|

#31

| |||

| |||

|

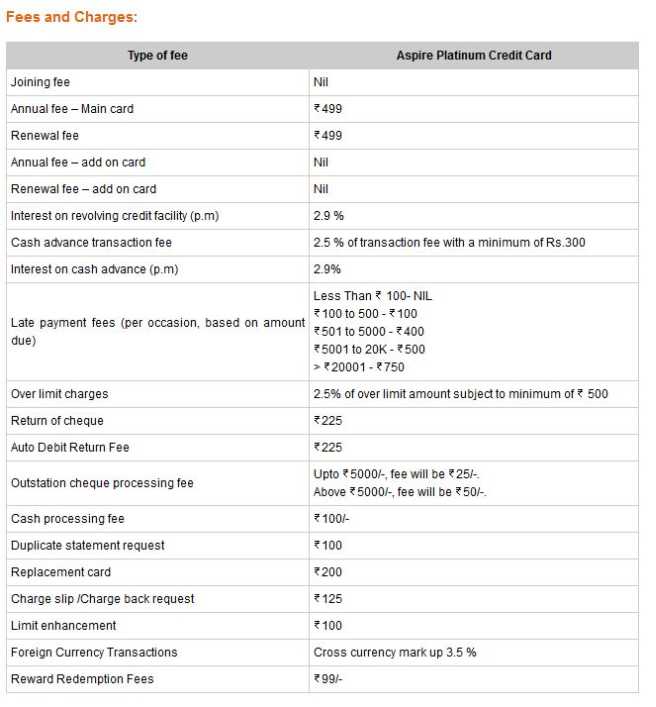

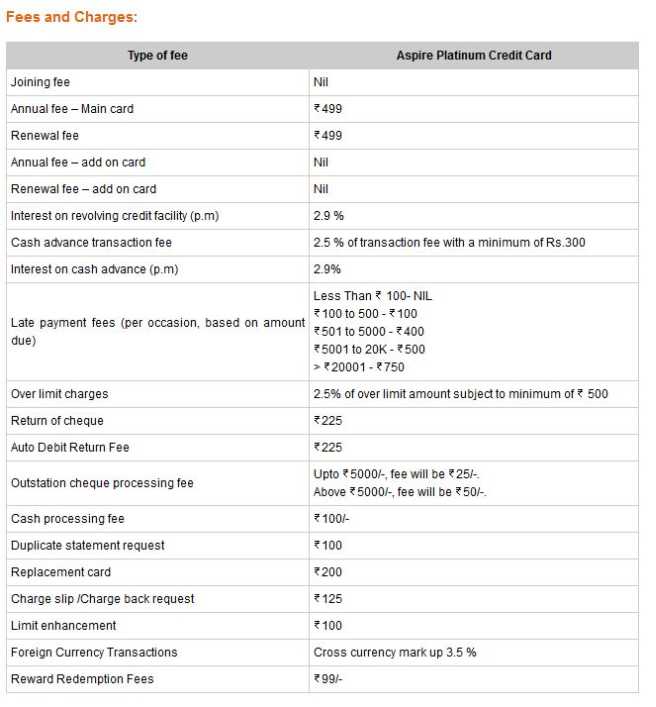

Hey , IDBI Bank offers Aspire Platinum Credit Card designed to provide best privileges in traveling, dining, lifestyle and to other aspirational needs. There online facility in not available to apply for Aspire Platinum Credit Card at IDBI Bank, to apply for this card you must have to visit the near by branch of bank . Here I am attaching the application form to issue Aspire Platinum Credit Card from IDBI Bank you can download it from here . Aspire Platinum Credit Card application form  Features and Benefits of this card: Earn More while you Spend Interest Free Credit Drive On Wider Acceptance Zero Lost Card Liability Family Cards VISA offers Fees and Charges: Annual fee – Main card 499 Renewal fee 499 Interest on revolving credit facility (p.m) 2.9 % Cash advance transaction fee 2.5 % of transaction fee with a minimum of Rs.300 Interest on cash advance (p.m) 2.9% Late payment fees (per occasion, based on amount due) Less Than 100- NIL 100 to 500 - 100 501 to 5000 - 400 5001 to 20K - 500 > 20001 - 750 Over limit charges 2.5% of over limit amount subject to minimum of 500 Return of cheque 225 Auto Debit Return Fee 225 Outstation Cheque processing fee Upto 5000/-, fee will be 25/-. Above 5000/-, fee will be 50/-. Cash processing fee 100/- Duplicate statement request 100 Replacement card 200 Charge slip /Charge back request 125 Limit enhancement 100 Foreign Currency Transactions Cross currency mark up 3.5 % Reward Redemption Fees 99/-

__________________ Answered By StudyChaCha Member |

|

#33

| |||

| |||

|

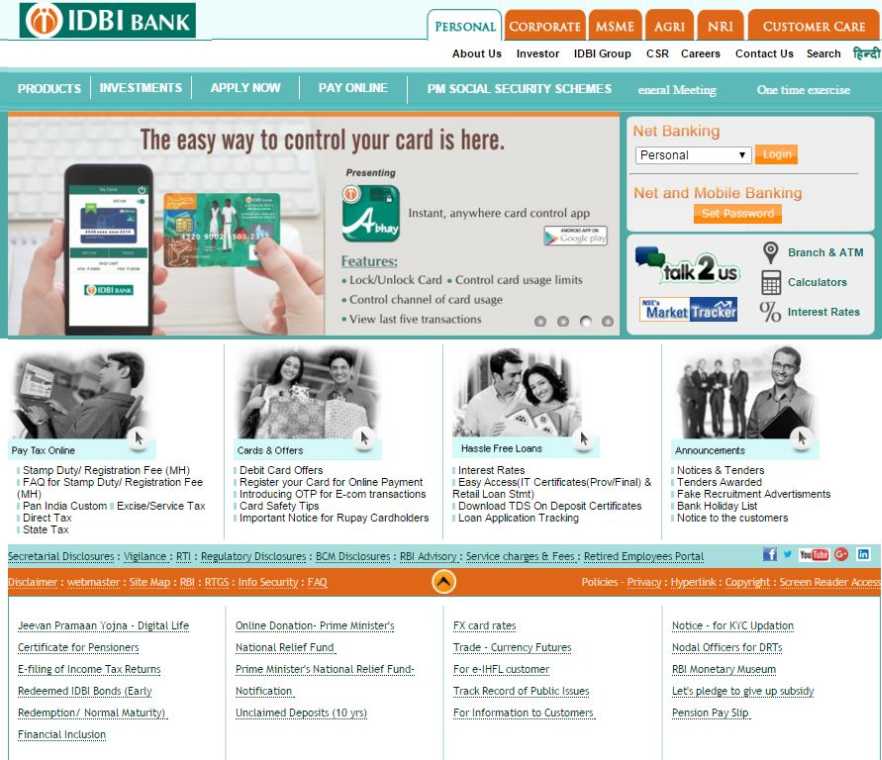

The IDBI Credit Card is a "Magic Card" it is a first-ever debit card with a credit limit, and one that charges you much less than a regular credit card. Eligibility: Customer should have satisfactory dealing with the Bank for the last 3 years Here I am giving you process to get Online Application form of IDBI bank for Credit Card… Firstly go to the official website of IDBI bank which looks like this image:  After that you will see “Products” option which is available left side top of the home, after that take you cursor on this option now you will get drop downs, take your cursor on Cards option from those drop downs again you will get drop downs Now click on Credit card option a new page will open which look like this  After that bottom of the page you will see “Apply Online” option click on that option a new page again will open which looks like this image:  After that you will get “Credit Card Application Form” option click on that option a pdf file will open….. Here I am providing you that pdf given below as a attachment Benefits of IDBI Bank Credit Cards • Attractive loyalty reward points • Convenient EMIs with lower interest rate • Up to 48 days interest free credit period • International Validity • Fuel surcharge waiver • Add-on card facility • Zero lost card liability • Air Travel Accident Insurance Cover

__________________ Answered By StudyChaCha Member |

|

#35

| |||

| |||

|

IDBI Bank Credit Cards are accepted globally. Credit Cards issued are EMV Chip and PIN enabled for security purpose. Benefits of IDBI Bank Credit Cards: Attractive loyalty reward points Convenient EMIs with lower interest rate Add-on card facility Zero lost card liability Up to 48 days interest free credit period International Validity Fuel surcharge waiver Air Travel Accident Insurance Cover Type of IDBI credit card: Royale Signature Credit Card Aspire Platinum Credit Card To apply for issue credit card from IDBI bank you have to download application form and fill it. After completely filling the application form you must attach required documents . Along with documents submit filled in application form at near by branch of bank . Authorized member of bank verify the application form and documents . After all verification credit card will be issued . Aspire Platinum Credit Card fee and charges :  IDBI credit card application form

__________________ Answered By StudyChaCha Member |

|

#38

| |||

| |||

|

IDBI Bank (Industrial Development Bank of India) was established in 1964 by an Act of Parliament to provide credit and other financial facilities for the development of the fledgling Indian industry. As you want to apply for IDBI Credit Card , so here I am telling for its require eligibility to apply for it : Require eligibility: Age 21 to 65 Income Requirement Nil Employment Salaried or Self-Employed Interest Free Period Up to 48 days ATM Cash Withdrawal Charges 2.5% of amount withdrawn or INR 300 Documents require : Proof of Identity Voter ID/ Passport/ Driving License/ PAN card/ Aadhaar Card Proof of Address Electricity/ Telephone Bill/ Election Card/ Passport/ Adhaar Card Proof of Income Latest 3 months Salary Slip/ Latest 3 months Bank Statement/ ITR/ Form 16 Bank profile Type PSU Govt Traded as BSE: 500116 NSE: IDBI Industry Banking, Financial services Predecessor IDBI Founded 1 July 1964, 54 years ago Headquarters Mumbai, India Key people Mr. Rakesh Sharma (MD & CEO) (Interim) Products Consumer banking, corporate banking, finance and insurance, investment banking, mortgage loans, private banking, private equity, wealth management, Agriculture Loan Revenue Decrease ₹28,043.10 crore (US$3.9 billion) (2016) Operating income Increase ₹5,370 crore (US$750 million) (2016) Net income Decrease ₹-3,664.80 crore (US$−510 million) (2016) Total assets Increase ₹374,372.12 crore (US$52 billion) (2016) Owner LIC and Govt. of India Number of employees 27,570 (March 2016) Capital ratio 11.76% (2016)

__________________ Answered By StudyChaCha Member |