|

#14

| |||

| |||

|

The loan can be obtained for any purpose whatsoever, it is an all purpose loan, If amount of loan is Rs.25.00 lacs and above then purpose of loan will have to be specified along with an undertaking that loan will not be used for any speculative purpose whatever including speculation on real estate and equity shares. SBI Property loan interest rates: 1 August 2015 Size of Credit Limit (Term Loan) Rate of Interest Upto Rs. 1,00,00,000/- 12.60% p.a. Above Rs. 1,00,00,000/- 12.85% p.a. No Overdraft against Mortgage of Property Rent Plus Scheme Loan Amount Rate of Interest For Loans upto Rs 7.50 Cr in Metro Center and Rs 5.00 Cr in Non- Metro Center 12.95% p.a. In all other cases (In case of deviation) 13.10% p.a. Tenure Maximum 10 years Docs Required: Loan against Property ID Proof PAN card/voters ID/ Passport/Driving License/Any other valid proof Address Proof Recent telephone bill/electricity bill/property tax receipt/passport/voters ID DOB Proof 10th class certificate/DOB Certificate Financial Docs Statements (latest 3 months bank statement / 6 months bank passbook) Latest salary slip or current dated salary certificate with latest Form 16 Eligibility You are eligible if you are: A. An individual who is; An Employee or A Professional, self-employed or an income tax assesses or Engaged in agricultural and allied activities. B. Your Net Monthly Income (salaried) is in excess of Rs.12,000/- or Net Annual Income (others) is in excess of Rs.1,50,000/-. The income of the spouse may be added if he/she is a co-borrower or a guarantor. C. Maximum age limit: 60 years.

__________________ Answered By StudyChaCha Member |

|

#16

| |||

| |||

|

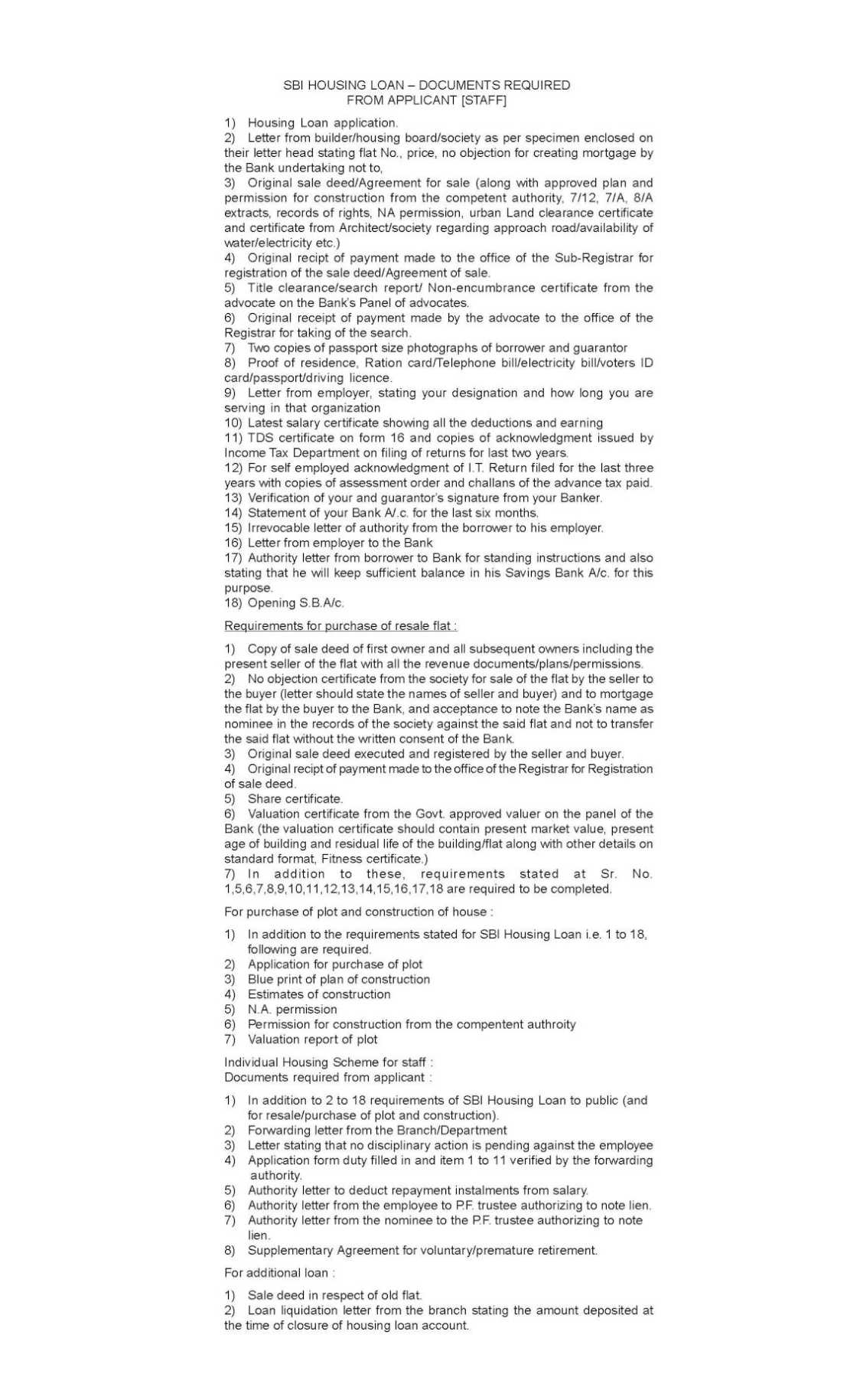

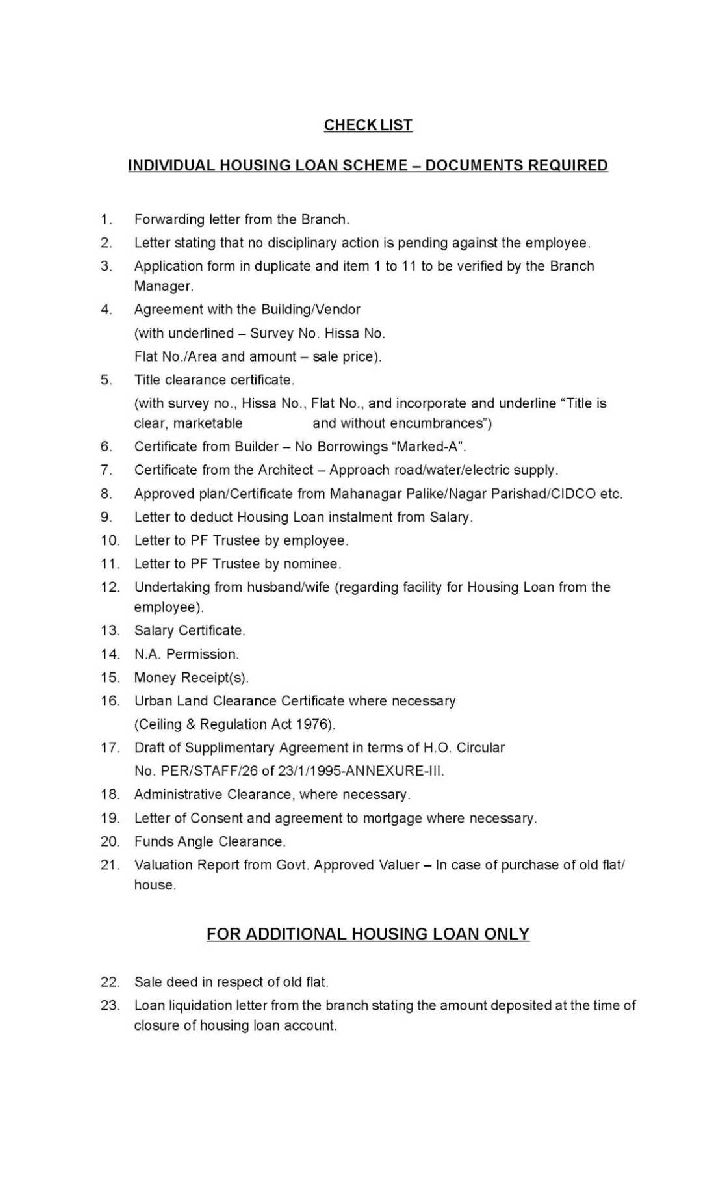

Home Loan scheme offered by state bank of India (SBI) to help financially to its customers on law interest rate . By using this scheme public can make true the dream of their own home . Yes , property documents are required while applying to issue Home Loan from state bank of India (SBI). Here is the list of documents required for home loan : Loan application. Original sale deed/Agreement for sale Original receipt of payment made by the advocate to the office of the Registrar for taking of the search. Letter from builder/housing board/society as per specimen enclosed on their letter head stating flat No., price, no objection for creating mortgage by the Bank undertaking not to, Original receipt of payment made to the office of the Sub-Registrar for registration of the sale deed/Agreement of sale. Title clearance/search report/ Non-encumbrance certificate from the advocate on the Bank’s Panel of advocates. Two copies of passport size photographs of borrower and guarantor Letter from employer, stating your designation and how long you are serving in that organization Proof of residence, Ration card/Telephone bill/electricity bill/voters ID card/passport/driving licence. Latest salary certificate showing all the deductions and earning Letter from employer to the Bank Opening S.B.A/c. TDS certificate on form 16 and copies of acknowledgment issued by Income Tax Department on filing of returns for last two years. Verification of your and guarantor’s signature from your Banker. Statement of your Bank A/.c. for the last six months. For self employed acknowledgment of I.T. Return filed for the last three years with copies of assessment order and challans of the advance tax paid. Authority letter from borrower to Bank for standing instructions and also stating that he will keep sufficient balance in his Savings Bank A/c. for this Purpose Irrevocable letter of authority from the borrower to his employer.   For more detail here is the attachment.

__________________ Answered By StudyChaCha Member |

|

#18

| |||

| |||

|

State Bank of India (SBI ) is known for its quick and individualized services. Bank offers commercial home loans with flexible repayment terms and on affordable interest rates. Features of loan : Complete transparency in operations Interest rates are levied on a monthly/daily reducing balance method Lowest processing charges. Long repayment period No Hidden costs or administrative charges. No prepayment penalties. Eligibility criteria for SBI Commercial home loans: Resident of India. Working/self-employed for a minimum period of 3 years . Age : Not be older than 65 years at the time of the final installment. Loan amount : Minimum amount : Rs.25,000. Maximum amount: 4,000,000. Margin: 15% of the estimated project cost 30% if only a plot of land is bought Security for SBI Commercial home loans: Equitable mortgage of current property/property planned to be purchased . Collateral security: LIC policies/ Individual guarantee of spouse/others or National Savings Certificates (NSCs)

__________________ Answered By StudyChaCha Member |