b When the insured events happen c When a premium is not paid d Whenever any of the three things mentioned above happen 30 Which one of the following statements is correct? a Maturity claim cheques are paid to the trustees in a MWP Act case b Maturity claim cheques are paid to the beneficiaries in a MWP Act case c Both the statements above are correct d Both the statements above are wrong 31 If a claim is made in January 2007 under a policy, which commenced in May 2002, stating that the life insured had died in April 2004, a Section 45 of the Act will not apply b The claim can be treated as an early claim c Foul play must be suspected d All the three statements above are correct 32 Which one of the following statements is correct? a A policy reported to be lost, may actually have been assigned b A policy has no value after the payment of survival benefits c Both the statements above are correct d Both the statements above are wrong 33 Which one of the following statements is correct? a The foreign exchange regulations apply if the life insured is a non-resident b The foreign exchange regulations apply if the claimant is a non-resident c Both the statements above are correct d Both the statements above are wrong 34 State which of the following statements is correct a ULIPs provide for flexibility b ULIPs are better than traditional policies c Both the above statements are correct d Both the above statements are wrong 35 State which of the following statements is correct a In ULIPs, the offer bid spread is the difference between the two prices b In ULIPs, the offer bid spread, will in some cases be zero c Both the above statements are correct d Both the above statements are wrong 36 State which of the following statements is correct a In ULIPs the insurance cover must be a minimum multiple of the premium b ULIPs can be surrendered after two years c Both the above statements are correct d Both the above statements are wrong 37 State which one of the following statements is correct a Life insurance is the best savings scheme for all persons b Life insurance is the best investment scheme for young persons c Both the statements above are correct d Both the statements above are wrong 38 Which of the following statements is correct? a An insurance agent has fixed working hours b An insurance agent has to mark his attendance in office every day c An insurance agent works according to his schedule d An insurance agent cannot do any other work 39 State which one of the following statements is correct a When vital information is not disclosed, the policyholder is benefited b When a claim is repudiated, the agent’s trustworthiness is affected c Both the statements above are correct d Both the statements above are wrong 40 State which one of the following statements is correct? a The social sector is not only in the urban areas b The social sector includes the unorganized sector c Both the statements above are correct d Both the statements above are wrong 41 State which one of the following statements is correct? a The Ombudsman’s authority is limited to claims matters only b The Ombudsman is not a judicial authority c Both the statements above are correct d Both the statements above are wrong 42 State which one of the following statements is correct? a The tax provisions are the same for all kinds of savings b The tax provisions are included in the Constitution c Both the statements above are correct d Both the statements above are wrong 43 A proposal for SA of Rs. 10 lakhs with DAB for monthly mode under SSS. Proposer had a previous policy of Rs. 5 lakhs with DAB. Proposal was accepted with health extra of Rs. 2.75 per thousand SA premium for DAB Re 1 per thousand. 5% extra for monthly mode. large SA rebate of Rs 2/- per thousand for 1 lakh and above. Tabular premium Rs. 48.20 maximum total SA on which DAB is allowed is Rs. 10/- lakhs. Find monthly (SSS) premium, rounded off to the next higher rupee a 4102 b 4121 c 4183 d 4195 44 Find out surrender value on the basis of following data (the answer to be rounded off to the next lower rupee). SA Rs.30, 000 DOC- 15.6.1992, Endowment with profit - 30 years Due date of last premium paid 15-06-2007 mode half yearly Accrued bonus Rs.750/- per thousand SA. SV factor 23% a 3670 b 3765 c 8740 d None of these 45 A money back policy for SA. of Rs.50,000/- Matured after 25 years. Survival benefits of 15% each had been paid at the end of 5th, 10th, 15th, and 20th years. Bonus had accrued at Rs.965/- per Rs.1000/- SA. Interim bonus @ Rs.25/- per thousand SA is payable. What is the maturity claim amount? a 68250 b 69500 c 98250 d 99500 Correct Answers Practice Paper 6 1 d 16 d 31 d 2 a 17 c 32 a 3 d 18 b 33 c 4 c 19 c 34 a 5 d 20 a 35 c 6 a 21 b 36 a 7 d 22 d 37 d 8 d 23 d 38 c 9 c 24 b 39 b 10 a 25 d 40 c 11 c 26 a 41 b 12 c 27 d 42 d 13 b 28 c 43 b 14 c 29 b 44 c 15 a 30 a 45 b Here I have some name of books which also helps you to prepare for the exam. Motor Insurance Handbook  Life Insurance Handbook  IRDA Exam paper detail attached a word file; Last edited by GaganD; June 28th, 2019 at 11:15 AM. |

|

#2

| ||||

| ||||

|

Insurance Regulatory and Development Authority (IRDA) is the statutory body which regulates and develops the insurance industry in India. The Company is headquartered at Hyderabad, Andhra Pradesh. Mr. T.S. Vijayan is the Chairman of the Company. Sample Questions: 1. Insurance is a mechanism to reduce impact of adverse events on a) Non-value generating assets. b) Value generating assets. c) Current assets d) Fixed assets 2. Perils could be a) Uncertain b) Certain c) Definite d) Unlikely 3. Insurance is a function of a) Uncertainty b) Life c) Society d) Loss 4. Insurance works on the principle of a) Sharing of profits b) Sharing of assets c) Sharing of losses d) Sharing of expenses 5. A) Life Insurance protects the life of the insured. B) Life Insurance minimizes the financial impact of untimely death. a) A is correct b) B is correct c) Both A & B are correct d) Both A & B are wrong 6. Occurrence of ----- has to be ------ & not a -------- of the insured person. a. peril, uncertain, creation b. event, certain, creation c. risk, hazardous, profit d. event, random, creation 7. For getting insurance you need to pay ------- and get compensated by -----. a) Compensation, Claims b) Claims, Premium c) Premium, Claims d) Fees, Claims 8.----------- is the process, which prevents entry of people who do not share the same risk. a) New Business b) Valuation c) Underwriting d) All of the above 9.Life insurance is ------------- to the state’s efforts in social management. a) Complementary b) Supplementary c) Elementary 10. The insurance company is in the role of --------- where all decisions are taken for the benefit of the community. a) Caveat Emptor b) Uberrimae Fides c) Underwriter d) Fiduciary. 1. A policy in which the payments to the annuitant begins 5 years after the policy has commenced is called ----------- a) 5 year b) Immediate c) Delayed d) Deferred 2. The ability to do is ----------- a) Action b) Skill c) Attitude d) Knowledge 3. Which of the following statement(s) are “TRUE”? Statement A: A father can take a policy on the life of his own son who is 12 yrs old Statement B: One can take a policy on the life of a friend to whom has lent money a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 4. A duplicate policy can be issued when the original policy is a) Lost b) With assignee c) Pledged against a loan d) All the above 5. How is an annuity paid by the insurer? a) In installments b) In lump sum c) In annual installments d) In quarterly installments 6. In the case of moral hazard, ----------- a) A lien is placed b) The sum assured is reduced c) The proposal is declined d) Extra premium is charged 7. Which of the following statement(s) are “TRUE”? Statement A: The maturity proceeds of a policy are taxable as income Statement B: The premium paid under an insurance policy is fully exempt from income tax a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 8. Which of the following statements are “TRUE “ ? Statement A: A department in an office is a place where some specialized kind of work is done. Statement B: Agents are usually attached to branches of insurance offices. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 9. What is paid by the insurer when the policyholder decides to discontinue the policy ? a) Intermediate Claim b) Surrender Value c) Forfeiture d) Lapses 10. ----------- describes an agent who does not take the objections of his prospect lightely. a) Non-professional b) Arrogant c) Professional d) Mechanical 11. A policy in which the payment to the annuitant begins after 1 year and is payable thereafter annually, is called ------------- a) One year b) Immediate c) Annual d) Deferred 12. The questions in the proposal form and personal statement are ---------- material and relevant a) Without exception b) Mostly c) Only partly d) Rarely 13. An agent is subject to ----------- a) IRDA Regulations b) Terms of appointments c) Agents manual d) All of the above 14. The behaviour of an agents who tells his client that the advice given by another agent is wrong is ------------- a) Dominating b) Interfering c) Childish d) Non-professional 15. -------------- means the document produced to establish ones age. a) Affidavit b) Proof of age c) Certificate d) Evidence 16. ------------- describes an agent who keeps records of his activities and examines them periodically. a) Analyst b) Meticulous c) Non-professional d) Professional 17. Loans under insurance policies can be repaid -------------- a) In one lump sum b) By adjustment against claim c) In installments d) In any of the above ways 18. Surplus is an indication that ------------- a) Premium is high b) Targets have been met c) Neither of the above d) Both of the above 19. Which of the following statements are “TRUE “? Statement A: Insurance can be made to begin from previous year Statement B: The policyholder loses his rights when he makes a nomination a) Only statement A b) Only statement B c) Both statements are false d) Both statements are true 20. ------------ is the person to whom the policy is transferred in lieu of some consideration received a) Assignee b) Nominee c) Mortgagor d) Beneficiary 21. After how many years is a missing person presumed to be dead? a) Six b) Eight c) Seven d) Five 22. How is the purchase price of a deferred annuity payable ? a) In a lump sum b) In quarterly installments c) In annual installments d) Any of the above 23. If the proponent feels that a particular question in the proposal form does not apply to his situation he should ------------ a) Leave it blank b) Write “Not Applicable “ c) Cut it out d) None of the above 24. Which of the following statements are “TRUE”? Statement A: When a policy matures, the claim proceeds are paid to the assignee. Statement B: In insurance, the principle of “buyer beware” applies a) Only statement A b) Only statement B c) Both statements are false d) Both statements are true 25. The agent has --------------- freedom to act on behalf of the principle. a) Full b) Limited c) Specified d) None of the above 26. -------------- describes the behaviour of an agent who is willing to accept that a particular customer may not need life insurance. a) Defeatist b) Non-professional c) Timid d) Professional 27. The authority of an agent is --------------- a) Specified in the appointment letter b) Inferred from his action c) Verbally communicated d) all of the above 28. Which of the following statements are “TRUE”? Statement A: A policyholder loses his rights when he makes an assignment Statement B: If the proposal matures, the claim proceeds are paid to the nominee a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 29. Which of the following statements are “TRUE”? Statement A: It is the agent’s responsibility to ensure that all material information is made available. Statement B: If the proposal papers are incomplete, the agent will be held accountable. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 30. Which of the following statements are “TRUE”? Statement A: Old age is a risk. Statement B: Dying too young is as much as risk as dying too late. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 31. In the case of a policy under the provision of a Married Women’s Property Act, who can make a claim on maturity? a) Trustee b) Life insured c) Beneficiaries d) Life insured’s heirs 32. Which of the following statements are”TRUE”? Statement A: Any two persons can take a joint life policy. Statement B: Two business partners can take a joint life policy. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 33. Which of the following statements are “TRUE”? Statement A: The agent is at fault, if the policy sold does not meet the proponents needs. Statement B: The agent is responsible to ensure that the proposed policy meets the needs of the prospects. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 34. The attachment to a policy to indicate that the standard policy terms and conditions have been modified is called -------------- a) Clause b) Condition c) Rider d) Endorsement 35. What would be the paid up value of 25 year old endowment policy Rs.50,000 taken in October 1988, if the last half-yearly premium paid was in October 2000 ? a) Rs.26,000 b) Rs.27,000 c) Rs. 24,000 d) Rs. 25,000 36. Which of the following statements are “FALSE” ? Statement A: Policy decisions in an insurance organization mean decision relating to issue of specific insurance policies. Statement B: Policy decisions in an insurance organization mean decisions relating to the kind of plans of insurance to be offered to the public. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 37. If a person is born on 4.7.1981, his age next birthday on 25.11.2000 will be ------------- a) 19 b) 21 c) 20 d) 18 38. Moral Hazard is a matter of ---------------- a) Fact b) Opinion c) Evidence d) None of them 39. Which of the following statement(s) are “TRUE” ? Statement A: A nomination is valid only if it is made on the policy document Statement B: When the insurance policy is the subject matter of a will, the nomination is automatically cancelled. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 40. To whom can a policyholder apply in case of bad service from an insurer ? a) IRDA b) Consumer forum c) Ombudsman d) All the above 41. The single policy issued as evidence of the contract of group coverage is called ----------- policy. a) Master b) Overall c) Group d) Single 42. The process of determining if the claim can be paid is called a) Consideration b) Decision c) Acceptance d) Admission 43. Which of the following statement(s) are “TRUE” ? Statement A: Maturity proceeds under the insurance policy are subject to capital gains tax. Statement B: If the policy is lost, the claim will not be paid without a duplicate policy. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 44. What is the uniqueness of life insurance as a saving plan ? a) Tax benefits b) Liquidity c) Safety d) Guaranteed fulfillment of saving plan 45. The maturity proceeds of a policy financed by HUF will be paid to the ----------- a) Karta of HUF b) Life assured c) Nominee d) None of the above 46. ------------- is a document issued under the law authorizing a person to act as an insurance agent. a) Appointment b) License c) Certificate d) Mandate 47. ------------ means the process through which a product is carried to the customer. a) Marketing b) Distribution channel c) Promotion d) Sales 48. The insurer must transact at least 15% of the business in the 5th financial year in ---------- market. a) social b) Poorer c) Farmers d) Rural 49. Surplus declared in a valuation arises because of good -----------. a) Underwriting b) Management c) Investment d) all of the above 50. Which of the following statements are “TRUE”? Statement A: Insurance is necessary to cover the risk of living too long. Statement B: Insurance helps one to be less dependent on others. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 51. An agent is expected to report on the proponent’s ------------ status. a) Financial b) Medical c) Both d) Neither of the statements 52. Which of the following skill is required to influence the other person to do something ? a) Salesmanship b) Analytical c) Communication d) Persuasiveness 53. Surplus in a valuation arises because of favorable experience in ----------- a) Mortality b) Expenses c) Interest Yield d) All of the above 54. Which of the following statements are “TRUE”? Statement A: Duplicate policies are issued to enable policyholders make assignments. Statement B: Premium under a group insurance policy is constant for all time to come. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 55. Which of the statements are “TRUE”? Statement A: The premium under a group insurance policy is constant for all time to come. Statement B: Premium under a group insurance policy is recalculated every three months. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 56. To whom should an application for agency license be given ? a) The IRDA b) Controller of Insurance c) The insurer d) Any of the above 57. If a person is born on 2.2.1979, his age last birthday on 5.11.2000 will be a) 20 b) 23 c) 21 d) 22 58. What is the final stage in the selling process ? a) Approach b) Interview c) Convincing d) Close 59. Which of the following statements are “TRUE”? Statement A: If there is a nomination, the claim can be paid without further legal proof of title. Statement B: A nomination becomes invalid if an heir raises a dispute. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 60. Which of the following statements are “TRUE”? Statement A: Insurance is relevant only if there is possible economic loss. Statement B: An event, which will certainly happen, cannot be insured against. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 61. Which of the following approach (es) of the agent is appropriate? Approach A: The agent suggested to the prospect that he signs the proposal form and that he (the agent) would get them filled up later on the basis of the information, which he was noting down. Approach B: An agent used to tell his prospect that there was no better investment than life insurance. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 62. Section 45 of the insurance act is relevant for the policies which are at least ---------- years old. a) three b) Two c) four d) five 63. Which of the approaches of the agent is appropriate? Approach A: An agent used to collect from the office details of claims which were remaining outstanding for more than a month and then meet the claimants to help them out. Approach B: An agent used to collect from office details of claims which were remaining outstanding for more than a month and then meet the claimants to help them out on condition that they agree to take out business from them. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 64. Calculate premium from the following data : SA – Rs.1,00,000 Plan-Money Back-20 yrs Mode-half yearly Age nearer B’day-36 yrs Proposal accepted at ordinary rates with double accident benefit, TP – Rs.69.25 Rebate for half yearly premium is at 1.5% Rebate for large sum assured is Rs.2/- and Premium for double accident benefits is Re.1/- per thousand per annum. a) Rs.3,261/- b) Rs.3,461/- c) Rs.3,463/- d) Rs.3,361/- 65. Given that sum assured Rs. 1,00,000/- mode yearly-endowment policy 30 years without profits. Date of commencement 25/10/1993 first unpaid premium 25/10/2001 the paid up value will be --------- a) Rs.25,666 b) Rs.26,667 c) Rs.30 d) Rs.25,667 66. How is the purchase price of an immediate annuity payable? a) In installments b) In quarterly installments c) In annual installments d) In lump sum 67. Which of the following statement(s) are “TRUE”? Statement A: Fire is a peril, not a loss. Statement B: The essence of insurance is sharing of losses. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 68. A risk can be --------------- a) Measured b) Calculated c) Assessed d) All the above 69. What does ‘days of grace’ mean? a) Time allowed for paying premium b) Period during which premium is paid at discounted rate c) Time taken to reply letters d) Period after which only risks begins 70. Who is the person who arranges for a customer to get the necessary insurance ? a) Broker b) Retailer c) Agent d) Intermediary 71. The person appointed to attend to grievances of policyholders is called -------------- a) Grievance officer b) Complaints officer c) Ombudsman d) Designated officer 72. Bringing a policy, which has lapsed, back to force is called ------------ a) Recovery b) Revival c) Relapse d) Renewal 73. Who is the potential purchaser of a product? a) customer b) Client c) Consumer d) Prospect 74. Which of the following statement(s) are “TRUE” ? Statement A: Insurance works on the law of averages Statement B: Insurance is possible only when there are many policyholders. a) Only statement A b) Only statement B c) Both statements d) Neither of the statement 75. Approach A: A proponent called up the agent to know why a particular medical test was being asked by the office and the agent said that he was not aware of the same and would revert to matter the next day. Approach B: A proponent called up the agent to know why a particular medical test was being asked by the office and the agent said that he was not aware of the same, the office always did such stupid things and then he would sort out the matters the next day. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 76. Approach A: An agent insisted that all his policyholders should sent the premium cheques to him, so that he could ensure that delays did not happen through oversight. Approach B: An agent being friendly with the assistant in the new business department, used to keep track of the new proposals coming in and try to get additional business from the same parties. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 77. Approach A: When a prospect wanted to know details about various plans so that he could make a choice, the agent told him that the details were too complex for him to understand and that he (the agent) was there to give him the proper advice. Approach B: An agent had printed a prospect’s particulars sheet and would invariably make the prospect fill up the particulars himself. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 78. Approach A: The agent knew about the death of the client only when he received the copy of the letter written by the office to the wife of the insured, forwarding the forms. Approach B: The agent had the habit of greeting all his policyholders in the same town, on their birthdays and give them attractive presents. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 79. Approach A: When a prospect wanted to know what the agent would get out of the sale of insurance, he just gave him a xerox copy of his appointment letter. Approach B: When a prospect wanted to know what the agent would get out of the sale of insurance, he said that that was a confidential matter. a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 80. Approach A: When the prospect said that he had taken sick leave for a few days because he wanted to go outstation for an interview, the agent suggested that he need not mention it. Approach B: The agent suggested to the prospect not to mention the fact that the cause of death of one of his brother’s who had died young, was cardiac arrest. It was mentioned as ‘Accident’ a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 81. Approach A : Going through the existing policies of a prospect whom he is meeting for 1st time, the agent suggests that he should allow three of them to lapse and go in for new policies straightaway Approach B: Going through the existing policies of a prospect whom he was meeting for the 1st time, the agent suggests that nominations be made and offered to get them registered by the office a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach 82. Approach A: An agent had advertised in the Telephone Directory that his services were available for advice on all personal financial matters, including insurance Approach B: An agent advertised in the Telephone Directory that he specialized in Annuity policies, which he said were best for persons aged over 50 a) Only approach A b) Only approach B c) Both the approaches d) Neither of the approach Here I am attaching the previous year papers:

__________________ Answered By StudyChaCha Member |